In the midst of enormous change, many elite advisers find themselves at a crossroads, trying to determine the next stage for themselves, their teams and their clients. Often the path to independence is among the options considered. You’ve spent decades building and nurturing your practice. It’s not just a business — it’s truly a part of you.

Wouldn’t it be helpful to know what your practice is worth and understand the options available should you decide to monetize all or a portion of it one day?

If any of the following apply, you should know your monetization options:

- “I feel like it gets harder every day to deliver the level of excellence, creativity, and customization my clients expect and deserve.”

- “I have certain beliefs about client care and culture within my team today that I’d like to perpetuate in the decades to come. I don’t have confidence that my current firm will allow that to happen.”

- “The idea of taking a deal from another major firm doesn’t excite me. It’s hard to justify to my clients why this would be good for them, and I don’t need the upfront money – especially when it’s fully taxable and tied to a nine-year note.”

- “I’m hearing more and more about options for going independent and/or forming my own RIA, but I don’t know what I don’t know when it comes to evaluating what path is right for me, my team and my clients.”

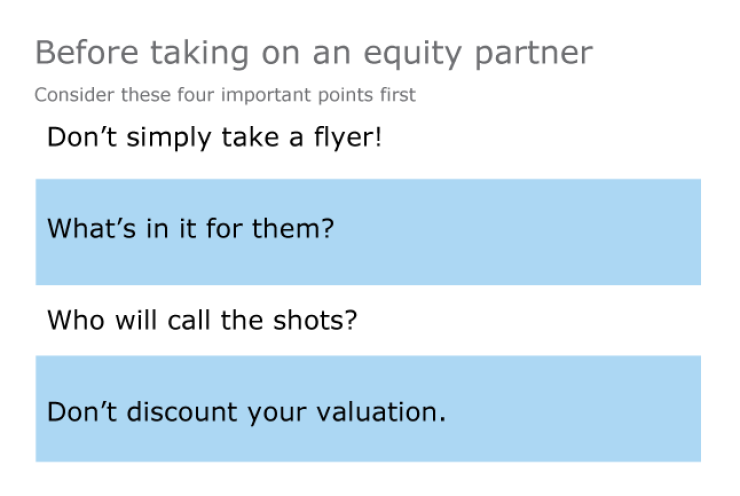

There are many different monetization approaches: succession planning, upfront money, equity and more. If you are evaluating the approach of taking on an equity partner by joining a network of independent RIAs, below are four important things to consider:

1. Don’t simply take a flyer! Who are these guys? Is the company profitable? If just barely, how can you be sure they’ll be able to stick it out? Ask for a representation of their EBITDA, which gives you the best view into their true cash flow.

2. What’s in it for them? Why is this firm interested in being your partner? Are they committed to the wealth management space, do they have a track record, or is this more of an experiment? Are they going to allow you to operate on your own or will there be an effort to cut costs and dress up for a sale? Will the services they bring to you have an additional markup from vendors or will the partnership be a true one in terms of sharing the P&L?

3. Who will call the shots? You’ve been an employee long enough. Be sure you maintain control of what to deliver to clients and oversight (hiring and firing) of personnel. Also, be sure that your control is ironclad even if your new partner has a change in control.

4. Don’t discount your valuation. It’s not only about the money, but receiving fair value is a reasonable expectation. Many deals are structured over multiple years. Will the deal be structured as a taxable event or with long-term capital gains? Are there hurdles to receiving your consideration – how long and tied to what? Will equity be part of the deal? If so, is there a vesting period? If the buyer is a private equity firm, what is their exit strategy? If the investor is a strategic one, will there be pressure to cross-sell or use specific vendors?

As you can see, there is much to consider, which is to be expected given the years of sweat equity you’ve invested in creating such an outstanding practice. This hard work and commitment are all the more reason to be thoughtful and thorough when you consider the next chapter in your professional career and that of your practice.

-

Should advisers opt for better platform options or losing back-office and administrative tasks?

September 13 -

Here’s what advisers need to know for a successful transition.

October 10

The potential to fulfill your entrepreneurial spirit by founding your own RIA based on the principles, experience and wisdom you’ve gained through your dedication over the years may seem daunting but is incredibly exciting. However, proceed with caution as all partners are not created equally. You want a partner equally committed to your long-term success as well as their own.