Despite uncertainty surrounding the fiduciary rule, LPL Financial will emerge stronger in the coming months, according to CEO Dan Arnold. The nation’s largest independent broker-dealer lost more than 200 advisers due to three major defections in the second quarter.

Changes like the Department of Labor rule will lead to “more adviser movement and opportunity for industry consolidation,” Arnold said Thursday during a call after LPL reported its second-quarter earnings. “We have been winning business by building on these themes.”

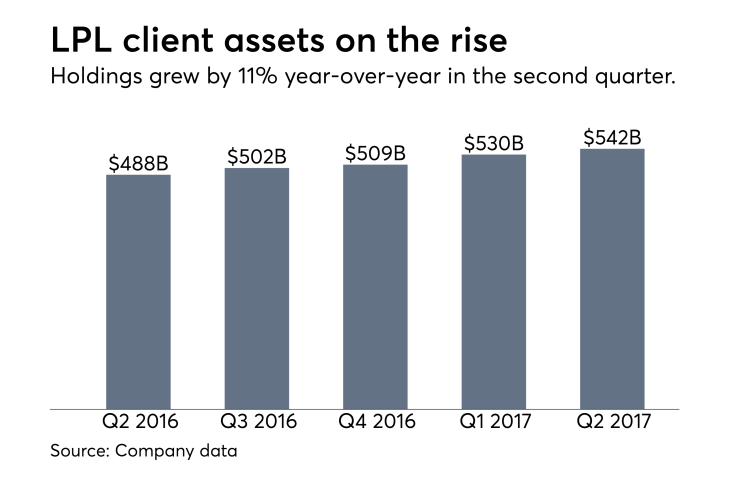

Client assets at LPL grew 11% year-over-year to $542 billion despite exits by

The steep costs of efforts by LPL and its competitors to

Concerns around the DoL rule were the “biggest driver” pushing LPL’s recruiting down for the quarter because “it just caused advisers to slow down on their decision-making,” Arnold said. “We’ve seen some reduction in that uncertainty. We feel good about growing through recruiting in the long term.”

-

The nation's largest IBD vows to take a “proactive approach” to the fiduciary rule.

February 9 -

Dan Arnold expects that upheaval to lead to more movement of advisers and assets.

April 28 -

The nation’s largest IBD plans to launch a platform with load-waived shares from 20 companies.

July 17

This year has seen more moves, bigger moves and more expensive moves.

RECRUITING BY THE NUMBERS

LPL has kept some recruiting momentum amid

The firm’s headcount fell by 98 from the previous quarter to 14,256. However, it has grown by 63 year-over-year. Exits by Resources Investment Advisors, Carson Wealth Management Group and WealthPlan Partners removed $5.6 billion in assets and 218 advisers from LPL’s fold, according to CFO Matt Audette.

The OSJ losses reduced the broker-dealer’s net new assets to an inflow of $400 million, down from $1.3 billion year-over-year. They pose no further impact on LPL’s results going forward, though, Audette said.

POST-DoL WORLD

Climbing advisory assets brought on by recruiting and market growth yielded the higher profits, he added. The firm saw outflows in new brokerage assets and inflows in new advisory assets for the ninth quarter in a row. Conversions from brokerage to advisory accounts hit $2 billion.

Earlier this month LPL announced a new investing platform

“The Mutual Fund Only solution is a great example of our commitment to preserving choice across both brokerage and advisory accounts in a post-DoL world,” Arnold said.

He cited the firm’s platform for separately managed accounts and its upcoming robo advice offering — which is slated for rollout next quarter — as other examples of the firm’s innovations. LPL is striving to help advisers get “more capabilities at a lower cost” to their clients, Arnold said.

“On the macro level, I think it’s reasonable to assume that prices will come down,” he said. “You’re seeing the entire ecosystem wrestling with that.”

The value of LPL’s stock has nearly doubled over the past 12 months to around $45 per share. Its price increased by about 1% in after-hours trading following the earnings announcement.