Investors are feeling more confident about their financial advisors and brokers.

When asked how effective various entities were at protecting investor interest, 70% of respondents in a new investor survey expressed confidence about their financial advisors and brokers -- up from 66% in 2012.

The Main Street Investor study is conducted annually by the Center for Audit Quality, a public policy organization affiliated with the American Institute of CPAs dedicated to enhancing investor confidence.

The market rebound has helped contribute to the improved numbers for advisors, says Cindy Fornelli, the center's executive director -- although she notes that investor confidence in advisors has also been high in previous surveys, even following the 2008 financial crisis. "Investors are relying on their financial advisors to guide them," she says. "The men and women of the U.S. are putting their trust in advisors to pull them through the market's complexities."

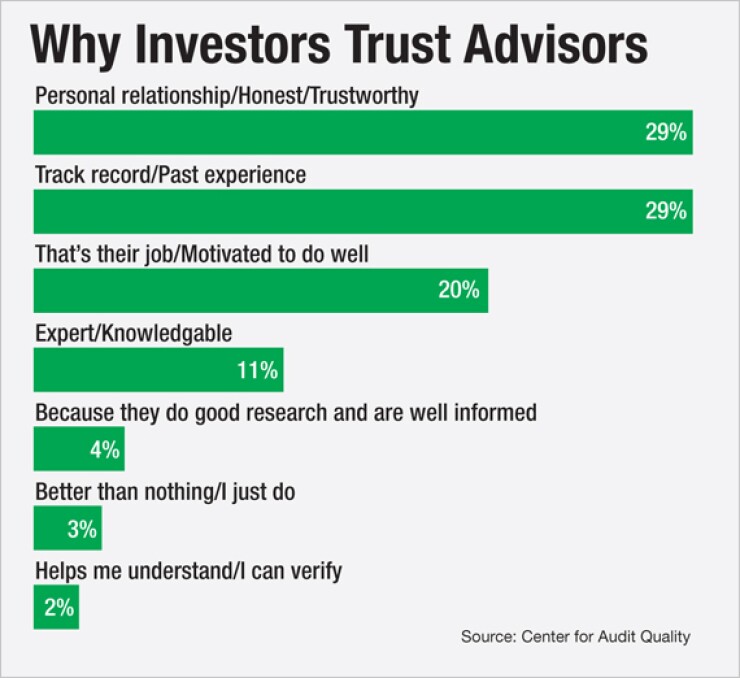

WHERE'S THE TRUST?

Investor confidence in advisors is highest among those the wealthiest group surveyed -- those who have more than $100,000 in investable assets -- with 71% overall saying they were confident, compared with 67% of those with fewer than $50,000 in assets.

Regardless of asset levels, women trusted advisors more than men did; the greatest level of confidence (73%) was seen in women with more than $100,000.

When asked whom they would trust as they considered investing in a public company, nearly three-quarters (72%) of investors said they would use their advisor as a source of information and advice for investment decisions -- more than would turn to SEC filings, financial reports, family and friends and (fortunately, for their sake) social media.

Moreover, almost half (48%) said they placed the most trust in their financial planner, advisor or broker.

"It bodes well for the industry that there is high trust in the financial advisor community," says Fornelli, who prior to her role leading the CAQ was a regulatory and conflicts management executive at Bank of America. "It shows that the market is complex and there is a lot to digest, so [investors] do need some professional help."

Read more:

-

No, Really: You Need Your Own Financial Planner -

Restoring Client Trust -

10-Year Investing Forecast: Takeaways for Advisors