Despite the loss of his CFP status and a subsequent bar from the industry, an advisor stole $5.2 million from his clients and family through his unregistered advisory firm, federal prosecutors charge.

Daniel H. Glick faces a felony wire fraud charge for the six-year scheme marked by Ponzi-like payments and his purchase of a Mercedes-Benz using client funds, the U.S. Attorney’s Office in Chicago

FINRA barred Glick in March 2014, the same month Transamerica Financial Advisors fired him and four months after the CFP Board found that

Glick, the owner of suburban Chicago-based Financial Management Strategies and Glick Accounting Services, also used his clients’ funds to make his mortgage payments as well as payments to two business associates, investigators say. The wronged clients included his elderly in-laws, according to prosecutors.

The fake signatures of his mother- and father-in-law allowed him to move hundreds of thousands of dollars from them to one of his companies, charging documents show. He shuffled money between clients’ accounts, his own and those of his associates to carry out the fraud, investigators say. He also allegedly provided clients with false account statements.

“Most of the funds that [Glick] misappropriated belonged to elderly clients,” according to the charging documents. “In order to continue and conceal his scheme, [he] created and provided false and misleading account statements to clients and made Ponzi-type payments to clients.”

-

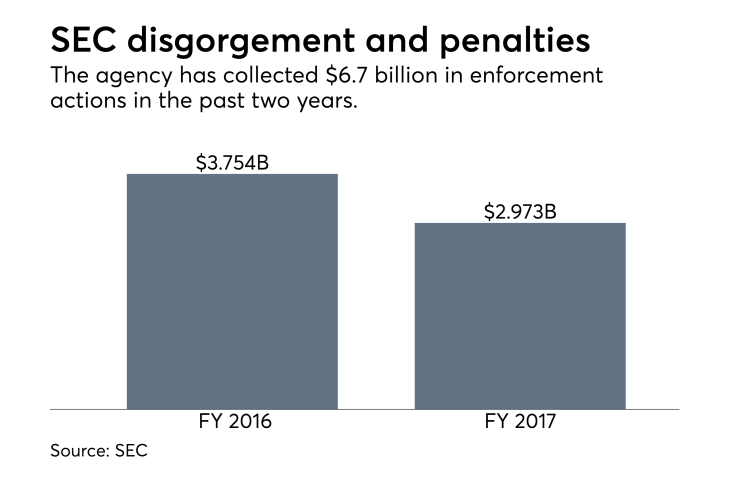

The SEC sought $3.4 billion in sanctions, the lowest total since 2013, according to data collected by a law professor at Georgetown University.

November 14 -

A federal judge issued a restraining order and a temporary asset freeze against the former broker.

March 28 -

The advisor used the money on cars and gambling in the latest Ponzi-like scheme, investigators say.

September 7

Stocks and Puerto Rican bonds are the focus of many cases among clients, advisers and firms.

WHAT’S NEXT?

Glick will enter a plea in connection with the allegations, according to his attorney, Mark Flessner, who declined to say how Glick plans to plea.

“We’re in negotiations with the government to resolve the matter,” Flessner says.

The SEC had named Glick’s associates, Edward H. Forte and David B. Slagter, as relief defendants in the civil case filed in March. The regulator accused Glick of forwarding them more than $1.8 million of the stolen funds. Neither Forte nor Slagter face criminal charges, however.

Eric Onyango, a lawyer for Forte, wrote in an email that his client “believes that the civil claims directed at him in the March 2017 complaint have no legal or factual basis and will continue to vigorously defend them in the appropriate forum.”

A lawyer for Slagter didn’t respond to a phone call and email Thursday morning.

Unlike the SEC case, federal prosecutors did not name in the criminal case the two associates to whom Glick allegedly made payments. Within the criminal case, the associates are referred to as “Da.Slag.” and “E.For.” Assistant U.S. Attorney Joseph Fitzpatrick explained in an email that the feds cannot confirm the associates’ identities “since their names weren’t disclosed.”

He added that the office does not comment on whether people or entities are under investigation.

While Glick has not been arrested, the judge in his case will order Glick to appear for his arraignment, which Fitzpatrick says has not yet been scheduled.

The judge in the civil case froze Glick’s assets this past spring. The SEC is seeking full disgorgement for his alleged victims, along with other penalties against him and the unregistered advisory firm. If Glick is convicted in the criminal case, he could spend up to two decades in federal prison for wire fraud.