In Brexit's wake, many advisers told clients not to panic. Stay the course, they said. Though sound advice, others are now questioning whether the U.K.’s decision is indicative of deeper-rooted issues that will cause long-term volatility.

A majority of advisers did not make any changes to client portfolios following the June 23 Brexit vote, according to a recent survey by Financial Planning, which polled 328 financial planners. They reported taking either a wait-and-see approach or believed that in the long term Britain’s decision to leave the EU will yield little to no effects.

“Any position we might take, defensive or otherwise, will entail risk,” a wealth manager says.

In fact, 55% of the advisers surveyed used the same amount of client assets to purchase non-U.S. developed-market equities in June as they did in May. That figure rises to 60% for non-U.S. developed-market bonds.

“I'm advising clients to remain invested and keep focused on longer-term goals,” a wealth manager says.

And yet a select number of advisers say Brexit may be a wake-up call to re-evaluate asset allocations; Brexit is the “catalyst for the eventual breakup of the EU and symptomatic of the end of globalization," in the words of one planner.

An adviser reports telling clients not to panic, but adds that renewed economic pain is coming. "Brexit reflects an increase in anti-globalization. As the largest exporter and importer in the world, the U.S. will suffer," this adviser says.

One planner believes Brexit is “a harbinger of increased volatility in the markets,” and increasing cash positions would be wise. Another is of a similar opinion, saying that hefty economic headwinds across the globe are imminent, and Brexit served to speed up the process.

Post-Brexit, many clients may want to sell, but others could see the volatility as a boon.

For those that took a softer position but still reallocated assets or advised clients to do so, they emphasized hedging against risks by increasing cash positions and liquid assets and reallocating from global equities to U.S. stocks. “Short term I'm recommending slightly higher liquidity and overweight in U.S. securities,” a wealth manager says.

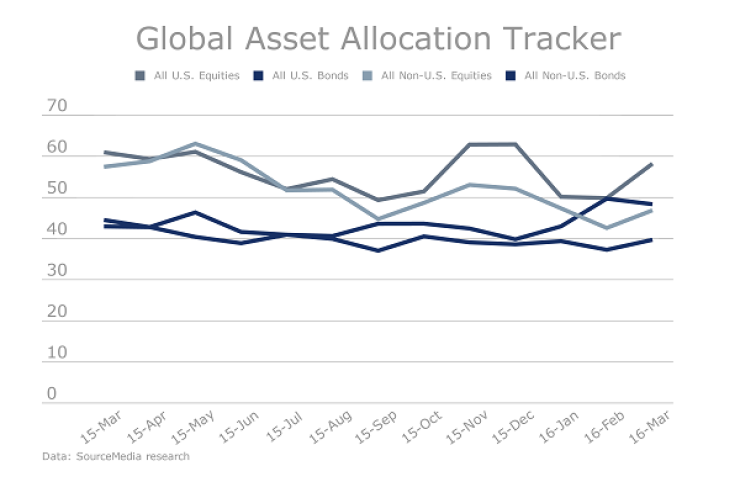

Indeed, advisers' allocations of client funds to global equities and bonds fell in June, according to Financial Planning’s latest Global Asset Allocation Tracker.

In contrast, a minority of advisers have also viewed Brexit as a bullish opportunity to increase exposure to European and international assets. One planner has found clients "excited" about potential buys in foreign and domestic markets.

“I believe that increased volatility over the next year is imminent, but it also represents opportunities for value investing,” this planner says. Another adviser used the weakness in the market to buy more international funds.

Nevertheless, most advisers are convinced Brexit-related volatility will be offset in the long term, with some stating that the U.K. and U.S. economies will be better off. They are advising clients to stay with their existing strategies and ride out the highs and lows.

“Our advice is to remain invested in a diversified portfolio, and assume Brexit as a longer-term almost non-event that will evolve,” a wealth manager says.

But what precisely constitutes the right diversification is vexing to at least one financial planner. “Any position we might take, defensive or otherwise, will entail risk," this planner says.