Some advisory firms have been slowly shifting away from billing on assets under management toward assets under advisement — i.e., assets on which an advisor may make recommendations, but not necessarily effect any transactions. The appeal of such an approach is understandable: Qualified plans are an ever-increasing piece of clients’ nest eggs, especially for those in their 30s, 40s and 50s. And while a potential client might have significant

The AUA movement is not without operational challenges, however, that advisors need to consider before adopting. Here is a primer on a new, novel yet tricky fee structure.

Most advisory firms that work with prospective clients who hold significant held-away assets approach it in one of three ways. The first assumes that the firm manages a brokerage account, even if that’s not necessarily profitable, in the hope that they’ll get the 401(k) rollover down the road — which will be bigger.

Now, if you can serve a $150,000 client profitably at that price point, great, but if you need a higher one to be profitable, waiting upward of 10 years for that big rollover may just be too long.

Consequently, some advisors handle the situation by not

And if your advice is worthwhile, the client will gladly pay their $3,000 holistic fee, especially since relative to the client’s overall net worth — which may be more than $500,000 of investment assets — $3,000 is a very reasonable sum.

There’s a third option though, and one I want to discuss in greater detail. This approach bundles holistic advice for all a prospective client’s investment assets, including their outside 401(k) plan. The fee starts at 1.2% for accounts under management and 0.6% — or half the AUM fee — for outside accounts under advisement. That 0.6% fee nets the client ongoing advice and guidance on their 401(k) allocation, and whether or how much to rebalance every year. It also includes annual due diligence on the investment lineup to evaluate performance, ensuring that the client still has the right options.

Even though the client’s assets are held away, you’re still advising on them and providing a valuable — and valued — service. You also now have a billing model that generates sufficient revenue to provide the client your overall services.

DIFFERENTIAL FEE SCHEDULES

A key aspect of this approach presumes that the advisory firm has one fee for assets under management and then a second, typically lower fee, for assets under advisement. In practice, the AUM arrangement may have a lot of ongoing management and seeking out new investment opportunities, whereas the AUA arrangement typically just consists of sending annually updated allocations for the 401(k) plan and reviewing the list of available investment options.

Unfortunately, while we have

It’s worth noting that some firms charge more than half their AUM fee and a few go so far as to get client passwords to log on to 401(k) plan platforms to manage those assets more directly, with ongoing rebalancing and charging the full AUM fee on both directly managed accounts and 401(k) plans under advisement. If you pursue this kind of approach, there are some additional cost layers to consider.

First and foremost, manually rebalancing client 401(k) accounts one login at a time can be a slow process. So while you might get paid more by charging your full AUM fee, you may not necessarily be more profitable if you have to invest significant time doing this.

Second, be cognizant that having outside access to client accounts will likely subject you to

A BIGGER CONCERN

The more substantive issue when considering the AUA approach is whether you’ll clearly convey to clients the value of what you would and wouldn’t provide in your fee structure.

An advisor sees a big difference in AUM and AUA, but from the regulator’s perspective, you can’t claim assets managed as

Clients don’t always recognize this as a big distinction in services, but they do recognize the fee difference between full AUM and lower AUA structures.

I’ve known a number of advisors who have used the AUA approach and, when the client retired and it was time for the rollover, the client said, “Eh, why don’t we just keep managing it the way that you are for the lower fee? I don’t need to move it all over and get charged double.” The takeaway: The firm must be very clear up front about the difference in the services that you’re providing by charging and managing AUM where you manage it, versus charging and advising on held-away assets under advisement where you’re just advising.

I don’t think this is an insurmountable challenge. On that held-away 401(k), simply adopt a more passive strategic approach where you annually rebalance, evaluate the investment options and charge a lower fee on that. In your managed accounts, you have a dedicated investment team that implements a tactical managed volatility approach to reduce sequence of return risk in retirement. So when the client retires, they’d want to roll over assets to have your specialized, retirement-centric investment management process working for them. That’s a proper upsell.

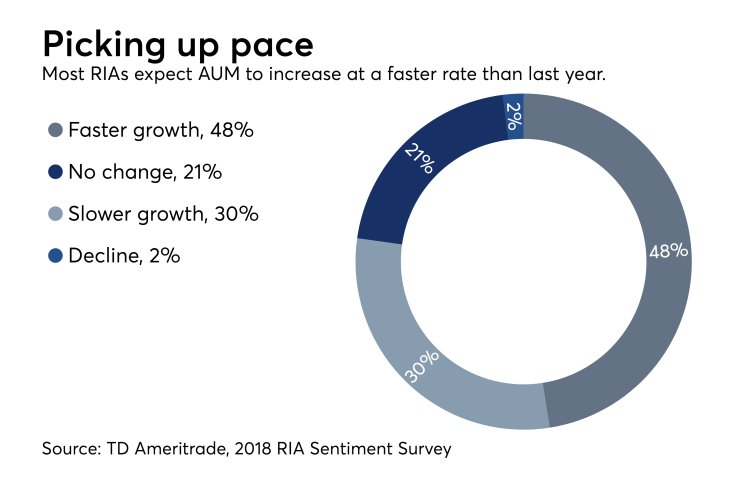

AUM, revenue and client base growth are soaring, but advisors must remain vigilant.

Yet even this passive approach has its pitfalls. If you’re not selling an investment management process as part of your AUM value proposition, it will be difficult to convince clients to switch from a low AUA fee to a higher AUM fee later. You may consider a single unified fee instead, without any distinction between AUM and AUA, especially if you’re going to log into client accounts to rebalance and select investments.

The other challenge is how exactly you’re going to calculate and bill that AUA fee. If you bill a percentage of the balance, you obviously need to know that balance. This means a client must give you statements — not a very exciting proposition when they know they’re about to get billed based on that material — or you pull values directly by logging into the client’s account. Again, that raises both the

The best approach may simply be to use account aggregation tools to pull the held-away asset account balance into your performance reporting platform that you use for billing — such as

BILLING CHALLENGES

Clearly you can’t bill an outside 401(k) plan directly without triggering a taxable distribution and a potential early withdrawal penalty. To navigate this, some advisors will bill the accounts they manage for the assets they’re advising outside of scope. That’s certainly legal and legitimate, but it’s also problematic.

One, if the held-away assets under advisement are significantly larger than the current assets under management, then the total fee billed from just the managed account will appear massive to the client. The fee out of your portion could be 2%, 3% or more of the total account. This is concerning both psychologically to the client who may balk at one giant fee coming from a single account, and also because many RIA custodians will red-flag fees coming out that are 3%-plus of the account balance.

And for those who have an active management process, billing one single fee for all accounts, managed and advised, is going make your performance net of fees look even worse. That’s because the account you’re managing is paying not just its own management fees but all the other fees, which most performance reporting software doesn’t discriminate between.

Even worse, if you’re managing an IRA it’s prohibited to bill the held-away AUA fee

At a minimum, be aware that you need some clear plan about how you’re going to handle billing, especially if a large portion of client assets are expected to be outside AUA and not AUM. Consequently, it may not regularly be practical or feasible to bill the entire advisory fee from just the small portion of assets you’re actually managing.

The bottom line is to understand there is an opportunity for expanding the advisory relationship with clients beyond just managing the particular investment accounts that they have directly under your purview and billing on those accounts, and then trying to set appropriate minimums to ensure you generate the revenue per client that you need to justify the work you’re doing.

But if you want to add this AUA offering, a clear value proposition must be created and put forward to the client — lest you undermine the perceived value of a full AUM fee on a

Whatever you do, never claim assets under advisement in held-away accounts

Armed with this knowledge, you can set about creating value on both sides of the ledger.

So what do you think? Does the Asset Under Advisement fee structure make sense for your practice and clients? If so, how might you navigate the operational and regulatory challenges while ensuring that your clients understand the value in the services you are providing? Please share your thoughts in the comments below.