Amid Apple Addition, Best & Worst Performing Dow Stocks

Apple is being added on the day that Dow component Visa institutes a four-for-one split. Because the Dow is price weighted, Visa will go from 9.71% of the benchmarks weighting to 2.53% (pro forma). And, despite Apples addition, the Visa split will cause the information technology sector to decline from a weighting of 19.17% to a pro forma 17.05%.

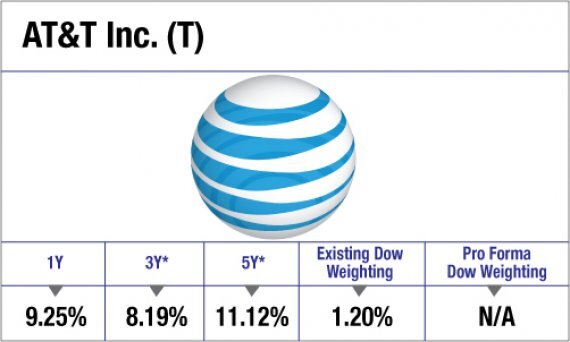

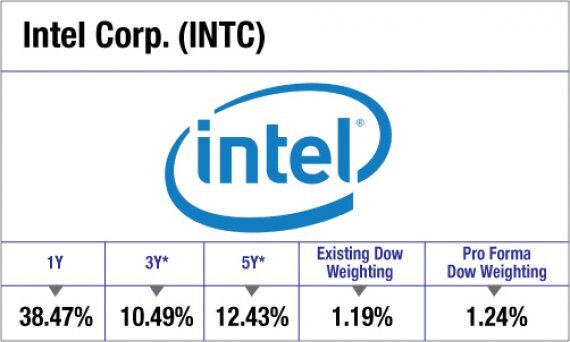

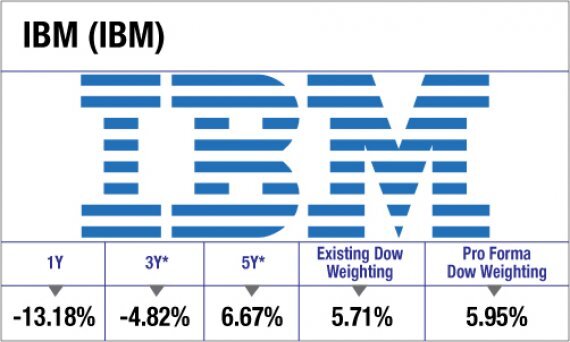

If your clients buy individual stocks, the following charts will show them how Apple and AT&T have fared over the past few years. In addition, weve included data on the four best and four worst performers among the Dow 30 over the past 12 months (as well as annualized data for the past three and five years) ended March 6, the day that Apples impending membership in the exclusive club was announced. Data on index weightings is as of March 5. Joseph Lisanti

Scroll through or click here to view a single page version.

Sources: Morningstar; S&P Capital IQ; S&P Dow Jones Indices.

Image: Bloomberg

Apple (AAPL)

AT&T (T)

Best performer: Cisco Systems (CSCO)

Best performer: Intel (INTC)

Best performer: Home Depot (HD)

Best performer: UnitedHealth Group (UNH)

Worst Performer: Chevron (CVX)

Worst Performer: IBM (IBM)

Worst Performer: American Express (AXP)