After financial advisor Sarah Carlson fell victim to a violent hit-and-run driver, she became a long-distance triathlete — and a vivid example of why disability insurance is so important for clients.

Carlson’s individual disability policy, combined with her Social Security benefits and a state victims’ fund, enabled her to avoid suffering a financial loss that could have worsened the impact of the brutal crash 18 years ago, the Fulcrum Financial Group founder told attendees this week at a

The details of insurance policy provisions can make a crucial difference to clients in the event of a crime, accident, medical illness or other unforeseen crisis, Carlson and two other advisors agreed.

The chances of a policy being triggered aren’t small: an employee who turned 20 last year has a 25% chance of becoming disabled before their normal retirement age,

“People really fear death, but we also have a Superman complex,” said panelist Lauren Zangardi Haynes of Richmond, Virginia-based Spark Financial Advisors. “Sometimes we think, ‘Oh, that won't happen to me.’”

Haynes’ team reviews every area of clients’ insurance coverage, including home, auto, life, disability, health and various types relating to business owners, she said. In addition, Carlson pointed out, advisors should make sure clients understand the “opportunities and limitations” of each disability policy, such as the price, whether mental health services are included, possible catastrophic coverage and if they’re integrated with state and federal programs like Social Security.

In 2003, Carlson was in New York for a due diligence meeting when the now-incarcerated driver of a stolen SUV slammed into her, ripping off a section of one of her legs and shattering her pelvis. Although she had a “beefed-up emergency fund that went through so fast,” Carlson went “from being able to provide for my family to not being able to do anything,” she said. The Spokane, Washington-based advisor endured 12 surgeries before ultimately participating in Ironman Triathlons. Some doctors had warned her she would never be able to walk again.

“It was about three years of being totally disabled,” Carlson said. “Disability [insurance] helped me keep my house, helped me not go bankrupt. And, as a result, I put four kids through college, I have a thriving business and I'm glad I didn't have to make some tough decisions.”

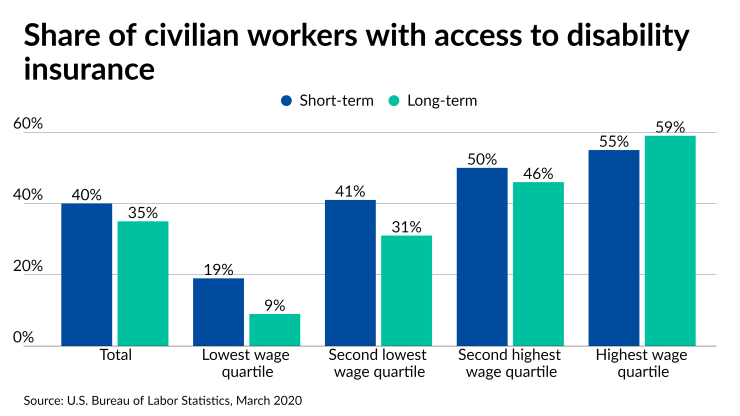

The prospect of having to make such a difficult choice looms for a much larger share of the workforce than most people realize, according to Carol Harnett, president of the Council for Disability Awareness, an industry-funded nonprofit. A little more than a third of employees have long-term disability coverage and 40% have short-term policies, Harnett noted.

“We still aren't even at 50% of people who have that kind of coverage available to them,” she said. “And then if they access it, of course, and they don't pay any of the premium, it's completely taxable.”

Harnett added that with workers changing jobs “more rapidly” these days, the policies aren’t portable if they leave their current employer.

In the case of death caused by a catastrophic event, life insurance provided by employers will help, but the amount of, say, the equivalent of 10 years worth of income from a clients’ salary “far exceeds any kind of life insurance,” according to Kath Derisson of Omaha, Nebraska-based Fyvie Financial. The income protection of disability policies makes them more important for many clients, she argues.

“It's painful; it's not paying just a few bills here and there, it's paying to sustain you,” Derisson said. “There's no magic tree that provides you with money every day. That would be great if we did have one, but, realistically, we are our biggest asset. And I always always say that to my clients, ‘You are your biggest financial asset. You’re the one who earns that income. Without that income, you don't have any savings accounts. You don't have any investments over time.’ So a really key point to drill home is the importance of that.”