Volatility related to trade tensions with China have left nearly all of the top-performing funds tied to the region over three years with short-term losses.

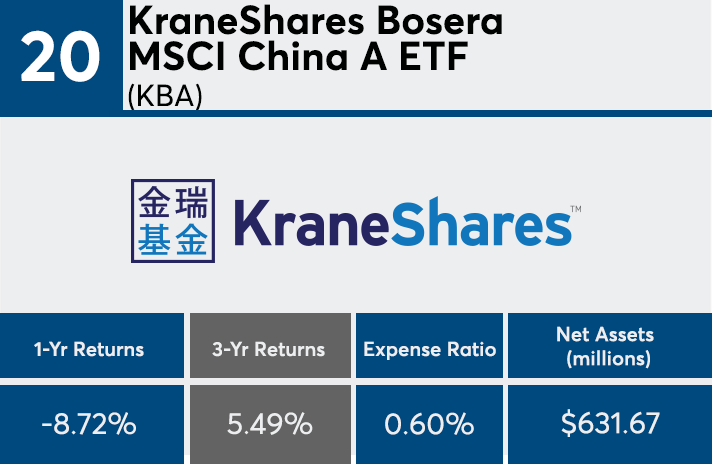

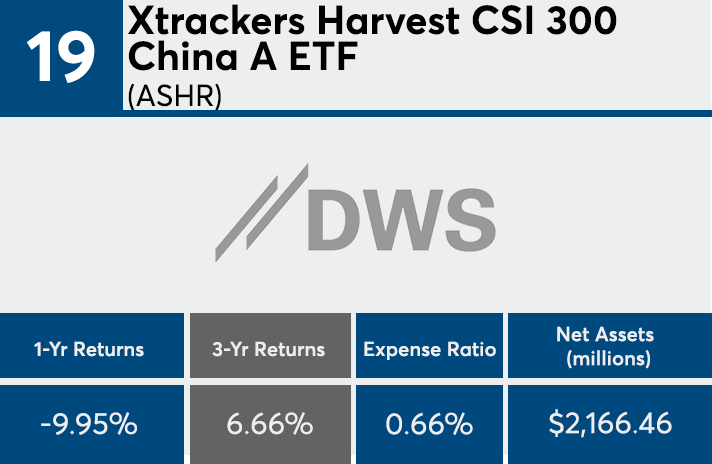

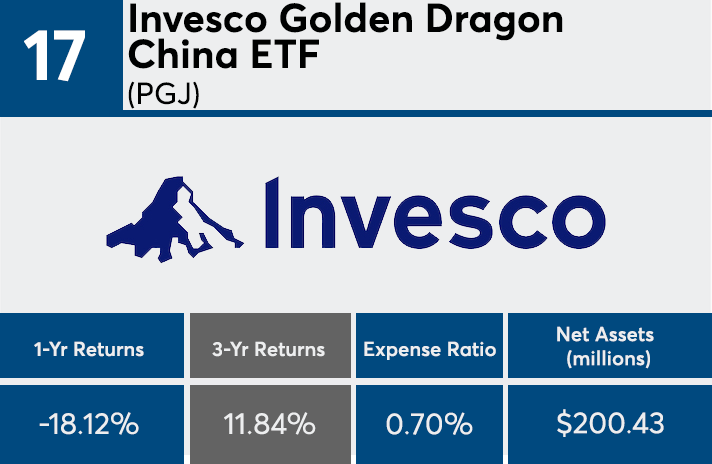

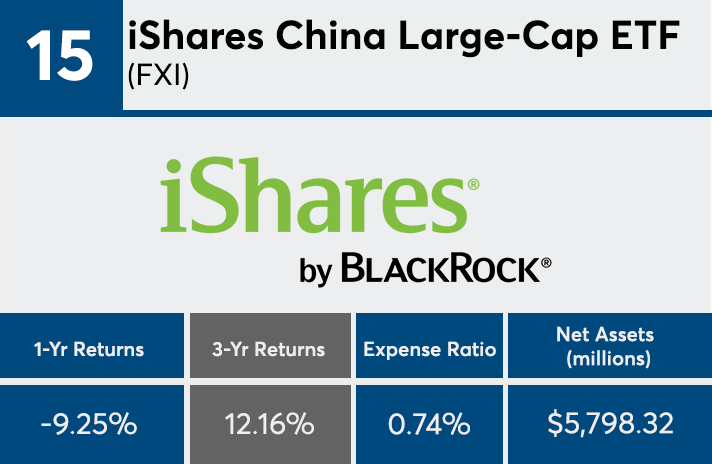

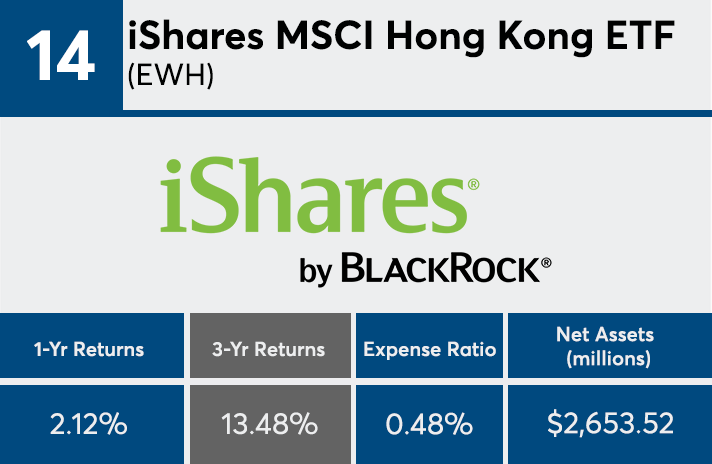

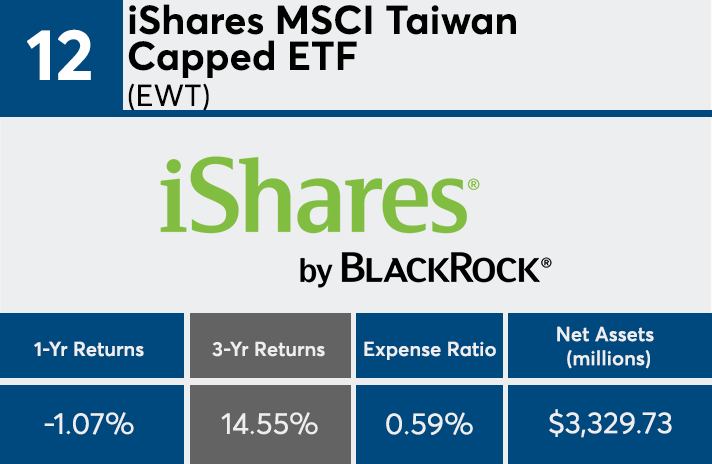

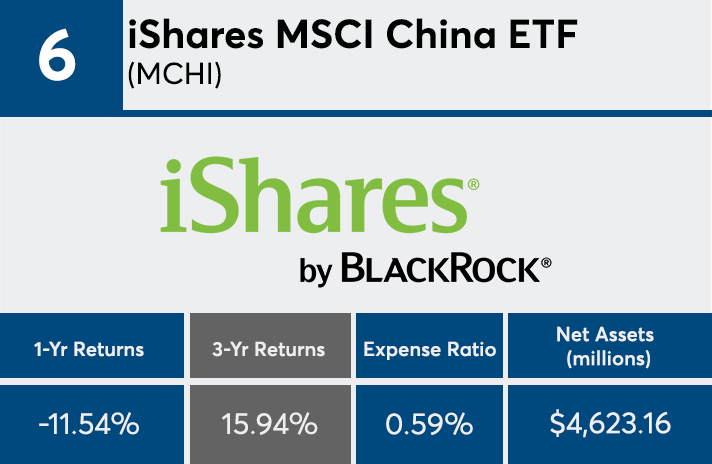

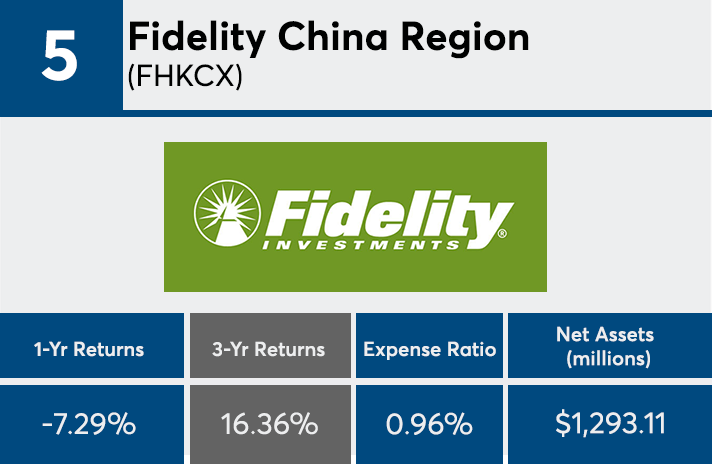

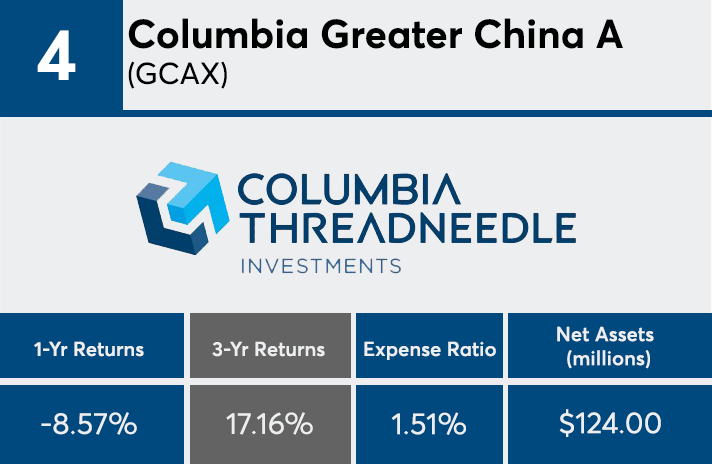

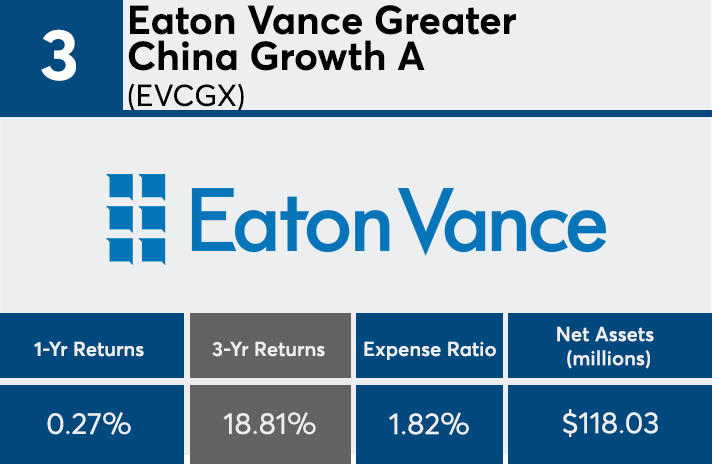

The industry’s 20 best-performing China region stock funds (with at least $100 million in assets under management) bested their sector peers by an average of nearly 3 percentage points, Morningstar Direct data show. With almost $27 billion in combined AUM, funds that invest at least 70% of total assets in equities and 75% of stock assets in China, Taiwan or Hong Kong recorded three-year returns of as little as 5% to more than 20%. Year-over-year, all but two of these funds had losses.

Advisors have a lot to consider when analyzing the China region universe of funds, says Ben Johnson, director of passive strategies at Morningstar.

“Not all China-focused funds are created equal,” Johnson says. “Some offer broad market exposure through a combination of Hong Kong and onshore-listed equities. Others might focus exclusively on onshore stocks, or A shares, as they are commonly known. Some of these funds try to navigate thorny issues, like the corporate governance concerns presented by state ownership of large, publicly listed firms. Others zero in on very narrow segments of the market, like internet companies.”

More than half of the funds that topped the ranking over three years are ETFs. The 20 with the best returns, which posted an average three-year return of 14.27%, saw an average one-year loss of 9.71%, data show. The broader universe of China region funds, which had an average three-year return of 11.52%, saw an average loss of 14.43% over the last year. “Advisors should take the time to dig into the details of these funds' processes or their underlying indexes to understand what it is they might be getting,” Johnson says.

A look under the hood shows these funds carried an average expense ratio of 0.84%. That is a little less than twice the price of the 0.48% investors paid for fund investing on average last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. The largest fund in the sector, iShares China Large-Cap ETF (FXI), which has a 74-basis point expense ratio, recorded a 12.29% three-year return but a one-year loss of 12.9%, data show.

Patrick A. Sweeny, principal and founding partner of Symmetry Partners, says advisors with clients who have holdings in these products — and who keep up with the threats of a full-blown trade war — should be stressing the importance of staying invested during times of volatility.

“The chief risk for financial advisors or retail investors is the greater the volatility, the more difficult it is for the client to stay in their seat and get the long-term return,” he says. “The most important thing advisors do is coach or educate clients on how markets work so they stay in when times are bad, as long as it’s a diversified portfolio.”

Scroll through to see the 20 China region mutual funds and ETFs ranked by the highest three-year returns through May 10. Funds with less than $100 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund, as well as one-year returns, are also listed. The data shows each fund's primary share class.