Demand for RIA firms is high, and supply is limited. As a result, some advisers considering retirement are holding off while the value of their business continues to rise.

But bull markets don't last forever, the regulatory environment is uncertain and owners aren't getting any younger. Supply in

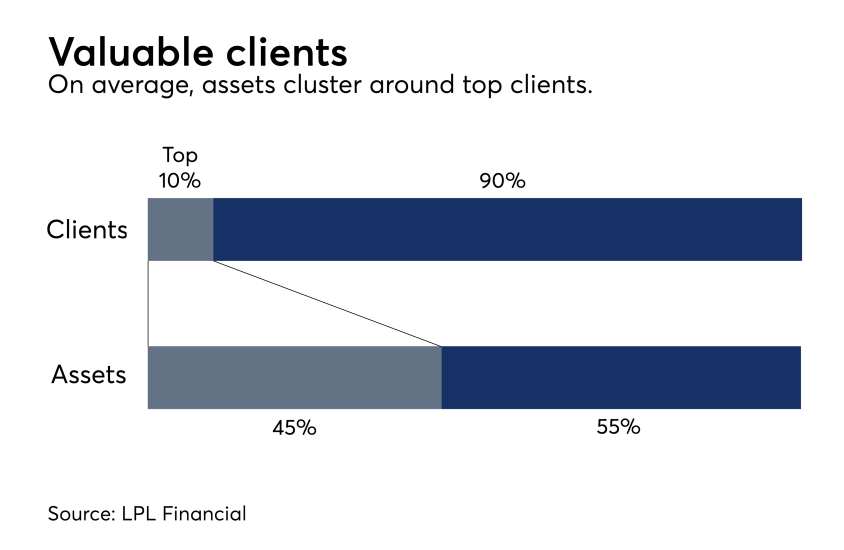

Owners need to do all they can now to maximize the value of their business.

According to LPL Financial's recently released white paper "5 Strategies for Improving Business Valuations" the following criteria are critical for determining — and boosting — the market price of an adviser's book.