President Biden's Department of Labor dealt the independent broker-dealer community a setback when it rescinded a Trump-era regulation regarding independent contractors, a favored business structure for registered reps.

The original rule would have made it easier for businesses to deem workers as independent contractors. It was not sector-specific, instead relying on what the DoL calls an “economic reality test” to determine whether workers are in business for themselves or should be classified as employees.

But last week, the DoL determined that the rule failed to meet the standards for worker protection under the Fair Labor Standards Act and withdrew it.

"By withdrawing the Independent Contractor Rule, we will help preserve essential worker rights and stop the erosion of worker protections that would have occurred had the rule gone into effect," Labor Secretary Marty Walsh said in a statement.

"Legitimate business owners play an important role in our economy but, too often, workers lose important wage and related protections when employers misclassify them as independent contractors," Walsh said. "We remain committed to ensuring that employees are recognized clearly and correctly when they are, in fact, employees so that they receive the protections the Fair Labor Standards Act provides."

The IBD industry welcomed the original rule for providing clarification in delineating when registered reps were acting as independent contractors rather than employees.

In October 2020, Cetera hailed the proposal for the now-withdrawn rule, saying in a comment letter that it set a standard in an area that had been rife with conflicting legal precedents emerging from various court cases over the years. The firm, which is a corporate parent to eight broker-dealers and RIAs, explained that the "large majority" of its more than 7,500 individual reps were independent contractors.

"They offer investment-related services to customers through Cetera, but many of them also offer other non-securities products such as insurance or professional services such as tax preparation," Cetera wrote in its letter. "Their ability to best serve their clients depends on continuation of their status as independent contractors and how independent contractor status is determined, and we are vitally interested in this issue as a result."

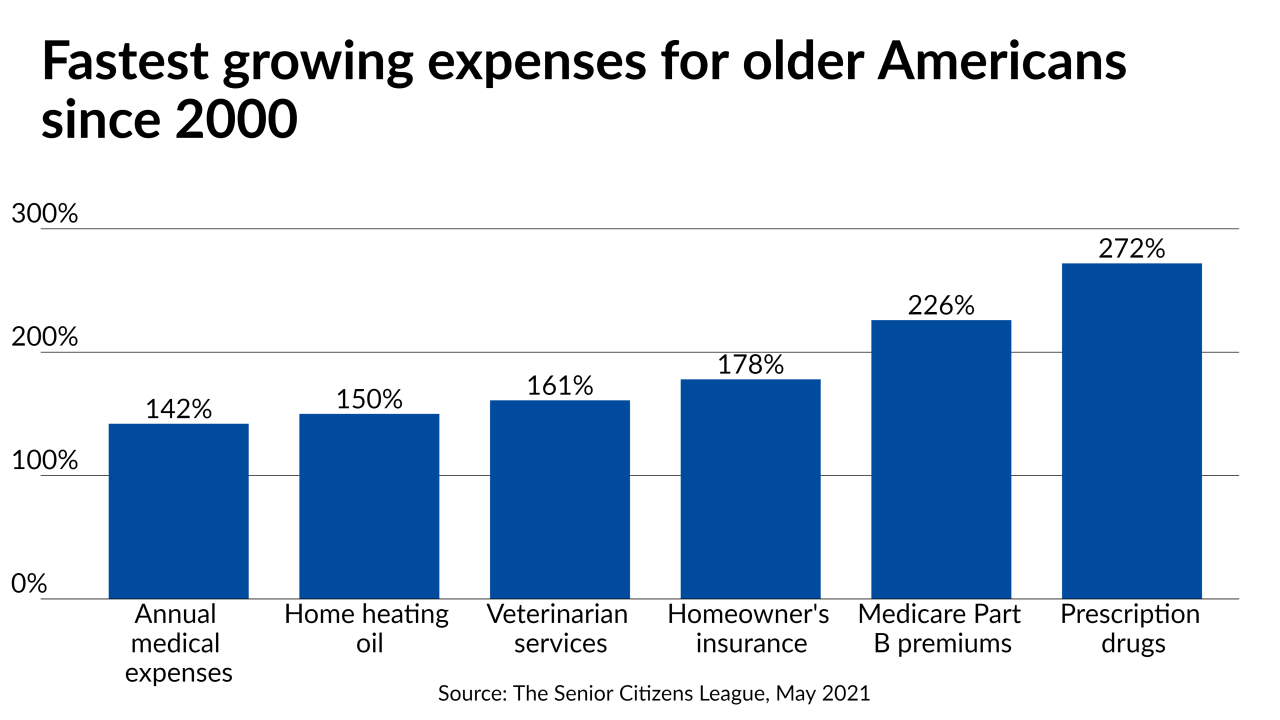

The Senior Citizens League made its forecast amid inflation fears and as advocates criticize the formula for calculating the annual adjustment.

Cetera was broadly supportive of the DoL's proposal, as were LPL and the Financial Services Institute, the leading trade association for IBDs.

The DoL announced its final rule Jan. 6 with an effective date of March 8. But then on March 12, Walsh's DoL issued a notice of proposed rulemaking for undoing the independent contractor rule. More than 1,000 comments poured in, including many from the IBD world imploring the department not to scrap the rule. But the DoL was unmoved.

FSI blasted the rule's withdrawal, with CEO Dale Brown warning in a statement that it would prevent "independent financial advisors and firms from operating confidently knowing their independent contractor status is secure."

He added: "The repeal of the consistency and uniformity established in the rule will result in the return to the confusing and conflicting interpretations previously applied by differing courts. Ultimately, this will lead to our members having to divert time and resources to defending their independent contractor status from inaccurate challenges rather than helping their clients achieve their financial goals."

A spokeswoman for FSI declined to comment further on the record about its concerns about the withdrawal of the rule, but the group has a long history of lobbying against efforts to restrict advisors' ability to claim independent contractor status. In one high-profile case, FSI successfully lobbied to secure a carve-out for financial services firms in California's 2019 law that extended employee classification to certain gig workers.

In comments on the DoL's proposed withdrawal, many objected to the process by which the department was seeking to roll back the rule.

Cetera, for instance, acknowledged that while "it is certainly within the prerogative of the department to decide that the final rule does not represent good public policy ... it is not in the province of the department or any other administrative agency to wash away validly adopted regulations simply because it disagrees with them." The firm called for a more "substantive review" in its letter.

Cetera, through a representative, declined to comment for this story.

The DoL's action leaves open the possibility of legal action to try to reinstate the prior rule. FSI, which was part of the group that successfully

"We are exploring all advocacy avenues available to us at this time, but we don't discuss specific details of our advocacy strategy," a spokeswoman for the lobbying group said.