The Department of Labor's fiduciary rule is upending the wealth management business in unexpected ways. The latest target: lucrative recruiting bonuses to entice advisers to switch firms.

Initial signing bonuses, or "front-end" awards, are compatible with the best interest contract exemption, the Labor Department

But the back-end part of such awards, which are often contingent on an adviser's ability to reach certain targets for sales and assets, can "create acute conflicts of interest that are inconsistent" with the exemption, according to the department.

"Such disproportional amounts of compensation significantly increase conflicts of interest for advisers making recommendations to investors, particularly as the adviser approaches the target [for assets to bring over]. Accordingly, financial institutions generally may not enter into such arrangements under the full BIC exemption," the department says.

A Labor Department official, who asked not to be identified, said the incentives firms provided were a point of concern.

"Imagine you’re the customer with this representative who is on the threshold. If he makes a sale to you, he gets a huge increase in compensation. If he doesn't, he doesn't get it," the official says. "The amount of money he makes for reaching that threshold is just out of whack with the recommendations he's making. That's what worries us about that."

-

"We fully expect to offer a range of options to help our clients," CEO Paul Reilly said.

October 27 -

CEO Jim Cracchiolo said the firm will still offer variety on its platform, but that it needs to make sure products are "appropriate for the client."

October 26 -

Unlike its rival, Morgan will keep commission-based retirement accounts under the new regulation's best interest contract exemption.

October 26

A COMPELLING OFFER

The impact on recruiting is unclear at the moment.

Many firms, including UBS, LPL and HighTower, were not immediately available for comment. Industry insiders said that firms likely needed more time to digest the regulatory guidance. Spokeswomen for Merrill Lynch and J.P. Morgan Securities declined to comment.

Plus, Merrill Lynch grabs UBS planners who managed $750 million in client assets.

"Our recruiting packages will be fully compliant with the DoL [rule] while providing advisors a compelling offering to make Stifel their firm of choice," John Pierce, head of recruiting at Stifel, says.

It also wasn't immediately clear how or if firms would structure recruiting deals differently.

"Do we have to break out retirement assets from his or her regular assets? If a recruit has $150 million in assets, and $100 million is not retirement assets and $50 million is, then do we structure two recruiting deals?" asks Jeff Bischoff, founder of Old Greenwich Consultants.

Danny Sarch, president of Leitner Sarch Consultants, expected it would impact recruiting.

"Deals may have to be changed to reflect it. It's possible that firms will choose to do away with revenue back-end deals altogether," Sarch said.

The Labor Department official said that firms could opt to pay the entire bonus upfront — meaning no back-end components.

"If it's just 'Here's what we're going to pay you,' then I don't think that implicates our rule," the official said.

The official adds that if it's a case of come to firm X and get paid Y dollars and "it doesn't depend on what products they're recommending, or their assets or revenue they'll make for the firms, then that really doesn't really create any conflict of interest under our legal structure."

From recommending wrong share classes to cherry-picking allocations, these are the pitfalls advisers should avoid.

STOPPING THE GRAVY TRAIN?

Elite advisers can earn huge windfalls when signing on with a new firm.

For example, last year, Wells Fargo offered Credit Suisse advisers up to 300% of production to move to the wirehouse.

Such bonuses are often partly structured in the form of forgivable promissory notes.

Ross Intelisano, an attorney at Rich, Intelisano & Katz who represents brokers, says that it’s possible firms may start including a carve out to avoid including accounts covered by the new regulation. Another possibility is to cut back-end bonuses.

But, Intelisano adds: “If they remove the back-end bonuses from the deals will advisers still be willing to jump ship? If firms move the back-end numbers to the up front bucket, they remove the added financial incentives for advisers to grow their business and will be risking advisers not performing even early in their deals. This may cause firms to shorten the durations of the recruiting deals and also lower the total economics of the deals.”

The Labor Department said that pre-existing recruiting agreements will be grandfathered in under the rule: "These agreements predated the rule, exemptions, and this guidance, and, accordingly, were not designed to evade their terms."

However, firms are required to ensure "stringent oversight" and that the arrangement with the recruit doesn't violate other conditions of the new regulation.

Industry insiders were divided as to whether firms would use the rule as a basis for cutting back on recruiting deals.

"The first firm that tries to do that will see the number of recruits spike down," Bischoff says. "And if they all did it, then it might be collusion, in my opinion."

'THAT MAY TWEAK OUR RESPONSE'

The fiduciary FAQ was hotly anticipated by wealth management firms, many of which are still struggling to determine how best to comply with the rule. Many of the 34 questions the department answered addressed issues surrounding the best interest contract exemption (question 12 addressed recruiting bonuses).

Raymond James also announced Thursday that it will offer clients commission-based retirement accounts under the exemption. CEO Paul Reilly, speaking prior to the release of the FAQ, said his firm's full fiduciary compliance strategy would be contingent on its clarifications.

"That may tweak our response," he said during an earnings call.

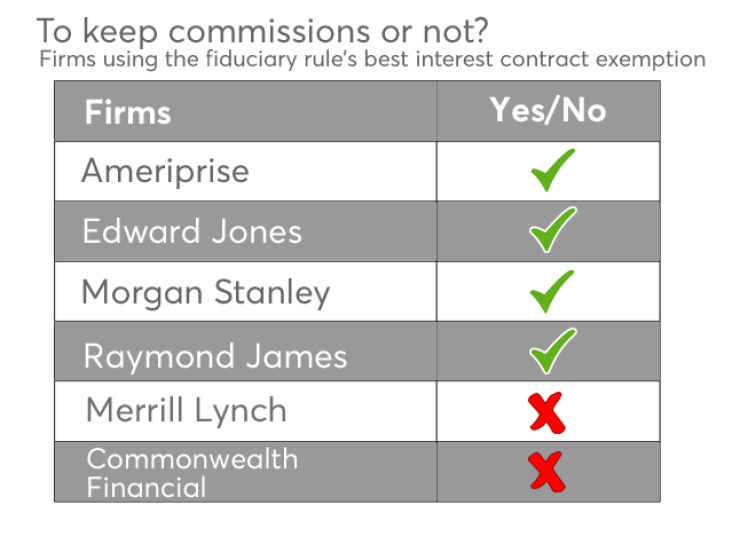

While most of the industry has yet to announce their fiduciary compliance plans, several major brokerage firms have unveiled the details of their strategies. In addition to Raymond James, Morgan Stanley and Ameriprise will also be using the exemption to offer clients commissioned-based retirement accounts.

Merrill Lynch and Commonwealth Financial Network have opted not to. The firms said that they were well positioned to transition to fee-based accounts. Merrill, which has 14,000 advisers, also said clients can use its self-directed platform as well as its forthcoming robo adviser. Commonwealth, which has 1,650 independent advisers, also cited the threat of lawsuits; clients have a right to private action under the rule.

Also on Thursday, Massachusetts' securities regulator said that a new survey of advisers in the state showed that more of them need better training in order to comply with the new regulation.