Some of the smaller firms in the independent broker-dealer sector are helping fuel its giant shift to fee-based business.

Advisory revenue from the top 50 IBDs participating in Financial Planning’s IBD Elite study outpaced commission business

The 50 largest firms generated $13.04 billion in fees and $11.18 billion in commissions in 2018 — a discrepancy of $1.86 billion. A year earlier, the spread was only $112.2 million.

In fact, fees at the largest firms have soared by 331% since 2007, while commissions have grown by just 25%. Fees now constitute 45% of their $28.79 billion in combined revenue, nearly double the share of only 23% of $13.24 billion in revenue among the top 50 firms in 2007.

The significance of this change can’t be overstated — and it’s far from over. Experts and industry executives point out how the move to full-scale planning changes the needs of financial advisors and their clients, and they say advisory business will eventually go above 50% and beyond.

To be sure, mainstays of the IBD sector like Northwestern Mutual, Commonwealth Financial Network and Cambridge Investment Research are contributing to the shift at the largest scale. They each generated several hundreds of millions of dollars more in advisory fees than any other IBDs who ranked in the top 10 in fee-based mix of business.

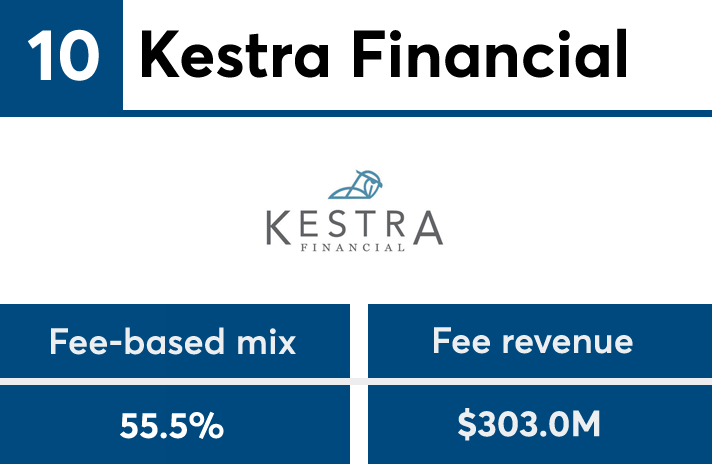

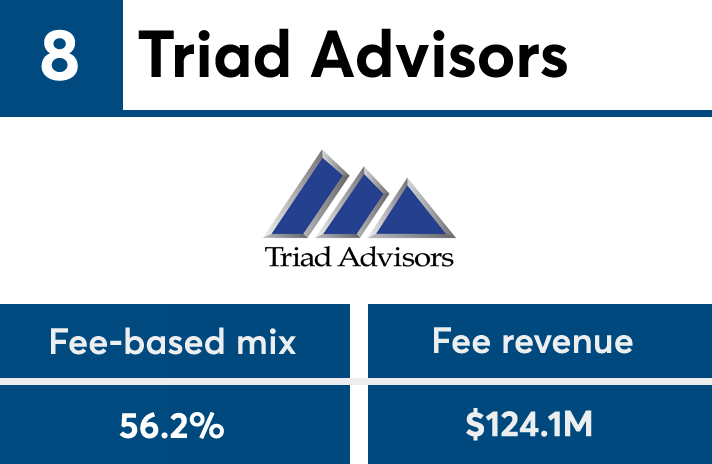

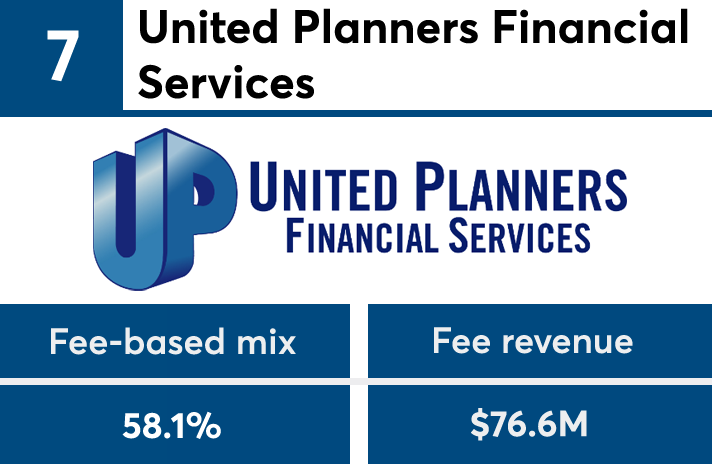

However, their share of advisory revenue hasn’t risen to the level of some midsize and smaller firms who are finding their niche on the cutting edge of a switch that’s been decades in the making. PlanMember Securities, Geneos Wealth Management and Founders Financial Securities each had a fee-based mix of more than 70%.

The fee-based share of business came from the portion of firms’ revenue they attributed to fees, rather than commissionable transactions or other sources. For the top 10 list of IBDs with the highest fee-based mix in the sector, scroll down our slideshow below.

To view FP’s annual recap of the IBD space, “Time to celebrate? Not just yet,”