Clients — and even some advisors — overreact to market losses, even though they occur less frequently than gains.

Are they on to something? Consider long-time performance of the S&P 500. This index has produced a positive annual return about 75% of the time since 1926. Even after accounting for inflation, it has had positive annual real returns roughly 70% of the time. Think of it this way: When a great batting average in the game of baseball is .400 (or getting a hit 40% of the time), a stock market batting average of .700 over the past 9 decades is truly remarkable.

Let’s look past the S&P 500, however. How often do other asset classes have negative returns? And, once a loss occurs, how long does it take for an asset class to recover? These are two questions worth further exploration.

THE SEVEN CORE ASSET CLASSES

To explore, we’ll focus on seven core asset classes that are often used in investment portfolios. Each of these asset classes have performance history going back to 1970: large-cap U.S. stocks, small-cap U.S. stocks, non-U.S. stocks, real estate, commodities, U.S. bonds and cash.

Large-cap stocks will be represented by the S&P 500, small-cap stocks by the Russell 2000, non-U.S. stocks by the MSCI EAFE index, real estate by the Dow Jones U.S. Select REIT index, commodities by the S&P Goldman Sachs Commodity index, bonds by the Barclays U.S. Aggregate Bond index and cash by the 90-day Treasury bill.

We will also examine the behavior of a portfolio composed of all seven indexes in equal allocations of 14.29% (with annual rebalancing).

As shown in the graphic “Summary of Asset Classes,” real estate has been the top performer overall over the 47-year period from 1970 to 2016, generating an average annualized nominal return of 11.42% (7.60% after adjusting for inflation). Moreover, it has seen positive calendar-year returns 83% of the time. After accounting for inflation, real estate has produced positive real returns 77% of the time.

Real estate has produced a negative nominal return just 17% of the time since 1970. That is an outstanding success ratio. The last negative calendar year for real estate was in 2008, during the height of the financial crisis.

Small-cap U.S. stock has been the second-best performer, with a 47-year annualized nominal return of 11.02%, 6.72% after inflation. It has had a positive calendar-year return 70% of the time over the past 47 years, and 68% of the time after accounting for inflation.

Large-cap U.S. stock had a 47-year annualized return of 10.31% and real return of 6.03%. The S&P 500 had positive nominal returns 81% of the time and positive real returns 72% of the time. The last negative year for the index was also in 2008.

It’s worth noting that cash shows positive nominal returns for all 47 years, but, after accounting for inflation, it had a positive real return only 60% of the time — the lowest percentage among all seven asset classes.

A portfolio with equal allocations of all seven asset classes has performed admirably over the past 47 years, producing an average annualized nominal return of 9.82%, with a standard deviation of 10.16%. The standard deviation for the multi-asset portfolio has been dramatically lower than that for any of the so-called performance engines (real estate, U.S. small stocks, U.S. large stocks, international stocks and commodities). Additionally, the seven-asset portfolio had a positive nominal return 87% of the time, and a positive real return 74% of the time.

ENDURING THE RECOVERY PERIOD

Over the past 47 years, each of the core asset class has produced a positive return at least 70% of the time pre-inflation, and at least 60% of the time after inflation. But, despite having very good batting averages, these asset classes do, of course, experience negative returns, which translate into temporary portfolio losses. Over time, these core asset classes have always recovered.

The question is: Do advisors and clients have the persistence to endure the recovery period?

It is a challenge. Portfolio losses don’t play fair, because it takes a proportionally bigger gain to break even from a loss. Thus, even though all the key asset classes have positive nominal and real returns most of the time, the losses they do experience can be disproportionately painful.

As shown in “The Math of Loss and Recovery”, as the portfolio decline increases, the needed gain to restore the loss also increases. For example, a portfolio loss of 35% requires a 54% (technically 53.8%) cumulative gain to restore the portfolio to its value prior to the loss.

A portfolio loss of 50% requires a 100% gain to break even. A 75% loss requires a 300% gain to recover the lost account value. The primary goal of a diversified investment portfolio should be to provide a reasonable rate of return while minimizing the frequency and magnitude of losses.

HAVING A STEADY HAND DURING MARKET LOSSES

The S&P 500 lost 37% in 2008. However, a diversified seven-asset portfolio fared better, with a loss of only 27.6%. In “The Loss of Math and Recovery,” we can see that a loss of 35% requires a 54% gain to break even, while a loss of 25% requires only a 33% gain to fully recover.

It’s important that advisors have a steady hand during periods of market volatility that produce temporary losses. The reality is that losses occur — but so does recovery. What’s needed most when markets are in a down period is patience and perspective from both advisors and clients.

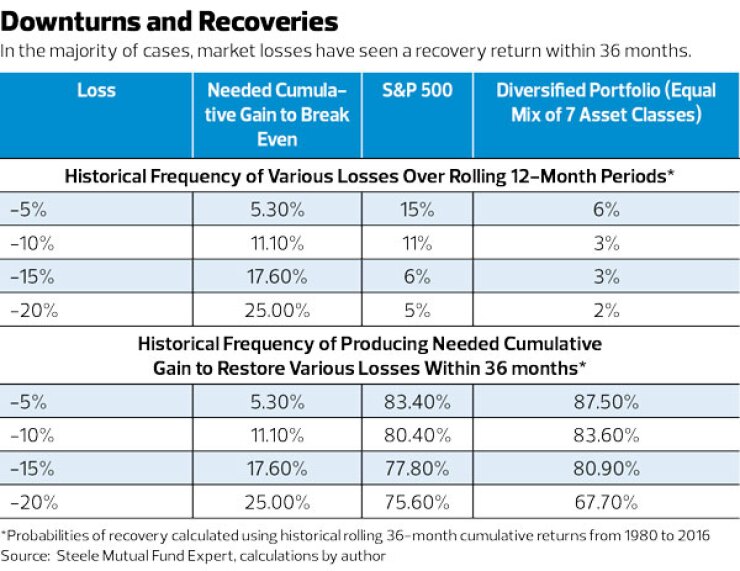

Based on an analysis of asset-class performance over the past 37 years, using monthly performance data from 1980 to 2016, there is a 15% chance that U.S. large-cap stocks will lose up to 5% in a 12- month period. There is an 11% chance of a loss of up to 10%, a 6% chance of a loss of up to 15% and a 5% chance of a loss of up to 20% within a 12-month period.

Consider all of these situations, assuming a recovery period of 36 months, with data going back to 1980. After experiencing a loss of 5%, the S&P 500 has, 83.4% of the time, generated the needed cumulative recovery return of 5.3% within a 36-month period.

From a loss of 10%, the needed return is 11.1%, which the S&P 500 has managed 80.4% of the time. A 15% loss requires a 17.6% cumulative gain for recovery, which the S&P 500 has accomplished 77.8% of the time. Finally, a loss of 20% requires a 25% cumulative gain to break even, and the S&P 500 has generated this needed return 75.6% of the time.

There is only a 3% chance that a well-diversified portfolio will experience a 15% loss during a 12-month period. If such a loss occurs, how quickly will a diversified portfolio recover? The good news is that, based on historical data, there is an 80.9% chance this diversified portfolio will fully recover within 36 months.

Depending on clients’ differing risk appetites, personal situations and time horizons, advisors may help clients get through tougher market times by explaining that, when it comes to losses, they are typically not forever.