The largest M&A deal thus far in 2019 will accelerate a “much bigger” change that started three years ago at Advisor Group, CEO Jamie Price says.

In 2016, insurance giant AIG

On May 9, Advisor Group’s owners

The earlier deal enabled the Phoenix-based firm to shift “from a corporate entity to a truly independent company” aligned with advisors and clients, according to Price. The new capital structure will help advisors gain scale and resources, he says.

“Private equity and smart money are very interested in the backdrop of this industry,” Price says, describing the growing investment in wealth management as good for advisors and the industry alike. “Our job is to help our advisors take advantage of that in ways that others can’t.”

Indeed, the deal stands out for its sheer size. With $268 billion in client assets, Advisor Group dwarfs the size of any firm that has sold so far this year.

-

Reverence Capital Partners agreed to buy 75% of the 6,500-advisor IBD network from the ownership team that purchased it in 2016.

May 9 -

People familiar with the matter said that Centerbridge Partners is in talks to buy the four-firm, 6,500-advisor IBD network.

April 23 -

Woodbury Financial Services has added 572 advisors with $22 billion in client assets since the fall of 2017, CEO Rick Fergesen says.

March 5

The market is expected to remain heated in the months ahead.

The biggest wealth management M&A deal in the first quarter — in terms of client assets — was the

With a reported price tag as high as $2.4 billion, Advisor Group’s transaction compares with the

All three deals involved private equity capital. PE firms are helping fuel record levels of M&A deals in wealth management for each of the past six years,

“Given wealth managers’ ability to generate consistent cash flows and high rates of growth, private equity’s interest in the industry appears here to stay and should continue to drive large-scale M&A activity and consolidation,” the report states.

Despite the level of investment, wealth management executives whose firms receive PE backing still say that the

“It’s not an industry where you think about cost-cutting,” he says. “It’s quite the opposite.”

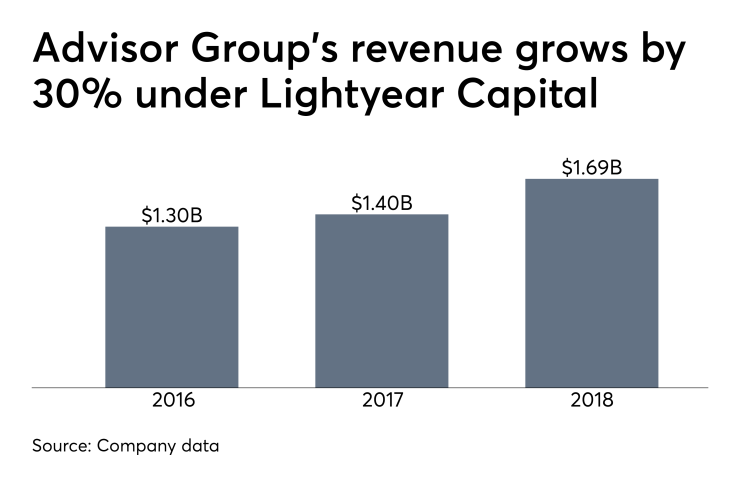

Under Lightyear ownership, Advisor Group’s headcount of producing representatives has jumped by around 35% and its client assets have soared by 60%. In the past year alone, the firm

Price and Advisor Group promise more of the same under Reverence. Lightyear, PSP and other current shareholders including retiring executive chairwoman Valerie Brown would retain up to a 25% stake in Advisor Group under the deal, the parties say.

The sellers will also keep seats on the board, alongside Price and other members to be appointed in the coming weeks by Reverence.

Milton Berlinski and two other Goldman Sachs alums launched Reverence in 2013 with a focus on financial services investments. Berlinski had spent 25 years overseeing the financing of such deals with Goldman’s financial institutions unit, Price points out.

Reverence’s past and current stakes include those in fund company Russell Investments, USAA asset management unit

Lightyear also appears to have shown a keen sense of timing with the deal. After nearly 10 years of bull returns in equities, wealth management is in a “toppy market” for sellers, says IBD recruiter Jon Henschen.

“The timing is right for Lightyear,” Henschen said in an interview the week before the official announcement of the Reverence deal. “Pulling the trigger now would make sense.”

Henschen spoke after

Price declines to discuss the final purchase price, citing the fact that both Advisor Group and Reverence are private firms. He also declined to state the timeline of the deal negotiations, calling the selection of Reverence an internal matter considered by the board.

He jokes that, judging by some of the media coverage of the possible deals, “You would have thought that it had been going on for two years.”

Advisors staying on with the firm will reap rewards in the form of a recognition and retention program after the deal. Other firms changing their capital structure without altering their overall management teams in recent months have opted not to provide any retention bonuses for advisors.

“We want to recognize our advisors in multiple ways,” Price says, noting the firm would share more details closer to the expected third-quarter close of the deal.

Brown, the departing chairwoman, has been a “fantastic partner, mentor, coach and, for me personally, a friend,” Price says. “She won’t be far away, particularly as an investor.”

The onetime Cetera CEO had retired to Jackson Hole, Wyoming, by the time Lightyear convinced her to join Advisor Group as executive chairwoman in 2016, Price notes. She’ll now return to retirement.

Brown is “grateful for the extraordinary success that our advisors and employees have created over the last three years,” she said in a statement.

She “worked closely with Lightyear and PSP in reviewing potential transaction partners,” Brown continued, expressing confidence that Reverence will “enhance Advisor Group’s momentum by supporting investments in solutions” for advisors and clients.