Though clients using digital investment platforms are commonly stereotyped as rookie investors with limited assets, new data shows robo advisors are attracting wealthier and more sophisticated clients.

Across demographic groups, use of robo-advisors is highest among consumers with at least $500,000 in investable assets, according to a survey of more than 5,400 households by data and analytics firm Hearts & Wallets. Nearly half of consumers using an automated portfolio consider themselves either “experienced” or “very experienced” at investing, and 57% of these investors also use financial professionals.

“Robos are making inroads with wealthy millennials and experienced investors, something that should concern established firms,” Laura Varas, CEO and founder of Hearts & Wallets, said in a statement.

Although wealthier customers are testing digital advice, they aren’t using it to completely replace human advisors. Most are only turning a small portion of their portfolios over to a robo, and a blend of human and digital advice is now the predominant behavior of American investors, Varas says.

“If in the future, financial advice engines get as smart as Deep Blue, the computer that beat Gary Kasparov at chess, many clients will still want advisors to explain things to them,” Varas toldFinancial Planning. “Optimizing [financial] behaviors and decisions over a family's lifetimes is a much more complex exercise than chess.”

Robo advisors are more popular among younger investors than older clients. Half of millennials with at least $500,000 use a robo advisor. When looking at Gen X and Baby Boomer investors in the same wealth bracket, the figure drops to 18% and 5%, respectively.

Automated investing is struggling to resonate with less affluent consumers, even among younger generations. Only 22% of millennials with between $50,000 and $500,000 of investable assets use a robo advisor. Just 10% of millennials with less than $50,000 use a robo.

Overall, only 8% of U.S. households have money managed by a robo advisor. Less experienced investors tend to be unsure whether they have a robo advisor, with 10% of “very inexperienced” investors reporting that they don’t know if they have money invested in an automated portfolio.

This confusion signals robos aren’t yet offering a product that resonates with these segments, Varas says.

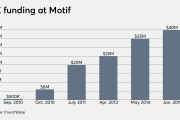

“The challenge for robos is to gain staying power with compelling value propositions that target specific customer groups,” Varas said in a statement. “Firms have only a few years to achieve critical mass, or they will be sold for parts like Motif and Folio Financial.”