The end of the annuity sales slump related to the fiduciary rule also resulted in new top issuers, as fixed and fixed-index products broke records in 2018.

AIG raked in $18.4 billion in total sales last year, a 29% jump from 2017 and the first time since 2007 it’s ranked No. 1 in total sales,

Sales reached

While AIG led in non-variable deferred sales with a market share of 9.8%, the FIA product called the Allianz 222 Annuity surpassed all other non-variable products in sales last year,

With macroeconomic and regulatory trends helping to reverse the drop in sales in 2017, the rise of commission-free products is also attracting more RIAs. Combined sales of fee-based variable annuities and FIAs soared by 48% year-over-year to $3.5 billion in 2018, according to LIMRA.

All fixed product lines sold at higher volumes while representing almost 60% of overall sales, Todd Giesing, LIMRA’s director of annuity research,

In an unprecedented development, the top 15 writers of multi-year guaranteed annuities each took in higher sales last year, Wink CEO Sheryl Moore noted. FIAs also topped their last record level in sales by 18% in 2018, according to Wink.

“While sales were down for 2017 because of the Department of Labor [rule], this year’s sales have more than made up for last year’s loss in sales,” Moore said in a statement.

-

Fixed and variable contracts ended 2018 at nearly reverse levels of revenue from their totals three years earlier.

February 25 -

LIMRA now predicts VA purchases to increase for the first time in six years while fixed contracts reach unprecedented levels.

November 26 -

Revenue from FIAs surged to well over the existing mark in the second quarter, while VAs stabilized after 17 straight quarterly declines.

August 24

The largest firms’ combined VA and FA revenues hit a three-year low in 2017, but the products still make up a significant portion of their businesses.

In another notable trend, fee-only RIAs are becoming a nascent growth area in the annuity space. DPL Financial Partners added its 200th member RIA to its network of fee-only advisors who have access to 15 different carriers and other insurance products besides annuities.

DPL is on track to reach 500 members by the end of 2019 after launching only last year, according to CEO David Lau. The network is hiring more staff to support its RIA members, who together count more than $100 billion of assets under advisement.

DPL’s growth “confirms what we’ve been hearing from advisors,” Lau said in a statement. “[F]iduciaries want to be involved in their clients’ insurance but need access to products without commissions.”

Issuers have shown eagerness to tap into the RIA channel

“Our strategy is not about market share but instead to be in a position to compete at scale in each of our businesses,” Hogan said. “We have a strong presence across fixed, index and variable annuities, and we’re pleased the market has responded so positively to our offerings.”

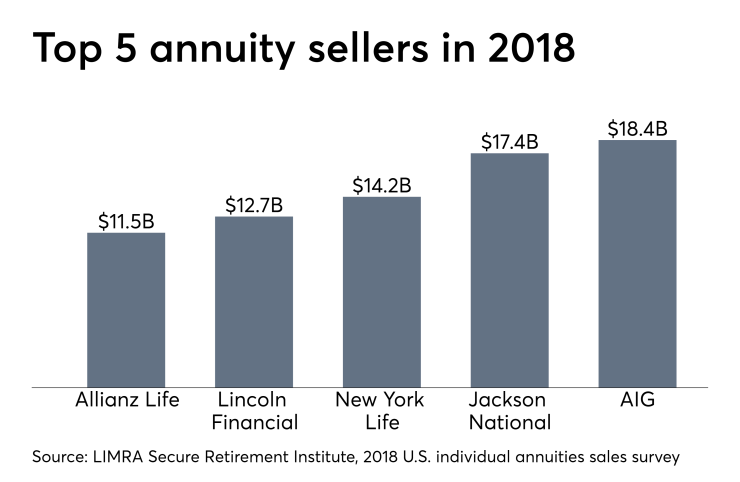

AIG supplanted Jackson National Life Insurance, which fell to second place with $17.4 billion in total sales but remained the leader in variable products with contracts of $16.7 billion. In fixed sales, AIG also toppled New York Life, which had the third-highest sales volume at $14.2 billion.

AXA Equitable Life and TIAA gave way to Lincoln and Allianz in the fourth and fifth positions, respectively. Sales of Lincoln’s variable products expanded by more than $2 billion to $9.1 billion in 2018, while Allianz’s FIA sales rose by over $1.5 billion to $9.1 billion.

Allianz enjoys a market share of 13.6% in the FIA space, alongside its top-selling 222 product, according to Wink. AIG grabbed 13.1% of the traditional fixed marketplace, while New York Life’s 13% share of the multi-year guaranteed annuity sales was the highest for that product.

In the burgeoning structured, or buffered, annuity product line, AXA is the No. 1 carrier with 40.8% of the market. The Brighthouse Life Shield Level Select 6-Year product brought in the highest sales of any structured product for each quarter in 2018, Wink says.