As buzz about the Republican tax bill ratcheted up in December, so did the calls to Jana Shoulders’ office at Mariner Wealth Advisors in Tulsa, Oklahoma.

“We started getting a lot of inquiries before the bill became law,” says Shoulders, who was a CPA for 18 years before starting a financial advisory firm in 1995. “Clients wanted to know what they needed to do before the end of the year.”

Soon after President Trump signed the bill, her team swung into action. Some wealthy clients who owned businesses, for example, needed to know if they could save on taxes by buying manufacturing equipment in 2017. Others needed advice on whether to pay state income tax by Dec. 31 if they weren’t subject to the alternative minimum tax.

“Time was limited,” Shoulders says, “but the decision clients had to make wouldn’t be easy. We knew they needed appropriate education about the new law.”

There’s little doubt that the new tax law has turbocharged wealthy clients’ interest in tax planning, especially as they begin to face the reality of the need to prepare their 2018 taxes differently.

“The law has definitely upped the ante,” says John Napolitano, CEO of U.S. Wealth Management, who is a CFP and CPA. “It’s been front and center on people’s minds and is making it easier for wealth managers to sell the story that they can coordinate everything.”

To be sure, the appeal to wealthy clients of having advisors able to help them manage their tax liabilities and strategies has been building for years.

While still an accountant, Shoulders said she kept hearing from clients who wanted advice beyond preparing tax returns.

“They said they wanted guidance to get from where they were now to where they wanted to be in the future,” she says.

By 2012, Shoulders’ firm, Adams Hall Wealth Advisors, had reached close to $1.5 billion in AUM and was acquired by Mariner Wealth Advisors. Shoulders now works closely with Mariner’s tax division, Mariner Consulting, and says tax planning continues to be integral to her work with wealthy clients.

Demand from clients also pushed another CPA convert, Sheryl Rowling, to switch jobs. She had worked as an accountant for 10 years before starting her own financial advisory firm, Rowling & Associates, in San Diego in 1987.

“My clients wanted me to handle their investments instead of referring it out,” she says. “And I was frustrated that, when you’re preparing tax returns, you’re always looking in the rearview mirror. I always wanted to put more emphasis on year-end tax planning and look at the client’s entire situation before giving advice.”

Rowling incorporated tax planning and tax minimization into a holistic approach to financial advice, and also developed software to help advisors make their clients’ portfolios more tax efficient when rebalancing.

‘A DIFFERENTIATOR’

“This approach has definitely been a differentiator,” says Rowling, who is also head of rebalancing solutions for Morningstar. “People hate paying taxes, and if we’re going to add value to a client’s life, we have to do more than put their assets into an allocator and fall asleep.”

Shoulders and Rowling aren’t alone. Incorporating and leveraging sophisticated tax planning is increasingly being utilized as an effective — if not essential — way to attract and retain HNW and UHNW clients.

“Tax planning has become less of a differentiator and more of a required offering for those serving clients with complex financial lives,” says Mark Tibergien, CEO of Pershing Advisor Solutions. “Many firms now utilize tax harvesting, but those who operate more holistically also look at a client’s entire balance sheet and income statement to know how to optimize their wealth.”

That philosophy has certainly been a guiding principle for AdvicePeriod, the Los Angeles-based RIA founded by Steve Lockshin in 2014.

Lockshin, a key player in the financial advisory industry who founded Fortigent, was chairman of Convergent Wealth Advisors and an early investor in Betterment, believes the commoditization of investment advice has opened a clear path for prioritizing tax and estate planning for wealthy clients.

“There really is no alpha left in asset management,” Lockshin contends. “The investment returns for clients of all the advisory firms within a three-mile radius of my office won’t be that different. But for clients with $100 million, an effective estate plan is a very big deal.”

If an advisor can eliminate millions of dollars in taxes and help clients avoid transfer tax on the growth, Lockshin maintains, the savings can’t be equaled with investment returns. “What makes this type of planning so valuable,” he argues, “is that the results are measurable and don’t increase portfolio risk at all.”

He cites the example of an AdvicePeriod client who recently sold a chain of retail stores and netted almost $300 million. “The client will pay zero dollars in transfer taxes when they die because we did good planning before the sale,” Lockshin says. “Compound that amount by another 40 years of life expectancy and we are talking amounts north of $1 billion.”

The company was recapitalized to restrict the value of the shares, Lockshin explains, “thereby reducing the amount that needed to be transferred. By utilizing the family’s exemption and some intrafamily sales, we pushed all of the value into generation-skipping trusts and left the tax liability with the parents, thereby preserving the family legacy rather than losing much of it to taxes.”

Sophisticated tax planning is also deeply embedded in the DNA of Wescott Financial Advisory Group, founded by Grant Rawdin in 1987 as an outgrowth of his tax law practice at the Philadelphia law firm of Duane Morris.

“People have had a recognition that tax planning can be proactive, while tax preparation is reactive,” Rawdin says. “The value we provide is offering a different way for clients with complex wealth to arrange their affairs more effectively using a tax perspective.”

To achieve that, Wescott has a so-called tax alpha group that provides clients with tax minimization strategies and their own annual tax scorecard. The group uses what Wescott advisor and CPA Bob Waskiewicz calls a “tax mining” approach to clients’ documents to ferret out relevant information that can be used to reduce their taxes.

After the tax bill became law, the tax alpha group gave each Wescott client a checklist and flowchart detailing how provisions in the new law impacted them, for better and worse.

Indeed, high- and ultrahigh-net-worth clients across the country were anxious to find out “the impact the new law had on them and the next steps they should take,” says Greg Sullivan, president and CEO of Sullivan Bruyette Speros & Blayney, a $3.5 billion RIA based in McLean, Virginia.

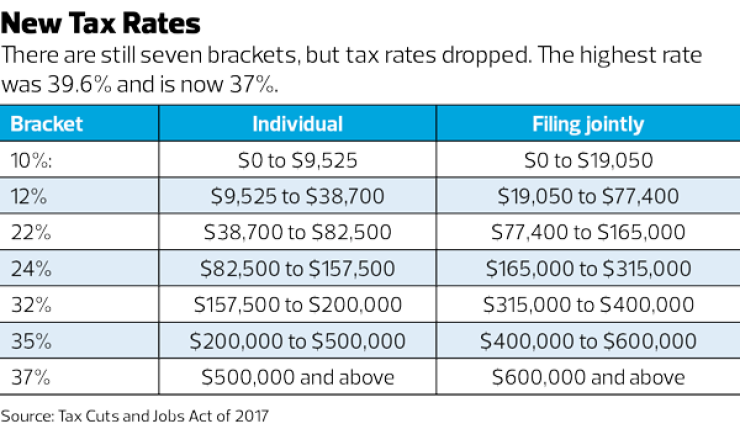

Wealthy clients are particularly interested in the exclusion threshold for the estate tax exemption, which was raised to $11.2 million per person and $22.4 million per couple, Sullivan says. But, he notes, it’s important to remind clients that the doubling provision expires in 2026.

The tax law has also drawn inquiries from owners of pass-through entities such as S corps and LLCs, Waskiewicz says. Changes in the corporate tax rate mean pass-through owners may not be able to deduct as much income as in the past, Waskiewicz says. As a result, they may want to re-examine their corporate structure.

AMT CHANGES

High-net-worth clients and business owners also kept a close eye on changes to the unpopular alternative minimum tax, which was rescinded for corporations and will apply to fewer individuals as a result of a raised threshold.

But the new law also brought bad news for HNW homeowners in high-tax states such as New York, New Jersey, California and Illinois who were accustomed to deducting five-figure property taxes.

Thanks to the new tax legislation, deductions for state and local taxes, including property, income and sales tax, are now limited to $10,000.

Clients impacted by the change who were considering moving to a low-tax state may want to pull the trigger, says Bill Morgan, a CPA who started a wealth management firm in Wyomissing, Pennsylvania, in 2005. The firm was acquired by Buckingham Strategic Wealth in 2016.

“Retirees in high-tax states may want to buy a place in a state like Florida for their primary residence,” Morgan says, “and either rent or buy a smaller condo up north for a second residence.”

And for HNW clients who had to pay the AMT, the loss of the state and local tax deductions “may not be quite as bad as first appears,” Morgan says. Those clients weren’t able to use the property tax deductions for the AMT anyway, he notes, and a higher AMT exemption and smaller SALT adjustment means they are less likely to be subject to the AMT in 2018.

“There’s a lot of misinformation out there,” Morgan says. “But, as a wealth advisor, you’re not working on the clock, which can restrict the conversation. You can have a deeper relationship with the client than as an accountant. And it’s way more enjoyable.”

In order to make the tax planning part of their business work, advisors have taken a variety of practice management approaches.

Some, like Wescott, include tax planning services in their core wealth management planning fee, which may be billed as a percentage of AUM or as a retainer, or both. Wescott does not prepare taxes for high-net-worth clients, but the firm works closely with its accountants and CPA firms.

Buckingham, one of the country’s larger RIAs with nearly $9 billion in assets, also includes comprehensive tax planning in its percentage of AUM fee. One Buckingham advisor with a master’s degree in taxation says studying the subject appealed to him because it required more critical thinking than accounting.

“Strategic tax planning is more like a puzzle,” says Elliot Dole, who works in Buckingham’s St. Louis headquarters and is also a CFP. “It’s endlessly complex and the law is always changing. You’re looking at the client’s entire picture and trying to see where they will be in 30 years instead of just saving taxes this year.”

Other firms, like Sullivan Bruyette, have a separate tax division that prepares tax returns for clients and charges for that service.

Sullivan’s advisors who do tax planning — including estate planning, portfolio strategy and advice on charitable giving — work closely with the tax services division, says Sullivan, who is both a CFP and a CPA. Tax planning is included in the overall financial planning fee, he adds, which may be a percentage of AUM, hourly or flat.

AdvicePeriod charges around 80% of its HNW clients — and nearly all its UHNW clients — a fixed fee for financial, tax and estate planning based on service provided and complexity, Lockshin says.

Clients with less than $10 million in assets “who are in the accumulation phase” aren’t required to pay a flat fee, Lockshin says. But for wealthier clients, including tax planning as part of a percentage of AUM fee is “a bit of a red herring,” he contends.

“Charging for asset management is charging for a commodity and giving away a premium,” Lockshin argues. “We want to charge for value and charge much less for a commodity.”

As for Shoulders and Rowling, both advisors include tax planning in their inclusive percentage of AUM fee (Shoulders also has some clients on a flat fee retainer), and also have a separate division where clients can have their returns done for a fee.

“We encourage collaboration with Mariner Consulting,” Shoulders says. “We found that a joint effort is a more enhanced experience for the client.”

For advisory firms without an in-house tax prep division, deciding exactly how — or if — to collaborate with outside CPA firms is an ongoing issue. Some firms have revenue-sharing arrangements with accounting firms, but Napolitano thinks that’s a bad idea.

“It sounds good in theory, but revenue sharing can result in tension over the question of ‘Whose client is it?’” Napolitano says. “There’s usually a fiefdom mentality. We want to be the head coach and assume fiduciary responsibility for the client. It took us three years to find CPA firms we could have a good informal relationship with.”

Buckingham also works closely with outside accounting firms, and some of their branches even share office space with CPA firms.

“We try to make their lives as easy as possible and make them part of the team,” Morgan says. “If a CPA is in a planning meeting, the client pays the CPA separately.”

Buckingham doesn’t ask an outside accounting firm for remuneration when it refers clients, Morgan says, but will pay a solicitor fee to registered CPAs who refer planning business to the firm.

Targeting niche markets

Sophisticated tax planning is also used to target niche HNW markets, such as professional athletes. Athletes with high incomes are extremely concerned about paying state taxes, says K. Sean Packard, tax director for OFS in McLean, Virginia. OFS works with athletes to determine if they are required to pay taxes to the state their team is based in, Packard says, even if they have residency somewhere else.

And the new tax law excludes a deduction for business earnings based on an owner’s reputation — exactly the kind of income many active and retired professional athletes rely on.

“As a result, we’re looking for opportunities to have business income for our clients that are not solely based on their reputation,” he says, “but businesses where they can take advantage of the law.”

He adds, “It’s a good example of the different type of tax planning that advisors can provide, beyond what clients have to file with the IRS.”