It doesn't get much better if you're a financial advisor.

"Advisors reported spectacular growth in 2017," says Vanessa Oligino, director of business performance solutions at TD Ameritrade Institutional.

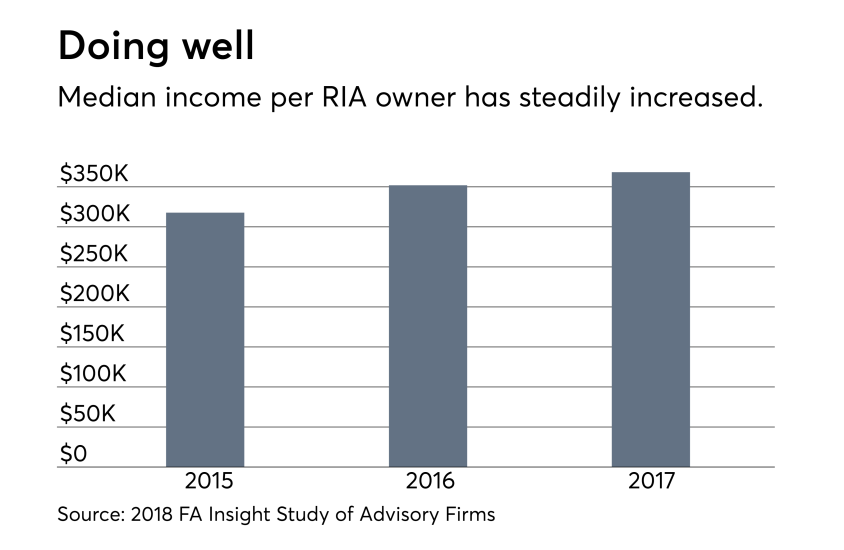

Indeed, the typical firm increased its client base nearly 8%, and median RIA revenue growth soared nearly 16%, the biggest percentage gain in seven years, according to TD Ameritrade Institutional's annual industry benchmarking study.

Median assets under management per client last year rose to nearly $1 million, an increase of nearly 7% from 2016, the 2018 FA Insight Study of Advisory Firms reported.

With a boost from the stock market, AUM soared 20%, nearly equaling the record increase recorded in 2009, when markets first sprang back from the low of the Great Recession.

What follows is a closer look at how RIAs arrived at the peak performance they are now achieving — and what they need to do to maintain that level of excellence.