BELLEVUE, Wash. — Advisers eager to help their high-net-worth clients pass on both their wealth and a sense of family harmony should master four key aspects of estate planning, according to one expert.

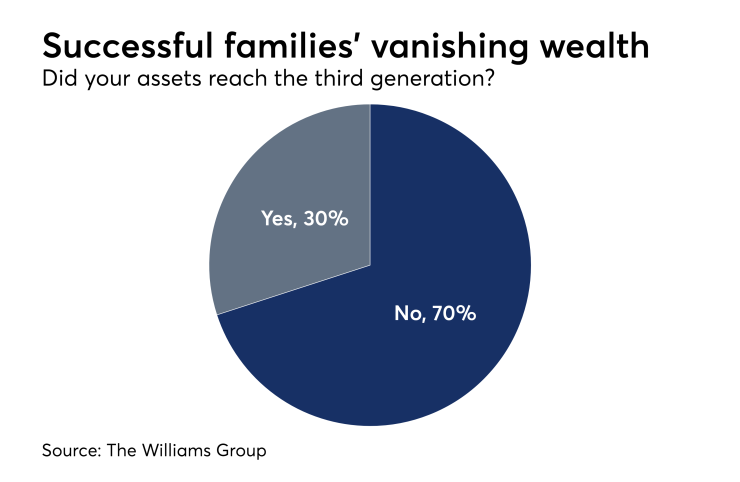

Most HNW individuals’ families have lost their fortunes by the third generation, research has shown. Advisers’ approach to investment and tax planning, family governance and working in teams decides whether clients buck the trend, said BNY Wealth Management national wealth strategist Justin Miller.

“These are the wealthy families that you don’t read about, but that are doing well,” Miller said. “They not only pass the money down to future generations — kids, grandkids and beyond —some of our clients are seven, eight generations later and still going strong.”

HISTORY REPEATS ITSELF

In a speech here Friday at the NAPFA spring conference outside Seattle, Miller cited multiple academic studies which have concluded that 70% of wealthy families’ fortune is gone by the third generation and 90% is gone by the fourth.

The ultrawealthy are taking more conservative positions this year, but younger investors are still bullish, according to a recent industry study.

Anecdotal evidence spanning the world also backs up the point, he said. Americans’ refrain of “shirtsleeves to shirtsleeves in three generations” stands alongside near-exact proverbs from China, Japan, India, Ireland, Italy and Mexico which all reference the loss of wealth by the third wave.

Indeed, this isn’t a new realization. Andrew Carnegie, Alfred Nobel, Henry Ford, as well as members of the Vanderbilt and Rothschild families have all spoken about the difficulties of inherited wealth. “Riches, in spite of the most violent regulations of love to prevent their dissipation, very seldom remain long in the same family,” Adam Smith wrote in “The Wealth of Nations” in 1776.

Miller even displayed a quote from the Old Testament in the same spirit.

TEAM-BUILDING

Families that succeed in preserving their wealth get advice from more than just their planners, according to Miller. Advisers must work in tandem with other professionals to deliver on the goal, he said.

“No one adviser can do it all,” Miller said. “No one can be an expert in all things. A successful family relies on a team of advisers, but not just a team — a collaborative team of advisers. That means the attorney, the CPA, the insurance adviser, financial planner, wealth manager, investment manager are all working together.”

Lawyers in particular represent advisers’ biggest pitfall when it comes to wealth transfers between generations, according to Bob Maloney, an estate planning specialist from Squam Lakes Financial Advisors in Holderness, New Hampshire. Advisers should pick out attorneys with the right skills, he said.

“I don’t want to teach a lawyer to write a trust,” Maloney said. “If you’re open to saying, ‘Who would you recommend?’ then we all win. But I’ve got to educate my client before going into that office.”

INVESTMENT STRATEGIES

Another member of the team, the investment manager, also may not be doing a good job, according to Miller. BNY Mellon studied roughly 2,700 investment managers’ statements involving $8.7 billion in assets over three years and found widespread, objectively “significant” problems, Miller said.

Some 89% of the portfolios were missing entire asset classes, and the same percentage showed a lack of an overall plan, according to Miller. Three-fourths had little or nothing in the area of tax management.

The ups and downs of equity markets pose another area of concern. Advisers should ease their clients’ panic about investments by playing a lead role, he said.

“It’s the volatility that scares clients, that scares humans. They’re afraid, they’re paralyzed by fear. They’re afraid to take any action,” Miller said. “So it’s up to us as good advisers to address this.”

-

There's no point in waiting on new policy to initiate preparation that is protective and vital, no matter what the ultimate law may be.

March 2 -

Given how dysfunctional many families are during a crisis, a lack of coordination of agents can sow even more financial confusion, and even conflict.

December 15 -

When a tax-deferred account is part of an estate, failure to follow the tax rules correctly can result in a financial disaster.

February 17

TAX PLANNING

One HNW client of Miller’s was sitting on $25 million the client hoped to pass on to the next generation, he recalled. Miller showed the client how tax planning could shield $5.6 million from tax, but the client failed to make the proper transactions and submit the necessary paperwork.

His team then ran different calculations. They computed that the procrastination could cost the client $15.3 million in 10 years. For every month the client waited, they were losing over $80,000, according to Miller.

“That’s why clients need to put these plans into place now,” Miller said. “All of that future appreciation of these assets — you’re giving a big percentage of that to the IRS down the road.”

Miller recommended vehicles such as an intra-family loan, a family limited partnership and multiple types of trusts to avoid a tax hit. Maloney, who spoke before Miller in a session on startup practice management, also mentioned the urgency of trusts and wills for clients looking to transfer wealth.

“If they have adult children and they’re trying to figure out something to do to help their kids, let them figure out an estate plan,” Maloney said. “Don’t miss these opportunities. Just because a client has a trust and will, don’t assume they still work.”

FAMILY VALUE PLAN

Additionally, advisers can open lines of communication between family members, which Miller admitted may often cause tension among relatives who don’t get along. Any arguments will pay dividends down the line in both family harmony and wealth, he said.

Charitable gifts offer an easy way for a family to practice discussing their estate, according to Miller. Two grandparents who are clients of Miller’s set aside $1,000 for each of their five grandchildren to give away as they saw fit, $5,000 each for their children’s families and $10,000 for cousins.

Larger families, he added, must come up with a transition plan. The so-called royal plan leaves the matriarch and patriarch in charge until death, while a different model known as the “representative” plan creates a system where family members vote on a board to work with the family’s advisory team.

Most representative plans include requirements to determine who gets to vote to elect the board and which family members are eligible to serve on it. All family members remain beneficiaries, though.

One family required voting members to work at least two consecutive years outside the family business. The requirements stirred a tense reaction, but the “forward-thinking” provision allowed for long-term stability, according to Miller.

On the other hand, one HNW client tried to set up a philanthropic approach that would ensure the descendants gave only to his favored charities. He wrote up a list of the organizations and gave it to his children, telling them they could choose from among the favored group.

“It was so bad that his daughter and son-in-law got up from the table in the middle of the meeting and flew home commercial,” Miller said. “They didn’t even wait for the private jet.”