It takes more than a variety of products and rock-bottom fees to become a go-to fund provider.

Indeed, advisers prefer fund companies that go the extra mile. That means they want to see that issuers truly understand advisers’ needs. They also want relevant fund information and strong service, according to a survey of more than 600 financial professionals conducted by Corporate Insight and InvestingChannel.

Demand for ETFs soars; costs dominate adviser concerns, plus other key trends in portfolio management.

“Issuers that stand out from the pack are those that are partners to advisers — not just vendors,” says Michael Ellison, president of Corporate Insight. “Advisers appreciate the personal aspects of a strong fund-issuer relationship. That’s key.”

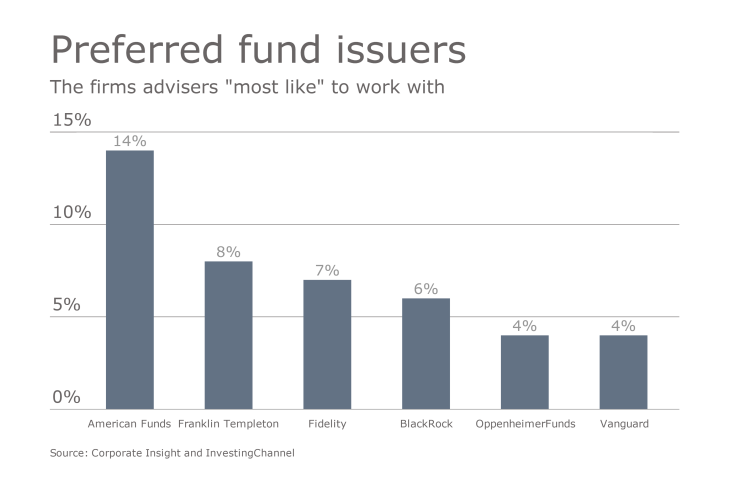

American Funds led the group of preferred issuers, followed by Franklin Templeton and Fidelity, according to the study. BlackRock, OppenheimerFunds and Vanguard rounded out the top. T. Rowe Price came in last with just 1% of respondents saying they would “most like” to work with the issuer.

'RELEVANT INFORMATION' WANTED

According to the study, 65% of advisers say their favorite vendor provides “relevant fund information” and 60% say their pick offers “good customer service.” Other top reasons include “appropriate communication frequency,” at 48% and “usable tools and technology,” at 44%.

And when advisers find a relationship that works, they spread the word. More than two of every five advisers gather information about fund performance and issuers from their peers, the study notes. The only other sources of information more commonly used by advisers for research are the issuers’ own websites and other business and finance websites.

Planners scouring those websites are willing to reward a fund company with new business — if the issuer provides the right content. According to the study, more than six in 10 advisers would invest in products from companies with which they currently do not do any business, but the issuer needs to provide “relevant, concise fund information,” while still being accessible and easy to navigate.

Advisers want a vendor who will work with them, says Ellison. Top issuers “are interested in understanding advisers’ needs and meet those needs through relevant content, targeted communication and useful technology.”