Financial advisor Pete Bush of Horizon Financial Group says he has noticed little or no disruption since the surprise announcement that his independent broker-dealer network is seeking a new CEO.

“I will say this,” Bush wrote in an email. “I get a lot more recruiting calls sent to my voicemail and email trash box!”

The 25-year veteran of Cetera Advisors and a predecessor firm met with Cetera Financial Group Chairman Ben Brigeman and other members of the IBD network’s board last week, days after the firm

Private equity firm Genstar Capital, where Brigeman is on the strategic advisory board, had only

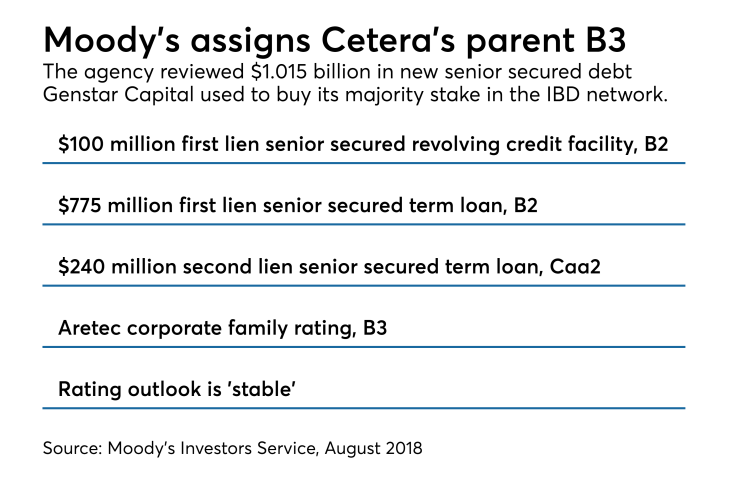

The network’s headcount may warrant concern: Cetera lost roughly a net 275 advisors year-over-year, falling to 7,500 at its six IBDs. Moody’s Investors Service had cited recruiting and a high debt-to-EBITDA ratio of 7.5x as key metrics in

However, talk of cost-cutting “could not be further from the truth,” according to Brigeman. The “event-driven” nature of wealth management also means

Bush and AdvisorNet Financial’s Dan May, who also attended the meeting with the board, reject the notion the network is trimming expenses. Instead, they praise the firm’s direction. Fellow office of supervisory jurisdiction manager Ron Carson issued an additional statement of support for the departing CEO.

The advisors, Brigeman and Cetera President Adam Antoniades acknowledge the shock of losing the well-liked Moore to retirement amid a serious undisclosed medical issue. Still, Genstar has marked up the value of Cetera since the deal closed Oct. 1, rather than the other way around, Brigeman says.

“It was just a magical fit for us,” Brigeman says. “What we have done for the last five months and will continue to do for the foreseeable future is invest in our growth.”

In fact, Antoniades says the firm set a record in 2019 recruiting so far, with as much as $6 billion in new client assets set to join the network by the end of the week. Cetera added a

“It's fair to say that we didn't have as strong a recruiting year as we would have liked,” Antoniades says. “We've far and away bridged that in the first 60 days of the year, where we've had record recruiting numbers. The fruits of our labor the past couple of years are starting to manifest themselves.”

He declines to state the number of advisors expected from the record level of incoming moves, noting also that capital reviews create uncertainty for incoming advisors and pitches from rival firms aimed at the disruption. Cetera also

Cetera’s headcount of producing representatives fell by nearly 1,800 over the past five years as it whittled the network to six firms from nearly a dozen under its onetime parent RCS Capital. Debtholders brought the holding company Aretec — ‘Cetera’ spelled backwards — out of

Better than expected retention of advisors and the “macroeconomic tailwinds” of higher interest rates and equity gains in client assets are working in the firm’s favor, according to Moody’s. On the other hand, the rating agency also noted higher operating and regulatory costs that require constant investment.

“The firm's increase in debt following the acquisition pressures the firm's financial flexibility and limits its room for additional debt at the existing rating level,” the agency said, predicting net revenues and EBITDA will rise enough to enable it to “slowly deleverage” after the acquisition.

Brigeman did not disclose the firm’s current debt-to-EBITDA level, but he says the firm’s profitability allows it to handle additional expenses under its new capital structure. Cetera’s large enterprises, such as the OSJs run by Carson, Bush and May, have also reported notable growth in recruiting.

Not every advisor, though, is buying into the new ownership and network structure with “traditional” and “specialty” channels of three IBDs. Kathleen Hansen’s Financial Planning Department, a hybrid RIA practice with $180 million in client assets,

Hanesen found the firm’s systems “cumbersome” and the service staff not very helpful when her practice had to repaper client assets after the shuttered Cetera IBD

“That's how unhappy I was,” Hansen says, adding she never wants to change IBDs again. “I see why Girard couldn't stay on their own. The move to Cetera was not a good one for us. We had to put our clients through two changes of broker-dealers in a year, which was just awful.”

E. Martin von Känel of Patriot Wealth Management, which has $120 million in client assets, came to LPL

“I just didn't want to be a part of it any longer,” he says, noting he doesn’t like changing business partners every couple of years. “It is disruptive in the way that clients get a letter that announces the new firm and then we get a phone call. Clients — like anyone else — don't like change.”

Cetera’s scale could allow it to consider going public or becoming self-clearing like LPL and Raymond James, according to IBD recruiter Jon Henschen. Despite the unfortunate reason for Moore’s departure and the hiring of an executive search team, a vacant CEO position is still “a big unknown,” he says.

“It leaves question marks,” Henschen says. “The longer a CEO’s position remains open, it just breeds insecurity and gives the other firms leverage to recruit advisors.”

-

The CEO said his decision to resign followed a physician’s recommendation in connection with an undisclosed medical problem.

February 19 -

Smaller firms are opting to turn into OSJs in an era of shrinking margins for IBDs and record consolidation in wealth management.

February 26 -

The past year brought major changes to the IBD network, including the sale of its majority stake and a structural reorganization.

February 5

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

Recruiting pitches to advisors and industry speculation have come in the wake of every transition at Cetera over Bush’s tenure at Cetera Advisors, Bush says. He praises Brigeman and fellow Genstar board member Hal Strong, noting their respective tenures at Charles Schwab and Russell Investments.

The meeting was about “investing heavily in the growth drivers and not at all about cost-cutting or consolidating our way to success,” Bush says. “Genstar is very interested in hearing from our entrepreneurial advisors about how to best support the growth of our individual firms and where to focus their capital investments that will most move the needle.”

Bush’s OSJ

The super OSJ, which CAN refers to as one of its “regions,” has soared to $63 million in annual gross dealer concessions from $1.2 million when May joined in 1993, he notes. The current ownership setup marks the seventh different one he’s worked with at Cetera, he says.

“I'm very excited about this ownership group because they're trying to grow to success and that's music to my ears,” says May. “They're able to look at the big picture and give you solutions that I don't think you're going to find anywhere.”

Carson Wealth, the influential advisor and entrepreneur’s OSJ region, recruited a

“RJ has always been a great friend and supporter of Carson Group over the years,” Carson said in an emailed statement. “Even more so, he’s someone the organization — as well as our advisors — highly respect, both as a person and a leader. We are saddened by the news and completely stand behind him and support him, as he navigates this transition.”

Moore will retire upon stepping down at the end of the month. He will still serve as an advisor to the executive team, Brigeman says. The decision did come as a surprise, though Moore took time off in December after the death of his brother, according to Brigeman.

The firm notified its advisors through an email message and an all-hands call for employees the day after Moore announced the decision, according to Brigeman and Antoniades. In addition to the advisor engagement council meeting, the firm is discussing the situation at advisor conferences taking place last and this month.

Antoniades is working on a series of upcoming tech launches aimed at providing “a differentiated and an optimized experience for both advisors and clients,” he says. The firm also began offering advisors a fee-for-service setup for prospects and clients this week under a

“We see huge opportunity for growth, in terms of advancing technology and service capabilities that allow our advisors to grow,” Brigeman says. “We think we have a compelling competitive advantage and we'll make sure that we invest heavily to be a leader in the marketplace.”