A common question clients ask their advisers is, “How long will my investment portfolio last during retirement?”

The answer, of course, depends on a number of variables: withdrawal rate, annual cost of living adjustment, portfolio asset allocation and how long the retirement period is.

Spoiler alert: the shorter the retirement time period, the more likely the portfolio will survive intact. But don’t just take my word for it.

Let’s take a look at two retirement portfolios as an example. The first is a 25% stock/75% fixed-income portfolio consisting of 15% large U.S. stock, 10% small U.S. stock, 55% U.S. bonds and 20% cash.

The shorter the retirement time period, the more likely a portfolio will survive intact.

The second is a 65% stock/35% fixed-income portfolio consisting of 40% large U.S. stock, 25% small U.S. stock, 25% U.S. bonds and 10% cash. Both portfolios are rebalanced annually.

The performance of large-cap U.S. stock is represented by the S&P 500; small-cap U.S. stock by the Ibbotson Small Stock Index from 1926 to 1978 and the Russell 2000 Index from 1979 to 2015; U.S. bonds by the Ibbotson U.S. Intermediate Government Bond Index from 1926 to 1975 and the Barclay’s Capital Aggregate Bond Index from 1976 to 2015; and U.S. cash by 90-day Treasury bills.

The timeframe for this analysis is the 90-year period from January 1926 through December 2015. The definition of success is based on the retirement portfolio’s ability to survive for the full length of the retirement window. Four retirement windows were studied: a 35-year window, a 30-year window, a 25-year window and a 20-year window.

THE CONSERVATIVE PORTFOLIO

Let’s first examine the conservative 25/75 retirement portfolio. As shown in “Windows of Success,” the portfolio survived intact in all 56 rolling 35-year periods, assuming a 3% initial withdrawal rate and a 3% annual COLA. As would be expected, the success rate was also 100% over all the rolling 30-year, 25-year and 20-year periods.

At a 4% withdrawal rate and 3% COLA, the 25/75 portfolio survived in just under 93% of the rolling 35-year periods and 98% of the rolling 30-year periods. Over 25-year and 20-year rolling periods, the success rate was 100%.

Survival gets dicey as we increase the withdrawal rate to 5% and use a COLA of 3%. The portfolio failed to last 35 years in over 40% of the rolling 35-year periods (58.9% success rate). Over 30-year retirement windows, it failed over 26% of the time (73.2% success rate). Over 25-year retirement windows, it failed about 7% of the time. If the retirement was only 20 years in length, it was successful 100% of the time.

The performance of the S&P 500 has nothing to do with a conservative multi-asset retirement model.

At a 6% withdrawal rate, the success rate of the conservative model was grim. It failed to last 35 years about 2/3 of the time. The same failure rate applied to 30-year retirement windows.

Assuming a 25-year retirement window, the 25/75 model was only successful just over half the time. If, however, the retiree is only planning for a 20-year retirement window, the conservative model was successful 91% of the time.

THE MODERATELY AGGRESSIVE CHOICE

Success rates improved dramatically if the retiree was willing to build a more equity-oriented 65/35 retirement portfolio – but only when the withdrawal rate was 5% or higher.

At a 3% withdrawal rate and 3% COLA, the 65/35 portfolio survived intact in every case, as did the 25/75 retirement model. When moving to a 4% withdrawal rate and 3% COLA, the success rate dipped slightly to 98% if the retirement window was 25 years or longer. The 25/75 model had similar success rates over the various retirement windows, assuming a 4% initial withdrawal rate.

At a 5% withdrawal rate, the durability of the 65/35 model clearly separates itself from the 25/75 model. The 65/35 model was successful in 91% of the rolling 35-year periods, compared to a 59% success rate for the 25/75 model. Over rolling 30-year retirement windows, the 65/35 portfolio was successful nearly 95% of the time, compared to a success rate of 73% for the 25/75 model. When the retirement window was 25 or 20 years long, the two models had comparable historical success rates.

When moving to a 6% withdrawal rate, the 65/35 portfolio was markedly better than the 25/75 portfolio. Assuming a 35-year retirement window, the 65/35 model was successful in 87% of the rolling periods, compared to a success rate of 34% for the 25/75 model.

If the retirement window was 30 years in length, the 65/35 model had an 89% success rate, compared to 34% for the 25/75 model. For retirement windows of 25 years, the 65/35 model was successful 89% of the time vs. a success rate of just under 54% for the 25/75 model.

Only if the retirement window was just 20 years in length (assuming a 6% withdrawal rate and 3% COLA) were the success rates of the two retirement portfolios similar (94.6% for the 65/35 model and 91.1% for the 25/75 model).

A SAMPLE CLIENT

Let’s take this information about retirement portfolio survival and apply it to a hypothetical client — Mr. Jones. This is a very simplistic example, but it serves a point.

In this example, Mr. Jones had a $100,000 annual income prior to retirement, and is wanting to withdraw about $50,000 from his retirement portfolio annually (with an annual COLA applied after the first year). Any additional retirement income will need to come from other sources (pension, social security, etc.).

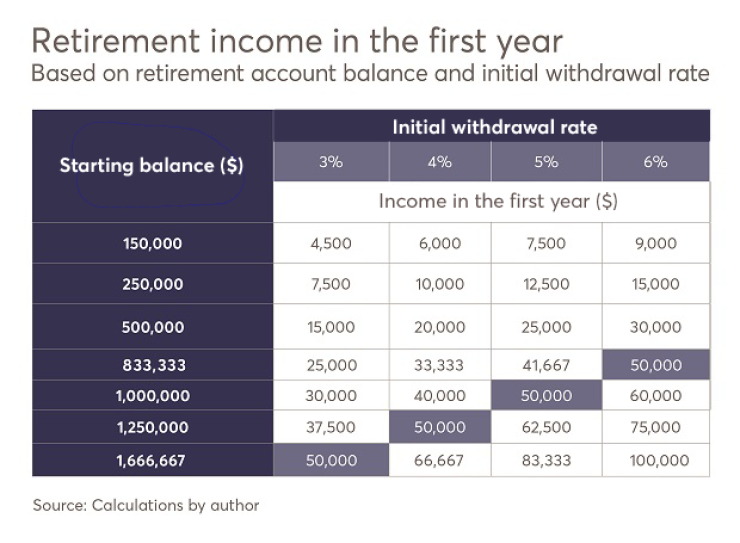

If Mr. Jones has only saved $150,000 in his retirement portfolio, he cannot withdraw $50,000 the first year unless he uses an extremely high withdrawal rate. It’s not until his retirement account balance is around $833,000 that a first-year withdrawal of $50,000 is feasible, but only at a 6% withdrawal rate.

As has been shown in the analysis above, a 6% withdrawal rate will require a more aggressive retirement portfolio design (such as the 65/35 model) if the retirement window for Mr. Jones is anticipated to be 25 years or longer.

Alternatively, if Mr. Jones has a larger retirement account balance of $1.66 million, he can use a 3% withdrawal rate to take $50,000 from his retirement portfolio during the first year of his retirement. Given that he is using a lower withdrawal rate of 3%, he can utilize a more conservative 25/75 retirement model if he so chooses, based on the historical performance of a 25/75 portfolio.

Or he can use a 65/35 model if he is seeking a higher return in his portfolio. Both retirement portfolios demonstrated high success rates historically over all the various rolling periods from 35 years down to 20 years when using a 3% initial withdrawal rate and a 3% COLA.

The freedom to choose a more conservative retirement model is predicated on using a lower withdrawal rate, which is a function of the accumulated retirement account balance. A larger balance gives a client the option to be more conservative in portfolio design. A more conservative retirement portfolio will experience less volatility in the account balance, which for many (if not all) retirees is how they perceive portfolio risk.

Here’s the really important point: If a client has done a good job of accumulating adequate retirement assets, he or she has earned the right to be more conservative in their retirement portfolio design, if they so desire. If they act on that choice and build a more conservative retirement model, it is imperative that they not compare the performance of that model to the S&P 500 or some other equity market index.

The performance of the S&P 500 has nothing to do with a conservative multi-asset retirement model. It would be a completely bogus comparison, and may lead clients to be disappointed with their conservative model when the U.S. equity market is experiencing a robust performance. This type of performance comparison would represent a classic case of using the wrong benchmark, or what I refer to as benchmark error.

We now have an idea of the level of risk needed in retirement portfolios to enable them to last for varying lengths of time at various withdrawal rates. Let the choosing begin — but let it also be accompanied by proper performance benchmarking.