Wall Street’s

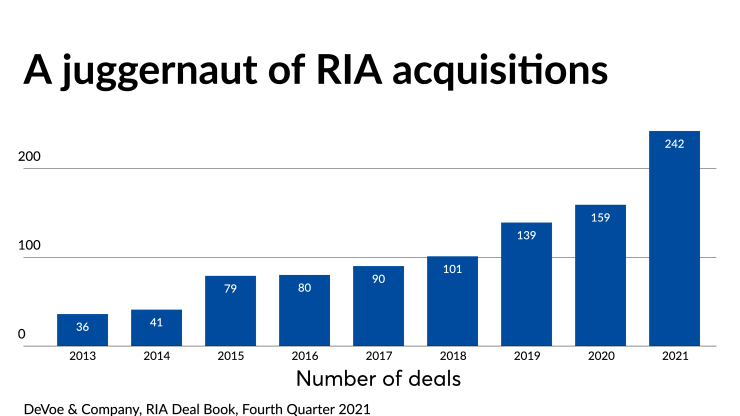

6 key trends for RIAs as mergers advance at torrid pace

Wall Street’s

Amid a busy April for big hires, compliance tech provider COMPLY and wealthtech platform TIFIN have brought on industry vets Michael Stanton and Jeannette Kuda, respectively, aiming for strategic growth.

After a mixed quarter for the firm's wealth unit, CEO Ron Kruszewski predicted that the Fed may cut rates zero or just once or even hike them in 2024.

The U.S. Chamber of Commerce and other business groups contend the Federal Trade Commission has exceeded its authority in nullifying contracts that prohibit employees from switching jobs to competitors.

Retirement doesn't have to mean scrimping and saving. Here are five parts of the country where seniors are living large in their golden years.

Advisor360° names former MassMutual exec Mike Fanning as its new CEO