Low fees and market-beating returns: Those are the attributes clients want in index fund investing — as well as the traits associated with the industry’s top-performing passive funds.

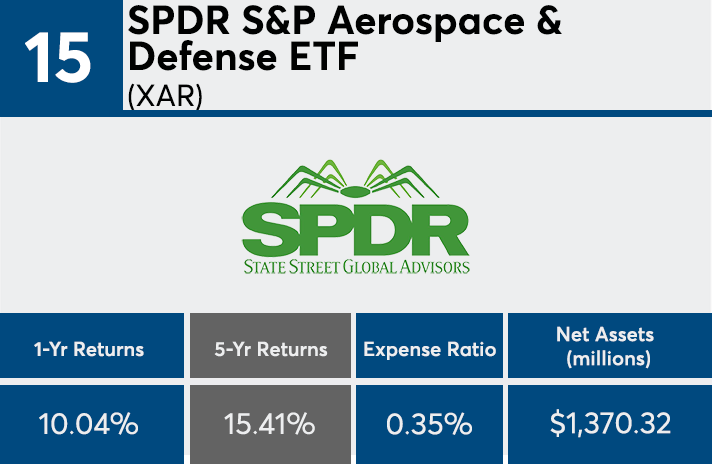

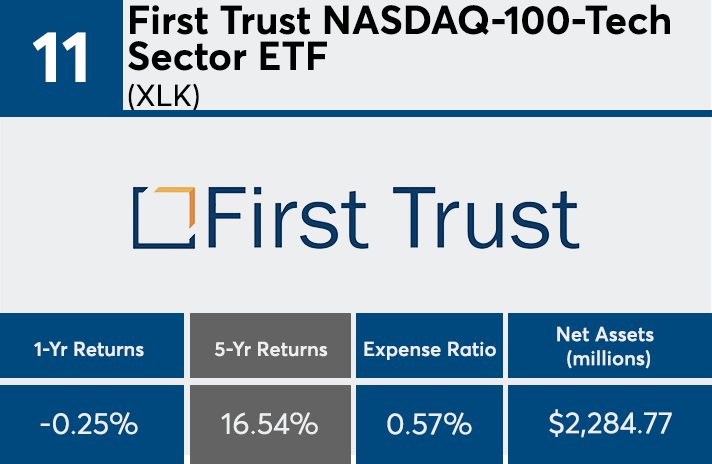

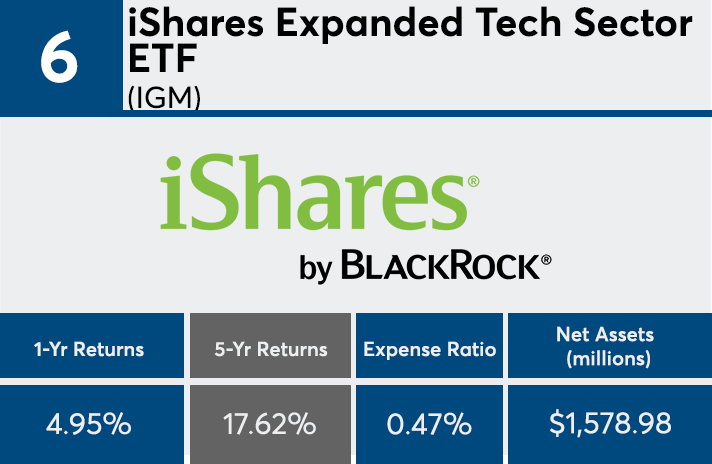

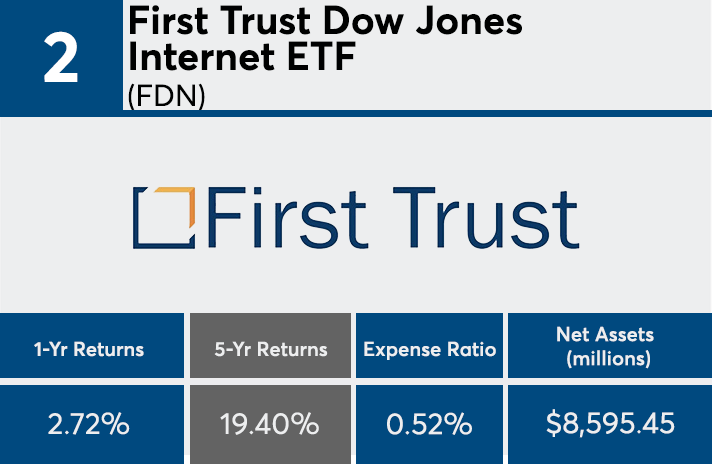

Home to a combined $149.7 billion in assets under management, the 20 passively managed products with the highest returns over five years were all ETFs, Morningstar Direct data show. Grant Engelbart, senior portfolio manager and director of research at CLS Investments, notes that most of the leaders are ETFs in the tech sector.

The best-performing passive fund portfolios over the last five years held companies like Microsoft, Adobe and Salesforce, stocks that have “carried most of the weight the past five years,” Engelbart says.

With an average five-year return of 16.7%, all of the leading 20 outperformed the broader market, data show. For comparison, the S&P 500 returned 9.9%, as measured by SPDR S&P 500 ETF Trust (SPY), while the Dow returned 11.16%, as measured by SPDR Dow Jones Industrial Average ETF (DIA), over the period, according to Morningstar.

A ranking of the largest 20 passively managed funds shows size is hardly indicative of superior returns. With a combined $3.6 trillion in AUM, the largest 20 posted an average five-year return of 6.79% and average expense ratio 0.07%, data show. With $804.5 billion in AUM, the industry’s largest passively managed fund, the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), had a five-year return of 9.24%.

The tech sector broadly contributed to growth outperforming value, and the U.S. outperforming international markets, says Scott Kubie, senior investment strategist at Carson Partners. But he advises staying wary going forward. "While many of the businesses behind these indexes are fantastic companies, you can always pay too much for a great business and there is always the risk the fundamentals could change,” Kubie says. “Advisors will need to work extra hard to make sure clients understand the benefits of diversification.”

At 40 basis points, the average net expense ratio among the top-performers came in slightly below the 48 basis points investors paid for fund investing on average last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. For advisors with clients invested in any of these funds, Morningstar’s director of passive fund research, Ben Johnson, warns that outperformers are never the best place to look for consistent returns.

“These funds offer exposure to extremely narrow and volatile segments of the market and are best used as bit players in a diversified portfolio — if they belong at all,” Johnson says.

Scroll through to see the 20 passive funds ranked by their five-year annualized returns through May 31. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund, as well as one-year daily returns, are also listed. The data shows each fund's primary share class.