Editor’s Note: This story is the final installment of a 3-part series.

Over the past few months, I’ve taken you on a journey to examine the strengths — and limits — of total-market funds. My quest was to answer these questions: Can a single fund that invests in U.S. stocks outperform a carefully selected collection of three index funds chosen to cover the corresponding asset group? Is the same true when we examine a single fund of non-U.S. stocks? You can find answers in the stories below:

Now I set my sights on bonds. Can a single U.S. “total” bond fund outperform a trio of bond funds that collectively cover the same bond categories? Here’s why it matters: domestic bond funds face an uphill battle as interest rates likely rise in the coming years. Thus, anything you can do to enhance the performance of the bond portion of your client’s portfolio is worth investigating.

I make my first stop at Vanguard. To cover the broad U.S. bond market, the firm has a one-stop offering for investors wishing to simplify their exposure to the U.S. bond market. Its fund, the Vanguard Total Bond Market Index (VBMFX), currently has a 40% allocation to U.S. government bonds, a 25% allocation to government mortgage-backed securities (GNMA) and a 35% allocation to U.S. corporate bonds. This type of fund is certainly convenient, but is it the best approach?

A THREE-FUND APPROACH

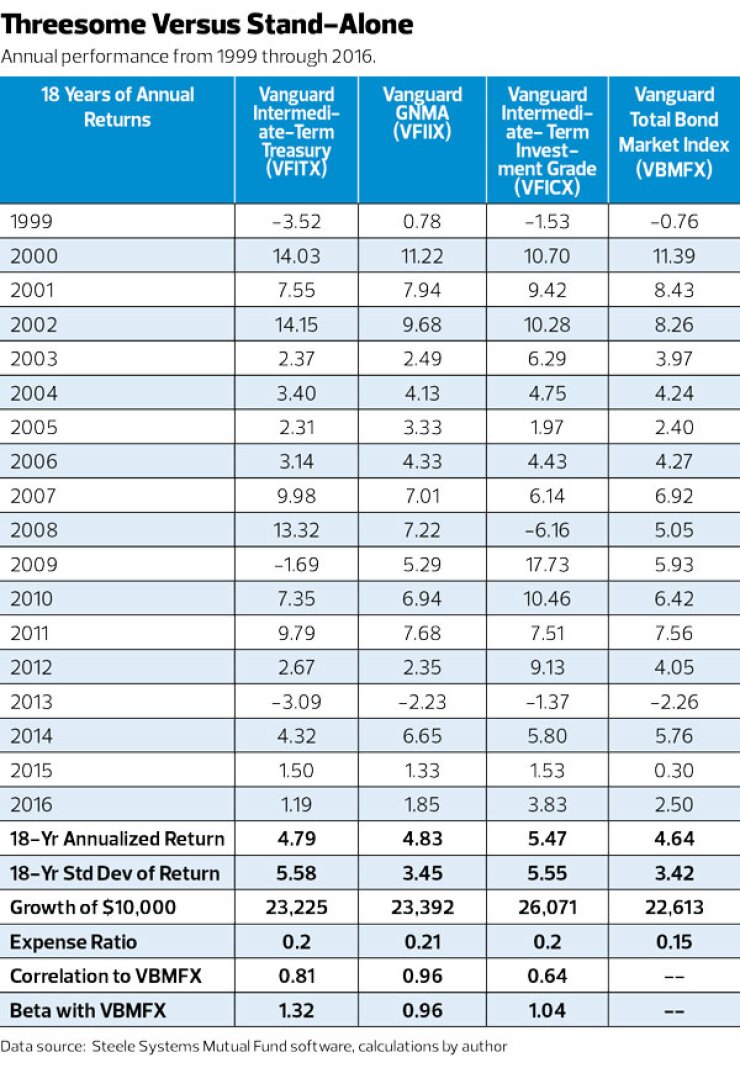

Another approach would be to invest in separate bond funds from each distinct bond segment: a government bond fund, a Ginnie Mae fund and corporate bond fund. For our exploration, I’m using Vanguard Intermediate-Term Treasury (VFITX), Vanguard GNMA (VFIIX) and Vanguard Intermediate-Term Investment-Grade (VFICX).

When combined, these three funds seek to accomplish (at least in theory) what the Vanguard Total Bond Market Index is trying to achieve. Thus, this study compares the performance of one single mega index bond fund against the combined performance of three separate bond funds, which are rebalanced annually. The time frame for this study was the 18-year period from Jan. 1, 1999 to Dec. 31, 2016. Performance data were extracted from the Steele Systems mutual fund database.

Using three bond funds instead of one mega index fund is likely to yield a slightly higher payoff.

The annual returns of the three bond funds are shown in the chart “Threesome Versus Stand-Alone.” Also shown is the annual performance of Vanguard Total Bond Market Index.

Over the full course of the study, each individual bond fund had better performance than the VBMFX, but in some cases this advantage was very slight.

The largest gap was 83 basis points between VFICX, the corporate bond fund, and VBMFX. Over 18 years, this resulted in an ending balance that was larger by almost $3,500, assuming an initial investment of $10,000.

A YEAR WORTH EXAMINING

The performance of each fund in 2008 is highlighted in yellow. VFITX was the clear winner with a one-year return of 13.32%, with VFIIX a distant second at 7.22%. VBMFX generated a positive return of 5.05% whereas VFICX lost 6.16% in 2008.

I have highlighted 2008 to make a point. When using three separate funds, there are more so-called “buckets” from which to withdraw money. Of course, we try to avoid withdrawing money from a fund if it has had a negative year.

If using a total-index fund, there is only one bucket — even though the bucket contains several different bond exposures. Nevertheless, if the overall return is negative (as in 1999 and 2013) and the investor had to withdraw money that year, the loss would be exacerbated. If, however, there were more buckets to withdraw money from, the investor could pull the money out of whichever fund had the best return. In 1999, that would have been the Ginnie Mae fund (VFIIX).

I refer to this phenomenon as distributed performance versus concentrated performance. A one-fund total-market solution is subject to concentrated performance and is therefore more vulnerable to the timing of withdrawals during market downturns. A combination of funds produces separate returns (that is, distributed performance) and is likely to be less vulnerable to portfolio withdrawals during a bond market downturn.

Threesome Versus Stand-Alone

Annual performance from 1999 through 2016.

Data source: Steele Systems mutual fund software, calculations by author

The important comparison, however, is the mix of the three funds against the total bond market index fund. As shown in the chart “Divide and Conquer,” the three-fund mixtures both produced better 18-year performance than the total bond market index. But this advantage over Vanguard Total Bond Market Index was only modest.

Divide and Conquer

Three approaches to gain exposure to the entire bond market.

Data source: Steele Systems mutual fund software, calculations by author

Moreover, the threesomes have high correlation with VBMFX and a slightly higher overall expense ratio (20 basis points) that the total bond index, whose expense ratio was only 15 bps.

In addition, the beta coefficient for the Vanguard-weighted three-fund approach was 1.13, which indicates that it is 13% more volatile than VBMFX. When the three bond funds are equally weighted, the beta coefficient dropped slightly to 1.11 — still 11% more volatile than VBMFX.

WHICH APPROACH?

However, in both cases, the modest amount of added volatility when using three bond funds instead of one mega index had a payoff — 45 bps of higher performance when using Vanguard weighting and 43 bps when holding each bond fund in an equal allocation of 33.33% (and rebalancing each year in both cases).

Despite slightly lower performance, when it comes to the fixed-income portfolio of your clients’ overall portfolio, the convenience of using a single total bond market index fund (such as VBMFX) is compelling.

But perhaps the tipping point in deciding which approach to use may be the issueof distributed performance versus concentrated performance. When using three separate bond funds (or more if you decide that additional bond funds will meaningfully enhance the diversification of the fixed income portion of the overall portfolio), you have more buckets from which to withdraw money. And that is always a beneficial option when it comes to preserving the value of portfolio during turbulent markets.

If all bond funds had similar performance, there would be no need to use several of them. But, as clearly shown in “Threesome Versus Stand-Alone,” there was often substantial performance variation among the three bond funds.

When considering the wide variety of bond funds beyond the three that are illustrated in the table, we can safely conclude that distributed performance is a prudent approach when dealing with bond funds.

Thus, if the slight performance advantage of using three separate bond funds doesn’t sway you, the advantage of having distributed performance in the fixed income portfolio of your client’s portfolio just may.