These are troubling times — especially for financial advisors and their clients.

As the novel coronavirus rocks the wealth management industry, causing

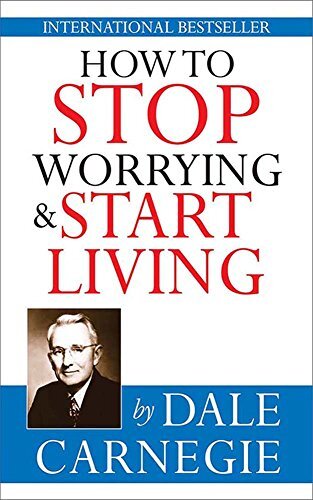

Financial Planning asked advisors, wealth management executives and industry experts for book recommendations to help their peers deal with the inevitable doubt and uncertainty creeping into their lives — and those of their clients. These titles have either made a positive impact on themselves or equipped them with tools to succeed in the face of this pandemic.

Whether you’re in search for a roadmap, strategies — or peace of mind for your clients — these recommendations fit the bill.

Click through the list to learn more.