Recent market turmoil is a reminder to advisors and their clients of the old Wall Street adage that trees don’t grow to the sky. March was a difficult month for stocks, with the S&P 500 sliding 2.69% (it fell 2.54% on a total return basis) as traders declined to celebrate the ninth anniversary of the current, aging bull market.

Focusing on dividend stocks versus non-dividend payers, shows dividend payers have outperformed the broader market. For the month, the average S&P 500 dividend payer slipped 0.78%, while the average non-payer fell 1.84%, according to S&P Dow Jones Indices. And over the prior 12 months, the average dividend payer gained 11.58% vs. an advance of 10.65% for the average non-payer. (Note that these averages are not weighted by market capitalization.)

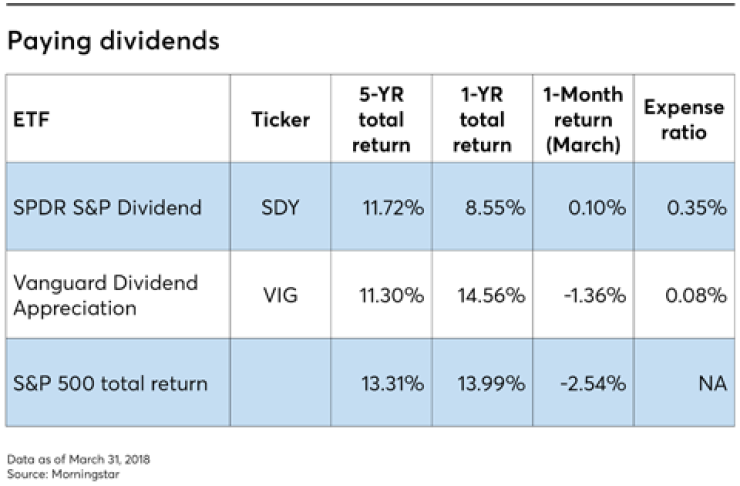

For the month of March, all five of the largest domestic dividend-oriented ETFs posted better returns than the index. Most lost less, but the SPDR S&P Dividend ETF (SDY, expense ratio: 0.35%) actually posted a gain of 0.10% in March.

Is this proof that holding only dividend payers is the right domestic equity strategy? Not quite.

While performance in March reinforced investors’ gut feeling that stocks paying dividends are worth holding onto as the market dips, longer-term results are less encouraging. When you look at the one-, five- and 10-year annualized total returns of these major dividend ETFs, they outperformed the S&P 500 in only two cases.

Over 10 years, SDY returned 10.40% annually vs. the S&P 500’s 9.49%. The only other outperformance was in the one-year category where the Vanguard Dividend Appreciation ETF (VIG, 0.08%) returned 14.56% vs. the index’s 13.99%.

Here’s a closer look at the two major dividend ETFs that (occasionally) outpaced the S&P 500:

SPDR S&P Dividend ETF (SDY) is the fourth-largest dividend ETF by assets with $15.5 billion in the portfolio. SDY tracks the S&P High Yield Dividend Aristocrats Index, which holds stocks from the S&P Composite 1500 that have increased dividends annually for at least 20 years. Special dividends are not considered. The index is weighted by yield and no position may make up more than 4% of the fund. According to Morningstar, the ETF’s top sector weightings are in consumer defensive companies (16.95%), financial services (15.51%) and industrials (14.82%). The largest holdings are AT&T, Tanger Factory Outlet Centers and Realty Income. SDY holds 111 positions and Morningstar calls it a large value portfolio.

Vanguard Dividend Appreciation ETF (VIG) is the largest dividend-focused ETF with $27.2 billion in assets. It is based on the Nasdaq U.S. Dividend Achievers Select Index, which mandates that holdings have at least 10 consecutive years of dividend increases and is limited to common stocks. Other proprietary criteria are applied, but are not disclosed by either Vanguard or Nasdaq. Because the ETF is a class of a traditional mutual fund, Vanguard delays reporting of holdings until 15 days past the end of the calendar month. At the end of February, the largest holdings were Microsoft, Johnson & Johnson and 3M. Morningstar lists the biggest sector holdings as industrials (30.7%), healthcare (15.5%) and consumer defensive stocks (14.5%). Although the fund holds 177 stocks in a range of market capitalizations, based on the weighted average of holdings, Morningstar classifies it as a large blend.

On a risk-adjusted basis as expressed in the Sharpe ratio, dividend-focused funds hold up fairly well. And when the market is weak, as it was in March, dividend stocks frequently show absolute outperformance.

The “bird-in-the-hand” approach is most popular when fear exceeds greed on Wall Street. But in the throes of one of the longest market advances in history, greed exceeds fear, meaning dividend-oriented funds function best as supporting players.