There's a disturbing trend that's taking me back to the bad old days.

I’m seeing more and more portfolios with low credit quality bonds and bond funds. At the same time, investment conferences I’ve attended lately seem to focus on income without any mention of protecting principal. In short, it’s essentially where we were a decade ago just before stocks plunged in 2008 when the average high yield bond fund lost 28%, just when investors needed fixed income to act as their shock-absorber. I remind people that they don’t call high yield “junk” for nothing.

While I think junk bonds are dumb, I’ve seen even dumber strategies. Some have told me that you just need to buy safe dividend stocks as a surrogate for fixed income. Well, I’m old enough to remember when General Motors and Eastman Kodak were two of the 10 most valuable safe dividend stocks in the world.

And many investors who thought large banks were safe dividend stocks found out otherwise in 2008. These ostensibly safe stocks are typically large-cap value stocks, which lost just a bit more than the 37% lost by the S&P 500 in 2008. Though iShares Select Dividend ETF (

Have we learned anything from even the relatively recent past? Unfortunately, it appears that many of us haven’t.

We don’t even need to go back 10 years. Five years ago, some were arguing that master limited partnerships were safe as they were “

So I think high yield is dumb but dividend stocks as a bond replacement is even dumber. And it raises the question: Have we learned anything from even the relatively recent past? Unfortunately, it appears that many of us haven’t.

The inescapable truth is that the eight-and-a-half-year bull stock market won’t last forever, and we will have some explaining to do to our clients if we lose their principal in the name of earning more income.

I certainly am in favor of getting more income for my clients. But, in my opinion, there are right ways and wrong ways to do it. Here’s how I help my clients safely earn more.

SAFETY FIRST

I strongly recommend my clients take risk with equities and leave the role of fixed income to cushioning losses when stocks tank. This approach provides my clients the cash and confidence to rebalance, allowing advisors to buy more stocks for them when they go on sale.

I’m okay taking on intermediate-term interest rate risk, because the client will recover from that risk as bond funds reinvest in higher-yielding bonds. And we must remember the economists have called the direction in intermediate-term interest rates correct well under half the time.

High-quality bond index funds are good, but you can often do better for your clients.

Unlike interest rate risk, however, default risk is forever. That’s why, when I use a bond fund, I typically stick to one that tracks the Bloomberg Barclays US Aggregate Bond index, such as Vanguard’s Total Bond Market ETF (

As of mid September, BND was yielding 2.35%, while AGG is yielding 2.24%. These yields aren’t spectacular, but I remind clients who pine for the 12% yields of the early 1980s that those yields weren’t really that hot; after taxes and inflation, real yields were about minus 7%.

Why do I use these index funds when Morningstar shows their performance is below average vs. their peers? I use them because their peer group, on average, includes nearly 10% junk, and some funds have up to 35% of the stuff. This violates the safety-first role of bonds. I also think that high-quality bond index funds are likely to beat their peer group when stocks tank, since riskier debt takes on some of the characteristics of equities.

So how do I safely boost yields further? And how can you?

BUY SECOND HAND CDs

The first way to safely earn more is using brokered CDs — specifically, brokered CDs purchased in the secondary market. I’ve found they consistently yield more than brokered CDs issued by the banks in the primary market.

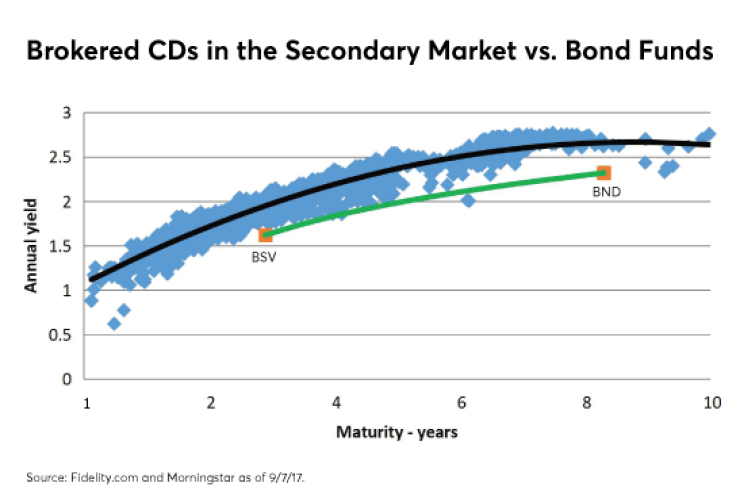

In the chart below, you can see the yields of these CDs that were available from Fidelity on August 15, 2017, vs. the yields of short-term (

By purchasing CDs above the average-yield line, you can earn an extra 50 basis points or so annually above what bond funds would yield, even after taking into account commissions, which typically lower returns by about 1 basis point. This disparity is a bit of evidence that markets are not terribly efficient. I think both the extra yield and the dispersion at each maturity would evaporate if institutions could invest, but the FDIC’s insurance limits ($250,000 for an individual and $500,000 for a joint account) are merely rounding errors for them. So this gives you an opportunity to have your clients earn more without taking on more risk.

A few things to keep in mind when buying brokered CDs:

- Don’t buy a callable CD. If rates stay low or fall even more, the issuer might redeem them. That means your clients most likely wouldn’t get that attractive yield for long.

- Make sure your clients don’t need their principal before the CD matures. Your clients will have a loss if interest rates have risen. In addition, they will pay a commission and a spread if you have to sell the CD in the secondary market.

- Don’t let the interest payments accumulate in cash. Brokered CDs don’t allow automatic reinvest of interest in the same CD so it goes to a cash or money market account.

- Understand that only the principal of the CDs are FDIC-insured, not any premium you pay for them. In other words, if things go south at the issuing bank, the government will back up perhaps only 98% of your investment.

This strategy works well under most AUM or hourly models. In fact, the accumulating cash from interest payments can be used to pay your advisory fees. It just takes a little of your time to set these up.

INVEST IN DIRECT CDs

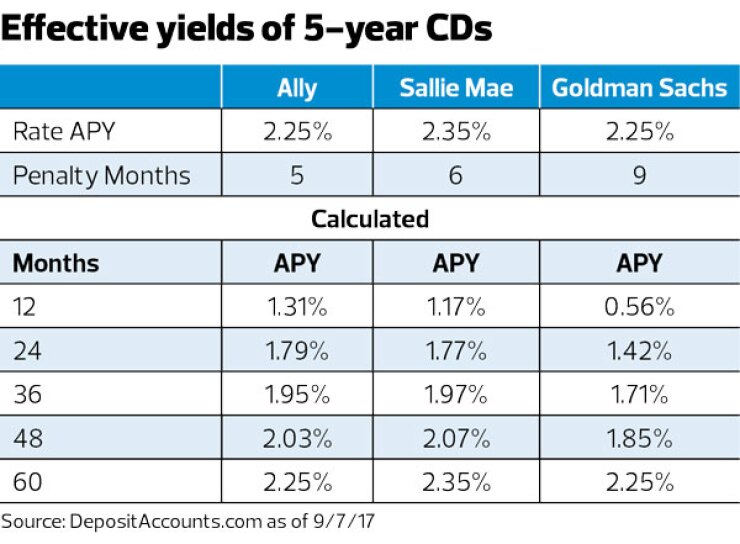

A second way I increase income for clients is to buy CDs directly from a bank or credit union. If you are afraid interest rates will go up and bond funds will decline, this is the strategy for you. If rates rise, brokered CDs are bonds and behave like bonds meaning they will lose value. Some direct CDs, however, have low early withdrawal penalties that allow clients to get their money back with a minimal fee. I use longer term-CDs that have low early-withdrawal penalties, which operate as a “put” if interest rates go up. Below are three attractive CDs as of mid- September.

Let’s say intermediate-term rates rose two percentage points in one year. In that case, an investment in BND would lose nearly 10% of its value. But the Sallie Mae 5-year direct CD, currently yielding the same 2.35% as BND, would instead return 1.17% after paying the early-withdrawal penalty, while freeing up cash to reinvest at higher rates. In short, this strategy gives clients intermediate-term yields with only ultra-short-term interest rate risk.

Unlike brokered CDs, these CDs must be purchased directly by the client, and advisors can’t take out AUM fees. So this strategy works well for advisors who bill by the hour or have a retainer model based on total assets.

GET FREE AND CLEAR

The third way to safely amp up clients’ returns is to tell them to pay down their mortgage. Though I often get hate mail from advisors when I write about this, the math is compelling and simple. The mortgage is merely the inverse of a bond, and your client is not going to make money borrowing at 4% only to lend it out at 2.8% or less.

I’ve heard all the arguments that the mortgage is tax deductible, but those arguments fail to acknowledge that the interest earned on the money not used to pay down the mortgage is taxable. In fact, it’s typically more tax-efficient to pay down the mortgage, since many clients are wealthier and being phased down from deductions and are being hit with the extra 3.8% Medicare tax on unearned income. (I address other criticisms of this strategy in

Clients, of course, need liquidity to do this, since they can’t just get their money back. This advice works well under an hourly or retainer model but lowers the advisor’s income in an AUM model. This is, however, the single biggest piece of low-hanging fruit we can do for a client. Responses from my clients on this strategy have been quite positive, as have been their discussion of it with friends and family. And word-of-mouth is always a great way to grow your practice.

I’m all for helping clients earn more on their fixed income. High-quality bond index funds are good, but you can often do better for your clients. Sometimes these recommendations fit well with your fee models, and sometimes they don’t. But if you’re a fiduciary, you owe it to your clients to put their interests first.

Juicing income safely is a great goal. However, thinking junk or dividend stocks are safe ignores lessons of the past and is likely to lead to disastrous results.