Though the shift from active to passive is clear, one category continues to attract investors against expectations: low-priced active funds.

Actively managed funds noted by Morningstar as the cheapest 20% saw $41 billion in inflows over the last two years. Active funds as a whole saw $586 billion in outflows in the same period.

"You would think it's active versus passive, but investors are looking for low-cost investing that could be found in the passive space and found in the active space," says Patricia Oey, senior manager research analyst at Morningstar.

As new money continued to flow into lower-cost index mutual funds, ETFs and institutional share classes in 2016, investors paid less in fund expenses than ever before, according to Morningstar's latest U.S. fund fee study.

The report examined the research firm's data which includes 217,000 open-end mutual funds, 11,600 closed-end funds and 14,100 exchange-traded product listings, as of March 31, 2017.

"We wanted to highlight that active funds are still gathering assets because they are well-priced and they have good managers," Oey said. "We wanted to make that clear, as opposed to always defining it active versus passive."

-

The firm has been building its passive business as investors dump active products.

July 31 -

Energy was likely a “headwind,” analysts wrote.

July 21 -

Although the funds experienced a combined $586 billion in outflows over the last two years, this segment reported inflows of $41 billion.

June 7

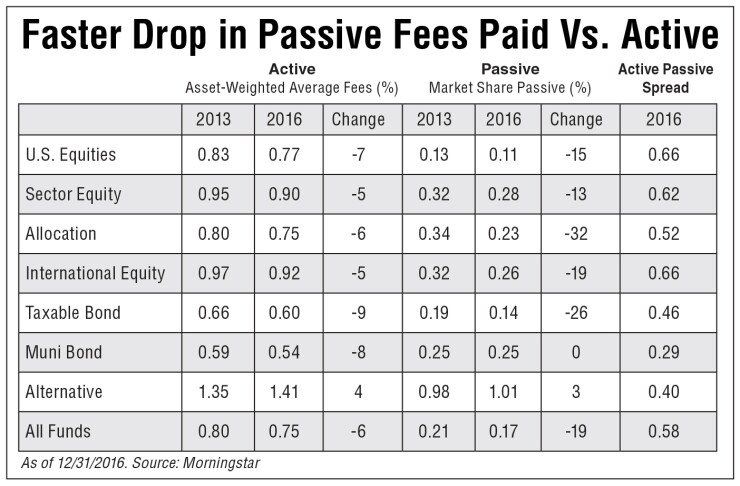

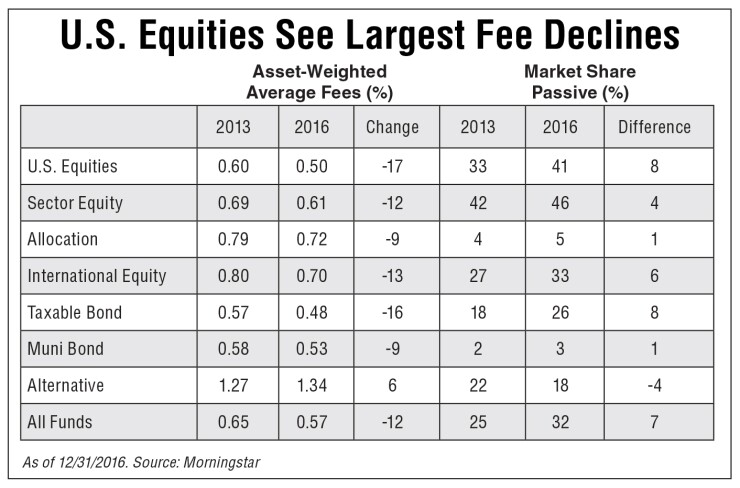

The asset-weighted average net expense ratio of all U.S. funds was 0.57% in 2016, down from 0.61% in 2015 and 0.65% three years ago; declines largely driven by flows into passive funds and less-expensive share classes, according to Morningstar.

The average expense ratio of the largest 2,000 funds of 2013, which made up for 85% of assets in mutual funds and ETFs at the time, was 0.72% in 2016, virtually unchanged from 2015 and 2014, Morningstar said.

When markets are high, everyone feels like genius, but they still have to pay expenses. Help clients keep them low.

ETFs saw asset-weighted average fees decline from 0.29% in 2013 to 0.24% in 2016. So, while fees are remaining generally static, a majority of the declines are coming from a migration to lower-cost products, Oey says.

"The adviser industry is moving toward a fee-based structure. We have to look at the overall cost the investors are paying," she says.

"If investors are moving toward advisers that have asset-based fee structures, then they pay for the funds — but they are also paying for the advisers' fees on top of that,” adds Oey. “The total cost needs to be evaluated."

Vanguard currently has the lowest asset-weighted average expense ratio at 0.11%, followed by SPDR State Street Global Advisors at 0.19% and Dimensional Fund Advisors at 0.36%, according to Morningstar.

The firm's asset-weighted average fees declined 21% over the last three years, the most significant decline among the 10 largest fund providers.

Take Vanguard out of the mix and the overall average expense ratio decline would have been 0.69% to 0.62%.

"Active is not dead," Oey stressed. "People are still investing in active funds that are reasonably priced and their performance is good."