Lower interest rates amid the coronavirus are slashing Ameriprise’s wealth business to the tune of hundreds of millions of dollars a quarter.

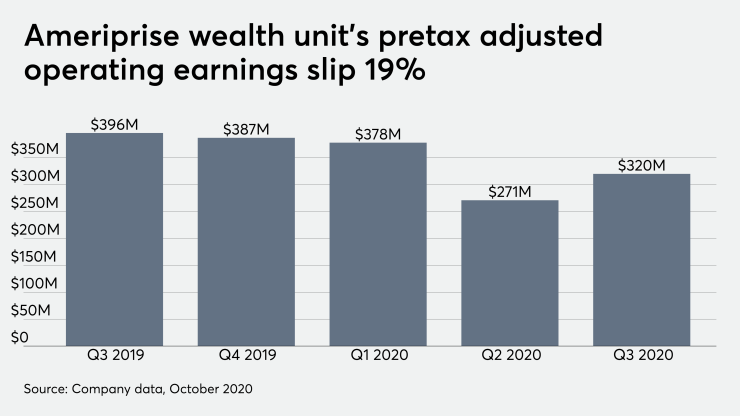

The firm’s Advice and Wealth Management segment’s pretax adjusted operating earnings fell 19% year-over-year to $320 million, Ameriprise

Since the Fed cut the federal funds effective rate during the country’s first outbreak in March, large wealth managers like the 9,905-advisor firm have been absorbing hits to their bottom lines. Inflows of $5.2 billion into the Minneapolis-based firm’s wrap advisory accounts — a 26% jump from the year-ago period — partially offset the lower interest revenue in the second quarter.

Without the declines, the wealth unit’s earnings would have increased by 14% for the quarter, according to Ameriprise. The firm recruited 99 experienced advisors for the period, which it says is the highest total in three years. Advisor productivity also expanded by 3% year-over-year to $668,000 in 12-month adjusted operating net revenue per advisor.

In an earnings call with analysts, CEO Jim Cracchiolo fielded a question about potential long term impact from the interest rates. He pointed to higher productivity among advisors, stemming from their adoption of technology and use of

“As they continue to really use those tools more fully, as we continue to help them manage through this environment, we feel very good about their ability to bring in client flows and to keep those clients active and focused on their goals,” Cracchiolo said,

While Ameriprise remains one of the largest independent and regional broker-dealers in those respective sectors, its headcount of advisors has stayed largely flat. The firm has 9,905 affiliated advisors, including 2,123 employee representatives and 7,782 franchise reps. In the past year, it has lost a net 25 advisors, with 42 fewer employee reps and 17 more on the franchise side.

Still, the earnings showed signs of resilience, even in a time of higher volatility and economic strain during the pandemic. Client assets surged by 9% year-over-year to reach $667 billion. And, despite the lower rates, client brokerage cash balances soared by 24% to $39.4 billion.

In his prepared remarks, Cracchiolo described the client cash holdings as “very high” compared to last year. “As opportunities arise over the next few quarters, we expect clients to put even more of their money back to work,” he added.

The value of the parent company’s stock ticked up more than 2% for the day after the earnings call to roughly $162 per share. Analyst Adam Klauber of William Blair maintained an “outperform” rating for the stock. In a note after the call, he cited an attractive valuation as well as the strength of Ameriprise’s wealth management business.

“While Ameriprise continues to face headwinds from lower interest rates and fee pressures, results should improve materially next year,” Klauber said. “The company continues to take share in wealth management with strong asset growth and productivity gains, with the new bank as an added tailwind.”