Full-service brokerage firms are losing their edge as increasingly self-reliant consumers take their business to banks and self-directed investment platforms, according to a new survey from Hearts & Wallets, a retirement and savings research firm.

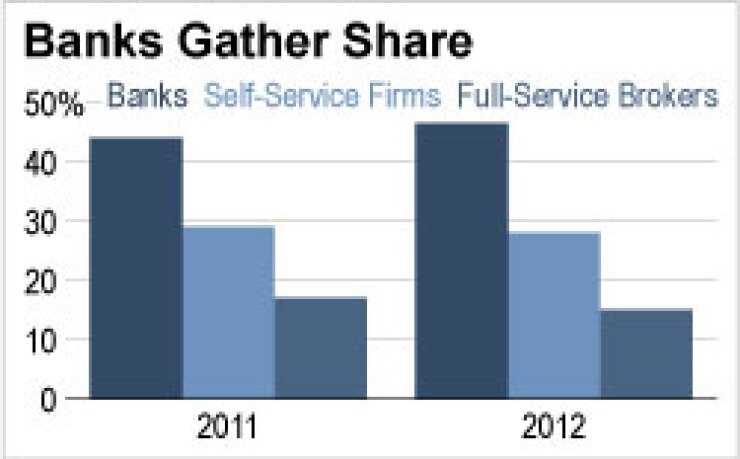

Banks have been the biggest winners, the study found. Almost one in two consumers (47%) say they keep the majority of their assets with banks, up from 44% in 2011. Self-directed firms and full-service brokers, in contrast, had only 28% and 15% of the market, respectively.

Full-service firms haven’t done a good job of defining what they do, said Chris Brown, a partner of Hearts & Wallets, in a telephone interview. “People don’t know the difference between Merrill Lynch and TD Ameritrade. They see all the firms as the same,” he said, adding the lack of understanding is bad for the industry.

Banks dominated households with less than $100,000 in assets. Almost six in 10 consumers (58%) in this wealth segment said they held the majority of their assets with banks.

Banks trailed their competitors in higher wealth brackets but are gaining share. Almost two in 10 consumers (17%) in households with $1 million or more in assets reported that the bulk of their assets were at banks, up from 13% in 2011.

Self-directed firms accounted for the lion’s share of the wealthier market, with 44% of consumers reporting primary relationships with firms such as TD Ameritrade and Charles Schwab. Full-service firms lost market share among this segment, falling to 32% from 36% in 2011.

Fewer investors are seeking out advisors, according to the survey. About one in five (21%) say they use a financial professional as their primary provider of investment advice, down from 25% in 2011. Usage dropped sharply among households with $100,000 to $500,000 and $2 million plus in investable assets.

Usage was tepid even among people who see themselves as relying on advisors to make investment decisions. Only 37% of the so-called “delegators” reported using a full-service brokerage as the primary investment provider, according to the survey.

Firms have not articulated their value proposition and this has caused a great deal of confusion among investors, Brown explained. He noted that while most consumers know the difference between Wal-Mart and Neiman Marcus, they can’t tell the difference between Scottrade and Merrill Lynch.

The survey, conducted in June and entitled “Focus on Advice: Preferences, Sources and Use of Technology,” was based on the responses from 5,400 U.S. households.