What do we mean when we talk of quality in equity investments? For some, quality is an attribute of stock performance: steady growth, limited volatility and a solid history of dividend payments. Others view it in terms of company profitability, balance sheet strength and cash flow.

“There isn’t a hard-and-fast rule for the average investor to look at,” says Ian Weinberg, a CFP whose Woodbury, New York, firm, Family Wealth & Pension Management, advises high-net-worth clients. Weinberg prefers what he calls “shareholder friendly” companies, which he describes as “a sort of qualitative factor.”

One characteristic he looks for is the tendency of companies to increase dividends over time. When companies do that, he says, “it tells me that they are also looking to increase earnings.”

To be sure, quality assessment can manifest itself in different ways. For instance, Northern Trust uses quality as a screen for more than a half-dozen of its FlexShares ETFs, as well as several mutual funds, but differs from Weinberg’s increased dividends approach.

“If I look at the past dividend growth rate of a company, that has very little relation to its future dividend growth rate,” says Michael Hunstad, director of quantitative research at Northern Trust’s asset management arm.

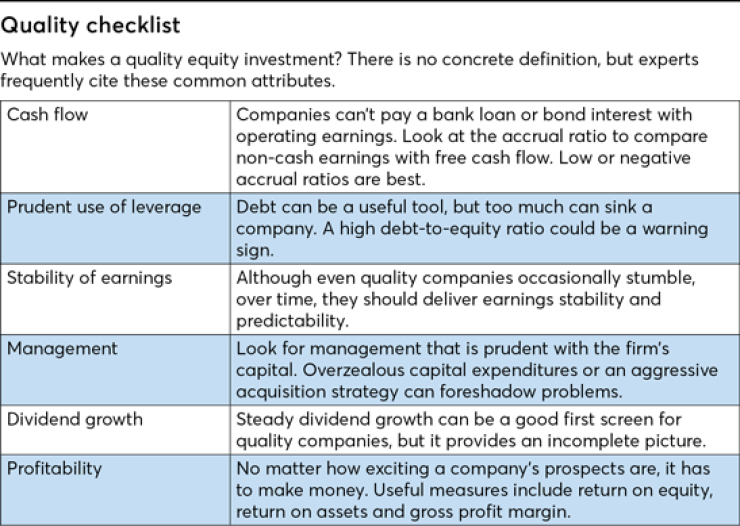

Instead, he uses numerous metrics that fit into three broad categories: profitability, cash flow, and management efficiency.

“Quality is probably the most nebulous concept in investments,” Hunstad says. “If you ask 100 different people what it means to have a high quality company, you’d get 100 different answers, and they’re probably all correct.”

That said, profitability varies significantly by sector, he notes. “Return on assets is a great metric for industrials, but an awful metric for financials,” he says. And concepts of profitability change from country to country because of differing accounting systems.

For Vanguard, which recently launched a suite of factor ETFs, “strong profitability” is a key component of quality. What delineates strong profitability? “It’s ROE over a year and then gross profitability. Those are the two main metrics,” says Matt Jiannino, head of product management for Vanguard’s quantitative equity products.

A quality company today may not fit that description next year. After all, “Sears was a quality name for decades,” says CFP Rob DeHollander.

For balance sheet considerations, he says, Vanguard looks “at things like share issuance, change in operating assets and leverage” to guard against companies that may have been profitable but lack the strength to maintain that profitability.

Aye Soe, managing director of research and design at S&P Dow Jones Indices, sees profitability as one of three Graham & Dodd-inspired attributes of high quality. She says that ROE, ROA and gross profit margin are all effective measures of profitability. “We went with ROE,” she says. SPDJI worried that after five years, companies with high gross profit margin would revert to the mean. “We didn’t see that with ROE,” she says.

The other two attributes, according to Soe, are “a prudent use of leverage” as measured by debt-to-equity, and consistent earnings. For earnings quality, she says, SPDJI looks at accrual ratios, noting that some research indicates that companies with high ratios underperform those with low ratios.

Ray Benton, a CFP in Denver, observes that Nobel Prize winning academics Franco Modigliani and Merton Miller maintained that dividends should make no difference to investors, who should not care if returns are in the form of dividends or capital gains. “But I think they do,” he says.

For his part, Benton believes that investors should not look at dividends in isolation. “I don’t think the dividend, in and of itself, is an indication of quality,” he says. Most important in quality companies, he says, is “the ability to self-fund their operations” with high free cash flow.

He favors using funds that invest in stocks with rising dividends. “When you do that, it picks up on some of these other quality elements,” he adds.

“Quality is probably the most nebulous concept in investments. If you ask 100 different people what it means to have a high quality company, you’d get 100 different answers, and they’re probably all correct," says Michael Hunstad, director of quantitative research at Northern Trust’s asset management arm.

For Rob DeHollander, a planner in Greenville, South Carolina, industry leadership is important, and being in the right industry is crucial. He looks for companies that “have the ability to expand and grow market share in the upcoming environment.” One area he favors is the “internet of things.” “We think there’s a multi-billion dollar industry emerging right before our eyes in the connectivity of devices,” he says.

Does investing in quality equities work? In the aggregate, over time, it appears to outperform the broader market.

Northern Trust’s data show that its high quality quintile produced a 2.9% annualized excess return over the Russell 1000 for the 10 years ended Dec. 31, 2017.

S&P Dow Jones Indices says its top quality quartile returned 14.95% annually vs. 10.11% for the S&P 500 from Jan. 1, 1995, through the end of last year.

And Vanguard, which operates in many countries, shows global outperformance of quality. From Nov. 30, 1975, through Sept. 30, 2016, quality outperformed the MSCI World Total Return Index by 1.3% annually.

To be sure, quality doesn’t always outperform. In 2017, low quality beat high quality, according to SPDJI data. “All factors are cyclical,” says Benton, who says a multifactor approach makes sense.

Others agreed. “We think of factor products as just another part of our investment offering to advisors,” says Vanguard’s Jiannino. He says the aim is to “give advisors a full suite of products to implement whatever strategy they’re trying to do in their portfolios for their clients.”

SPDJI’s Soe echoes that sentiment. “As an index provider, we cast a wide net,” she says. Northern Trust’s Hunstad cautions that advisors have to dig deeper. “You have to do your homework,” he says. “There’s no one finite set of metrics that will get you that full story.”

Advisors who use factor-based funds and ETFs need to understand what metrics are used to define the factors. Essentially, they have to look under the hood. But using quality or other factors to select individual equities requires a much deeper skill set.

Ultimately, everybody has a different definition of quality, Jiannino says. “In the end, when people look at quality, they’re going to have to decide what’s right for them in the quality space,” he adds.

And bear in mind that a quality company today may not fit that description next year. As DeHollander notes, “Sears was a quality name for decades.”