After more than 90 years of small stocks outperforming their larger counterparts, a reversal occurred in September as large-caps advanced while small-caps declined.

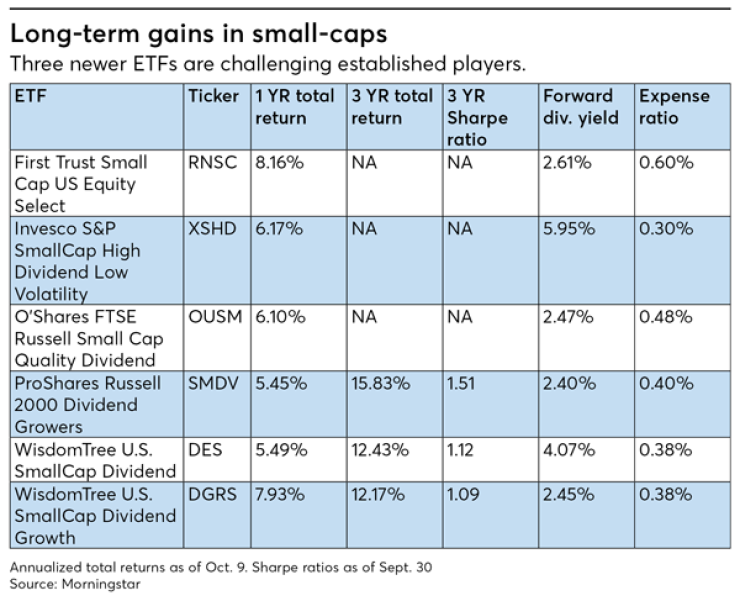

For some historical context, from 1926 through 2017, small-caps had a compound annual return of 12.1% vs. 10.2% for large stocks. Assuming that long-term trend reasserts itself, advisors who want a dividend-focused emphasis on small-caps in client portfolios have several ETF choices. One-year performance numbers are through Oct. 9.

First Trust Small Cap US Equity Select (RNSC, expense ratio: 0.60%) tracks the Nasdaq Riskalyze US Small Cap Index. That benchmark includes stocks from Nasdaq’s domestic small-cap index that have paid a dividend within the last 12 months. Sector weights are set to match those of the Nasdaq US 700 Small Cap Index. Within each sector, stocks are equally weighted. Largest sector weights are industrials (18.4%), financials (16.9%) and health care (16.8%). Launched in June 2017, RNSC had a total return of 8.16% over the past year.

Invesco S&P SmallCap High Dividend Low Volatility Portfolio (XSHD, 0.30%) holds 60 stocks drawn from the S&P SmallCap 600. The selection starts with the 90 top yielding stocks from the base index, with a limit of 10 stocks per GICS sector. These stocks are then ranked by volatility over the prior 252 trading days. The 60 least volatile form the index XSHD tracks. Financials (25.5%), real estate (19.9%), and materials (11.1%) are the largest sectors in the ETF, which was launched on Dec. 1, 2016. For the past year, XSHD had a total return of 6.17%.

O’Shares FTSE Russell Small Cap Quality Dividend (OUSM, 0.48%) This small-cap domestic stock portfolio, launched in December 2016, holds 223 stocks. In May, the ETF switched its underlying FTSE Russell index to one that excludes real estate. The multi-factor index screens for company quality (as defined by profitability, efficiency, earnings quality and leverage), low volatility, and higher yield among small stocks. Companies are capped at 3% of the index. Biggest sectors are consumer cyclical (20.4%), financial services (18.4%), and industrials (18.2%). For the past 12 months, OUSM had a total return of 6.10%

ProShares Russell 2000 Dividend Growers (SMDV, 0.40%) holds the 61 stocks in the Russell 2000 index that have increased their dividends annually for at least 10 consecutive years. Largest sector holdings are in utilities (21.8%), industrials (14.8%), and financials (12.7%). Launched in February 2015, SMDV had a total return of 5.45% over the past year.

WisdomTree U.S. SmallCap Dividend (DES, 0.38%), which holds 714 stocks, tracks a proprietary index that starts by removing the 300 largest domestic dividend payers. The bottom 25% in market capitalization forms the underlying index for DES. Stocks are weighted by the proportionate share of total cash dividends they are expected to pay in the coming year. Biggest sector weightings are consumer discretionary (21.8%), industrials (18.0%), and real estate (13.4%). Over the past 12 months, total return for DES, which went public in 2006, was 5.49%.

WisdomTree U.S. SmallCap Dividend Growth (DGRS, 0.38%), launched in July 2013, starts with the same capitalization screening as DES, but adds screens for expected earnings growth as well as a quality screen based on return on equity and return on assets. Despite its name, DGRS does not require dividend growth. Weighting is accomplished using the same methodology as DES. Top sectors for the 274-stock fund are industrials (27.6%), consumer discretionary (23%), and financials (15.7%). Total return for the past year was 7.93%.

Three of these ETFs have rather short histories. Advisors may want to watch them before taking the plunge. Among the older ETFs, SMDV has the best risk/reward profile based on its three-year Sharpe ratio. But if your client is more concerned with current yield, DES may be an option to consider.