It looks like the fee wars are finally over.

Earlier this month, Fidelity invoked the nuclear option by

Specifically, Fidelity launched two funds — the Fidelity Zero Total Market Index fund (

In looking at broad total stock index funds, Vanguard is now in fifth place when it comes to expense ratios. Fidelity, on the other hand, appears to have routed the competition and taken home the gold in this area.

1. Fidelity Zero Total Market Index Fund (

2T. Schwab Total Stock Market Index Fund (

2T. iShares Core S&P Total US Stock Mkt ETF (

2T. SPDR Portfolio Total Stock Market ETF (

5. Vanguard Total Stock Market ETF (

Clearly, Vanguard’s competitors are using these funds as loss leaders, while Vanguard continues to gain market share. Fidelity, Schwab, iShares and State Street all have more expensive products they can use to cross-subsidize their low-fee or no-fee offerings, whereas almost everything at Vanguard is already ultra-low cost. But as financial advisors, our fiduciary duty is to our clients, so we should put our clients in the best funds, irrespective of the firms’ motives.

Expense ratios are very important, but so are tax efficiency and broad portfolio construction.

When I consider the once-undisputed champion, Vanguard, against Fidelity’s new Zero funds in five areas — fees, index construction, fee offsets, tax efficiency and trust — I found Vanguard still came out on top.

That said, it was a close call between the two rivals.

-

“Are we reactive to what one competitor does? Absolutely not,” CIO Greg Davis says.

August 3 -

A big difference in fees may not be enough to offset taxes on capital gains.

August 7 -

The firm says it's likely to benefit from the strategy by luring new clients and earning fees on securities lending.

August 1

1. Fees: This wasn’t pretty for Vanguard. I’m used to scoring a percentage higher fee one fund has versus another. For example, VTI is 33% more expensive than SWTSX, ITOT and SPTM. But dividing by Fidelity’s zero expense ratio doesn’t work. Fidelity is the clear winner of this round.

2. Index construction: Broader is better. The closer a fund is to owning the entire market, the less uncompensated risk it takes on. Fidelity scores well on this front, but Vanguard does even better.

Fidelity states: “The index, which is limited to the top 3,000 companies, included approximately 2,500 constituents as of April 30, 2018.” Vanguard is even broader with 3,654 companies, even though its extra 1,154 companies are all very small. Nonetheless, Vanguard takes this round.

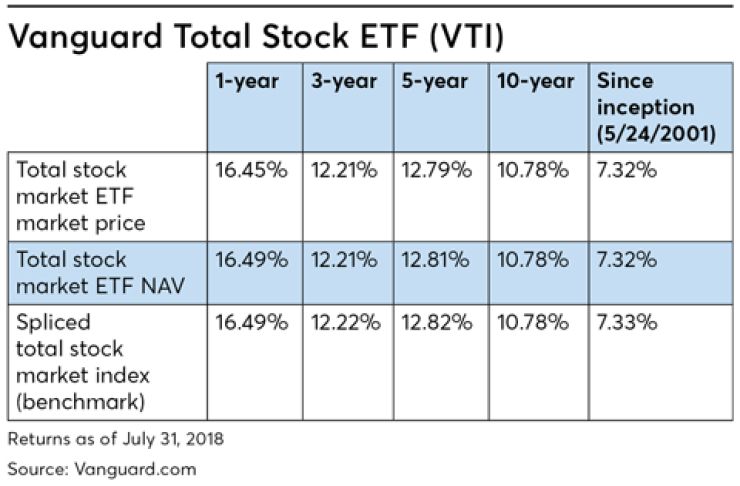

3. Fee offsets: While Vanguard has a 0.04% annual fee, it seems to match the returns of the overall index, as shown below. Vanguard changed index providers over the last decade, so the spliced market index is a combination of the MSCI US Broad Market Index and the CRSP US Total Market Index.

This is technically called tracking error, but it appears to be a

Earlier this month, Fidelity lowered fees and minimums to zero on some funds. It would seem the only way to lower fees further would be to actually pay investors to invest.

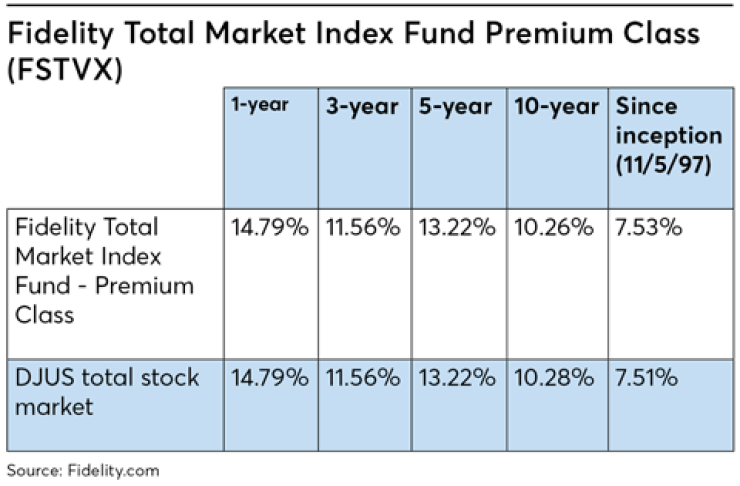

The new Zero funds don’t have a 10-year track record and, because they are self-indexed, I’m not sure they ever will, since there is no external benchmark reporting. We can look to other Fidelity funds for clues. Fidelity’s Total Market Index Fund Premium Class (FSTVX), as of June 30, was the most recent benchmark available, but Fidelity also appears to have positive tracking error as shown below. The annual expense ratio was between 0.07% and 0.05% during the 10 years below so they also offset their fees.

Fidelity spokeswoman Nicole Abbott stated some revenue from securities lending flows through to fund holders though she provided no specifics. Still, because Fidelity has nearly matched the index over the past decade and bested the index of the fund’s life, I’m going to score the two firms as on equal footing in this area.

4. Tax efficiency: Taxes are fees too, at least for taxable accounts. Since stock index funds are generally very tax efficient, they are best located in taxable accounts. The new Zero funds don’t have a track record yet, but we can make some educated guesses based on the tax efficiency of existing Fidelity Total Market Index Funds.

Vanguard scored a zero on this front, meaning VTI and other share classes passed through no capital gains in 2017. Thus, fund holders were in control of when they paid those taxes or possibly even avoided those taxes overall. While no one knows just how tax efficient the Zero funds will be, Elisabeth Kashner, director of ETF research at FactSet Research Systems, points to Fidelity’s existing index funds. She notes that the Fidelity Total Market Index Fund (

In addition, I suspect the Fidelity Zero Total Market Index fund will be less tax efficient because it is narrower than FSTMX, owning fewer securities, especially in small-cap stocks. According to the prospectus, “the index is rebalanced annually, with a provision to make adjustments for certain corporate actions on a quarterly basis.” Thus, when some stocks are moved in and out of this narrower index, it would seem logical that there would be more capital gains passed through to fund holders.

Therefore, in this area, Vanguard wipes out Fidelity’s earlier cost advantage on fees by nearly a factor of five.

5. Trust: Quite frankly, there are some fund families I won’t do business with because I don’t trust them. I learned the hard way with my first S&P 500 index fund in the late 80’s, a Dreyfus fund. Dreyfus later raised fees dramatically and trapped my money, forcing me to choose between paying higher fees or high capital gains tax if I sold to buy a lower cost S&P 500 fund. Could Fidelity do the same after capturing assets?

While I don’t put Blackrock’s iShares or Schwab in the same category as Dreyfus, and I own both types of funds, I know that they have their own shareholders to balance with their fund holders. Quite frankly, I left iShares and Schwab out of this analysis because of their past actions.

iShares launched its Core MSCI Emerging Markets ETF (

Now, just because Fidelity is private doesn’t mean it won’t also have to balance fund holders with its shareholders — the Johnson family and others. Thus I was skeptical that they would later pull a Dreyfus and raise fees on these Zero funds. I posed this question to Fidelity spokeswoman Abbott and got a very definitive response. “The expense ratios on the Zero index funds are permanent,” she said. I don’t know if this assurance would be legally binding, but Fidelity responded without hesitation or ambiguity.

Beyond that, Fidelity just drastically

Vanguard, of course, is owned by its fund holders and doesn’t have two masters to please. Many say this sets Vanguard apart and causes it to put shareholders first. Personally, I don’t buy that argument. I’ve seen some ugly things done by mutual insurance companies owned by their policyholders. I think it’s the culture originated by Jack Bogle himself that sets Vanguard apart and wins my trust. Its history of lowering costs and starting the fee war has benefited so many investors.

Overall score: Taking all these factors into account results in a close call between Vanguard and Fidelity.

1. Fees: Fidelity wins by a wide margin.

2. Index construction: Vanguard is broader .

3. Fee offsets: Both firms add value.

4. Tax efficiency: Vanguard is far more tax efficient.

5. Trust: Both firms seem to do the right thing in indexing.

In my view, the winner is Vanguard. Expense ratios are very important, but Vanguard more than easily offsets its higher fees with much greater tax efficiency, though this wouldn’t be relevant in a tax-deferred or tax-free Roth account. In addition, the portfolio construction is better because it encompasses more of the market.

Fidelity has not yet put these two new Zero funds in its advisor platform. When I asked why not, Abbott told me “while they are not available to financial advisors today, we’re always reviewing and evaluating our product lineup.” Plus, I suspect that the existing Fidelity Total Market Index funds are actually slightly superior to the Zero funds, as a 0.015% expense ratio is probably worth the cost for a broader index, the possibility of greater tax efficiency and an external index provider.

Ultimately, fee wars are great for our clients, but the lowest expense ratios, while critical, aren’t the only criteria to judge funds.