One of the most common reasons individuals become business owners is to have more control over decision-making. Those decisions include, among others, what types of solutions the business will offer, how clients will be serviced, which vendors the business will use, and who the business will hire and fire.

On the latter point, the IRS’s website says, “One of the advantages of operating your own business is hiring family members.” That family member can be a spouse, sibling, parent or even a child. And while hiring a child may not be top of mind for many businesses owners, there can be a surprisingly broad array of tax and other benefits to doing so.

The key is to abide by standards of bona fide, age-appropriate work, ensure a reasonable wage, and follow federal and state regulations relating to labor standards. Understanding these, however, can feel like a part-time job unto itself. It also provides yet another avenue for planners and advisors to add value to the client relationship.

Although labor laws have evolved quite a bit over the past 80 years, the

Under the

The first tier covers children

The second tier of child labor laws covers children

By the time

EXEMPTIONS

All that being said, if you’ve considered hiring one or more of your own young children, none of the aforementioned laws likely matter.

Indeed, there is a broad exemption to the child labors laws for young children employed in businesses owned solely by their parents. Such children may, at any age, typically work an unrestricted number of hours, at any time of day or night, provided the parent-owned business is not involved in mining, manufacturing or other occupations designated as hazardous by the Labor Department.

Notably — and despite a substantial number of generally credible, well-respected sources suggesting otherwise — this exemption is available regardless of the entity structure of the parents’ business, as long as the business is wholly owned by the parents. In fact, as stated in

The exemption applies only when the parent is the sole employer of the minor. If the parent is a partner in a partnership or an officer of a corporation, the parental exemption does not apply unless the parents are the only members of the partnership or the sole owners of the corporation.

Thus, a sole proprietorship where one parent is the business owner clearly qualifies for the exemption — but so does a partnership in which both parents are the only partners, and corporations in which one or both parents are the only shareholders.

LOCAL CONSIDERATIONS

The FLSA only applies to situations in which a business is engaged in some level of interstate commerce. Thnks to the internet, phone and even mail service, however, nearly all businesses have some level of interstate commerce that would leave them subject to the FLSA.

In addition to federal rules, business owners wishing to employ their minor children must also be cognizant of

Some states have minimum age requirements that differ from federal rules for children working in a parent’s business, while others place

Thus, prior to employing any minor — including one’s own child — business owners should be aware of all pertinent local law. Otherwise any tax or ancillary benefits of hiring your child could easily be outweighed by penalties and/or prolonged audits and inspections by the Labor Department or state authorities.

SHIFTING TAXABLE INCOME

In addition to non-financial benefits such as the ability to spend more time together, there are several tax benefits that may be available when parents hire their minor children. Together, these benefits can produce significant tax savings.

The biggest and most obvious benefit to hiring a minor child in the family business is the ability to shift income from what is presumably the parents’ higher income tax rates to the child’s presumably lower rates. And thanks to Congress

In 2019 the standard deduction for individual filers is $12,200. Thus, minor children can earn up to $12,200 from employment and pay no federal income taxes. And while state income taxes may apply to those amounts in certain situations, if the child is at a lower federal rate than their parents, they will also generally be at an equal or lower state income tax rate too, making the potential income tax savings even greater.

In situations where a business-owning parent is in a relatively high income tax bracket, shifting income to the minor’s 0% federal and also lower state tax rate can produce substantial tax savings — especially when there are multiple children to employ.

And notably, the so-called kiddie tax is of minimal concern here, as it is levied on unearned income such as interest, dividends, capital gains and distributions from inherited IRAs, 401(k)s and other retirement accounts. In contrast, income generated from employment, including employment by a parent, is earned income. Thus, the kiddie tax does not apply to such amounts, and the full amount of the standard deduction, and availability of lower tax brackets, is permitted.

Example No. 1: Kent is the owner of Kent’s Kandy, a successful local candy store. He is currently in the 35% tax bracket and has three children, ages 14, 15 and 17. If Kent were to hire each of his children to work for the year and paid them each $12,200, the deductions would reduce his 2019 taxable income by $36,600, lowering his own taxes by $12,810 ($36,600 x 35% = $12,810). That tax savings alone more than pays for the salary of one of Kent’s children.

To make things even sweeter for Kent and family, if we assume that Kent’s children have no other income, the entire $12,200 salary paid to each child is 100% federal income tax-free, translating to a true family tax savings of the same $12,810.

From Kent’s perspective, if he were going to give his kids allowance or spending money anyway, this is a far more tax-efficient way of doing it — and it might teach them some life skills at the same time.

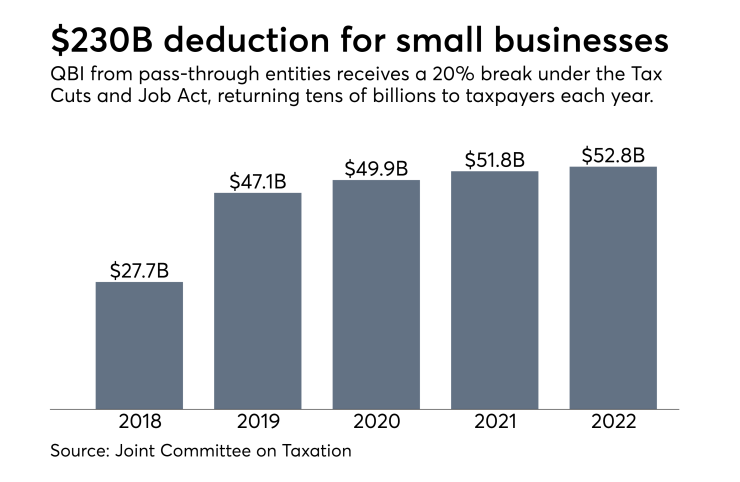

For business owners at or near the new

In addition, the wages paid to a minor child count as wages paid for the wages or wages-and-depreciable-property tests for the QBI deduction. This means those kids’ wages can

Cumulatively, the reduction of the owner’s income via the payment of salary to a minor child, plus the potential increase in the owner’s QBI deduction as a result of such a decision, can save a business owner with the right set of facts and circumstances nearly 50 cents of every dollar paid to their child in federal taxes. Getting Uncle Sam to split an allowance with you isn’t exactly a bad gig.

EMPLOYMENT TAX SAVINGS

In addition to the regular income tax savings that may be available when paying a salary to a minor child, federal tax law also offers potential savings on employment taxes as well.

Specifically, sole proprietorships, single-member LLCs and partnerships — but not corporations, including S corporations — where both parents are the only partners/owners of the business, are not required to pay Social Security or Medicare (FICA) taxes when employing their minor child. Though notably, that also means the child

Furthermore, sole proprietorships, single-member LLCs and partnerships where both parents are the only partners of the business are not responsible for federal unemployment (FUTA) taxes on children under 21. Such businesses, however, may still owe state unemployment taxes.

It’s also important to note that even if a child-employee’s wages are not subject to FICA and/or FUTA, those wages are still

CORPORATIONS

Even when a child’s parents are the sole shareholders, corporations — including S-corporations — are not eligible for the special employment tax breaks on FICA and FUTA. Still, parents in this situation have several tactics to consider:

Do nothing and hire the child via the corporation: One option is simply to accept the restrictions and hire the child. Sure, it’s nice to save on employment taxes, but the combined Social Security and Medicare taxes (15.3%) that would be owed on a child’s salary, plus the federal unemployment tax (6% on the first $7,000 of wages), would still only equal about 19% on a $12,200 salary. And ostensibly, at least some Medicare or Social Security taxes would have been paid by the parents if the income were allocated to them anyway. Thus, even with some FICA and FUTA tax obligations, there would still be tax savings when employing the child in the business, especially for higher-income parents.

Change entity structure: Another possibility for a parent in such a situation is to scrap the S-corporation and turn the business into a sole proprietorship, single-member LLC or partnership with the other parent. It’s highly unlikely that such a change would be beneficial solely for the purpose of escaping employment taxes on a child’s, or even multiple children’s, salary. However, given the many changes created by

Create another business and employ children there: A more aggressive approach to saving on employment taxes for parents looking to hire their child to work for their wholly owned corporation is to establish a separate sole proprietorship (or single member LLC or partnership, where both parents are the only partners) family management company.

The separate, employment tax savings–eligible family management company would then contract with the S corporation to provide services, and the family management company would then hire the children to provide those services. For example, the family management company might handle services such as answering phones, providing computer support, or performing social media marketing.

Parents who wish to go this route, however, should not do so willy-nilly. And while in theory nothing should prevent a parent from engaging in such a series of transactions, in the event of an audit, count on the IRS asking questions.

For those who choose to utilize this tactic, keeping good records is an absolute must. For instance, keep copies of the contract and/or related documentation between the regular S-corporation business and the newly formed family management company. Any outside business to the family management company — i.e., a small social media marketing engagement with another unrelated company — would likely also go a long way toward having the IRS respect the entity.

And of course, even in a best-case scenario the family management company would be the employer of the children, meaning the family management company would have to run payroll, issue the W-2s and file a tax return, likely a Schedule C. For some business owners this extra work may negate all or part of the benefits of establishment.

While families can often enjoy a material amount of income tax savings — and potentially FICA and FUTA tax savings as well — by employing and paying children in the family business, an immediate income tax savings is not the only benefit of the strategy.

THE ROTH EFFECT

Future tax rates are reasonably uncertain. But one thing that you can say about a child’s future tax rate with a high degree of confidence is that if the child’s tax rate today is 0%, thanks to the larger standard deduction and the fact that their future tax rate won’t be any lower. Thus, with respect to long-term tax planning, buying today’s low tax rate

There are only two requirements: 1.) An individual must be below their applicable income threshold — phased out between $122,000 and $137,000 for single filers in 2019); and 2.) They must have earned income. Thus, unless a minor child has a substantial amount of other income, in which case income shifting via employment may no longer make sense, they will be eligible to make a 2019 Roth IRA contribution up to the lesser of $6,000 or their actual earnings.

Thanks to the power of long-term compounded growth, these early contributions could have a material impact on the child’s retirement savings. For instance, by contributing the maximum $6,000 to the child’s Roth IRA each year from ages 15 through 17, by the time the child reaches 65 he/she will have accumulated nearly $500,000 of tax-free retirement money, assuming a 7% annual rate of return.

Also notable is the fact that while the child does need to have their own compensation to support the contribution, they don’t actually have to be the one to make the contribution. Thus, a parent-employer can allow their child to keep all of their earnings, while separately contributing their own money into the child’s Roth IRA — presuming the parent has not already capped out his/her annual gift limit to the child.

OTHER EMPLOYEE BENEFITS

If your child is an employee of your business, they are generally entitled to the same employee benefits as other employees. That could include benefits such as HSAs, FSAs or being able to contribute to — or receive contributions on their behalf into — other retirement plans as well. If you plan to hire your child, it’s important to understand these additional opportunities, but also additional costs, and plan accordingly.

For example, SEP IRAs are a common retirement plan for small businesses. If in addition to hiring your child you also wanted to include them when making SEP contributions, you would probably want to set up your plan so younger workers are allowed to participate. On the other hand, if you wanted to exclude your children from receiving SEP contributions under the plan, leaving the typical defaults in place make sense — i.e., preventing employees from participating if they are under 21.

In all cases it’s important to remember that whatever rules you set for your retirement plan or other employee benefits, they apply across the board. If you lower the retirement plan participation age and hire your son’s friend to work in the business, you’ll likely be making retirement contributions for the friend too.

A ‘REAL’ JOB

Clearly there are ample benefits to hiring one’s child. But like most decisions business owners face, before moving forward there are important things to consider that may make the decision less appealing.

If you’re thinking about hiring your minor child to work in your business, one of the most important things to ensure is that you respect the basic framework of an employer-employee relationship. You can’t, for instance, just throw you child onto payroll to save some taxes if they don’t actually do something in the business.

Rather, just like any other employee, your child should be hired to provide bona fide services. It’s highly unlikely that a five-year-old is going to be keeping your books, but there are certain jobs that even young workers can typically handle. Common work-related activities a minor might perform include cleaning as well as filing, answering the phones and other clerical work. Even using their images in the business’ marketing materials constitutes a service to the business.

Children may also be far more versed in computers, information technology and social media than their parents. Catering to these strengths can also provide ample reason to employ minor children in your business.

In all cases be certain that the work being assigned is not only age-appropriate to the child but also in line with relevant federal and state child labor laws.

A REASONABLE WAGE

When tax professionals discuss reasonable wages, it’s typically in the context of paying wages that are high enough. The reality is that reasonable has two boundaries: a lower one, below which wages are not significant enough to be considered reasonable, and an upper one, above which wages would also fail to be reasonable. When it comes to paying minor children, it’s this upper boundary that is often at issue.

Suppose you wanted to hire your child on a part-time basis for a salary of $1,016.67 per month, in order to grab the full $12,200 standard deduction amount for 2019. If your child only worked five hours per week for a total of 20 hours per month, that would equate to over a $50 hourly rate.

If their role in the business is clerical in nature, mainly consisting of answering phones, making photocopies or engaging in similar activities, chances are the IRS would find that $50 per hour rate to be unreasonable — especially if you have other, higher-skill labor on the books at a lower hourly rate. If on the other hand your child is doing more higher-level activities, such as social media marketing, a $50 hourly rate may not be unreasonable at all.

You should also try to pay your child cash — or at least electronically, via payroll, into an online bank account — to minimize concerns over conflated work with parental responsibility. Although federal laws allow salaries to be paid in property — e.g., an exchange of goods for services — it can be tempting for some to push the boundaries too far. In July 2014 Patricia Diane Ross, a paid tax preparer of all things, was denied by the tax court for deductions

Tracking a child employee’s hours and activities is good practice though, and should be done in all situations. And if you can get documentation of hourly rates for similar roles at other unrelated companies that are in line with what you’re paying, then you’re about as prepared as possible on this matter.

FINANCIAL AID IMPACT

In the United States the most common and important document for acquiring aid to fund higher education is the Free Application for Student Aid (FAFSA) form.

In general 50% of a student’s income is counted toward the expected family contribution (EFC), whereas only up to 47% of a parent’s income is allocated toward the same formula. Students are, however, allowed to protect nearly $6,700 of income with respect to the FAFSA calculation.

Thus, the shifting of income from parent to student may actually still produce a net-positive FAFSA result, depending on both the student’s and parent’s other income for the year. This is especially relevant once the child is a

THE DEPENDENCY STANDARD

The tax legislation passed in 2017 eliminated the personal exemption deduction for dependents beginning in 2018. Many people now erroneously believe that claiming a child as a dependent is irrelevant for tax purposes. That is far from the truth, and in some way claiming your child as a dependent is more important today than ever before.

Consider the expanded child tax credit. For years prior to 2018, the credit was only a maximum of $1,000 per child, and many upper-middle-class families lost out on the deduction because it started to be phased out at $110,000 of modified AGI. As a result of the 2017 tax legislation, however, the maximum credit

Ultimately, for some business owners, hiring a child can present a double-whammy benefit.

Thus, far more parents will have claimed far bigger child tax credits for 2018, and through 2025 under current law, than they ever have before. But in order to claim the credit, the child must be a dependent. There are many tax benefits that are available for children, but in general those benefits are only applicable if that child is a dependent.

So when does hiring your child potentially impact their dependency? Simply put, one of the key tests to determine dependency is the so-called support test, whereby in order to claim a child as a dependent you must provide at least half of their support for the year. In all likelihood a salary of $12,200 won’t allow a child to provide more than half of their own support, including housing, for the year. However, if the child has another job and lives in a reasonably low-cost area, it should be factored into the decision process.

Ultimately the key takeaway is that for some business owners, hiring a child can present a double-whammy benefit. It not only can afford them more time with their child, but also a variety of tax and other benefits to keep more of their hard-earned money in the family coffers. Knowing how to navigate not only tax law but also labor law is not extra credit — it’s a core responsibility.