Your Industry Is Being Disrupted. Here's What You Need to Know

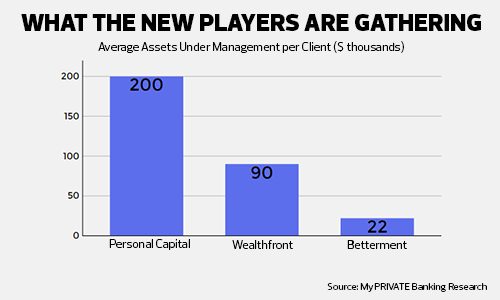

After all, the total assets managed by the top robo advisors represent less than 0.1% of the $33 trillion retail market in the U.S., according to Corporate Insight.

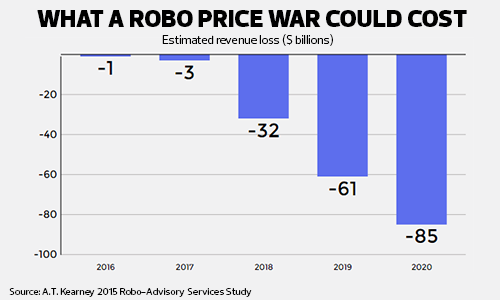

But it's not where automated advice stands today that has industry observers paying attention. It's where robos are expected to be five years from now -- how fast they will accumulate AUM, who will come to dominate the market, and the impact that will have on consumer behavior as well as the cost of doing business.

A number of studies have recently come out examining the digital disruption afoot in the wealth management industry, and we've gone through all of them to pull out key findings, figures and quotes that will help you see past the hype about automated investing and get a clearer picture on where the industry is heading.

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know

Your Industry Is Being Disrupted. Here's What You Need to Know