For years, margins at the nation’s largest independent broker-dealers have been shrinking due to a variety of pressures — and now, a sea change looks likely to accelerate those forces.

That change comes in the form of the Department of Labor’s fiduciary rule, which requires all advisers and brokers to put their clients’ financial interests before their own when it comes to retirement accounts. That could have a chilling effect on what products they can recommend and sell.

Read more:

These firms grabbed the top spot when it came to rapid growth.

After the U.K. banned commission sales of most financial products in 2012, the ranks of that country’s financial advisers dropped by 30% to 45%, says Jim Crowley, who heads Pershing Advisor Solutions’ broker-dealer business.

“Will we see anything that large here?” Crowley asks.

The short answer is maybe. Yet in the 31st annual ranking by Financial Planning of the largest independent broker-dealers, we found cause for both fatalism and optimism.

TO VIEW THE FULL RANKINGS CLICK

“The strong will get stronger and the weak will get weaker,” predicts Wayne Bloom, CEO of the No. 4 firm, Commonwealth Financial Network.

The biggest change agent is the fiduciary rule. Proponents say the rule is intended to alter Wall Street culture and will be seen as a legacy achievement of the outgoing Obama administration.

While IBDs may still charge commissions, the rule raises the bar for doing so, leading some experts to speculate that the U.S. could come in for a British-style contraction.

Many brokers have relied on commission sales for their entire careers. Crowley forecasts broker attrition in a range of 10% to as much as 30%.

Others in the space have been less dour, predicting attrition of no more than 10%. However, one consultant, Tim Welsh of Nexus Strategy, says he expects a possible 40% drop over the next three to five years.

SMALL FIRMS DISAPPEAR

Either way, once the dust clears, many small IBDs will likely be gone, either swallowed by larger firms or converting to offices of supervisory jurisdiction for their bigger competitors.

Or, in the worst-case scenario, simply going out of business, IBD leaders, consultants and recruiters say. Many that remain will transact far fewer commission sales and come more closely to resemble the country’s RIAs, who pioneered fee-only advice, they say.

Contributing to the expected attrition of brokers is the age of the industry’s workforce, in which the average exceeds 50, according to Cerulli Associates. There are many older brokers who may choose to retire rather than change old business practices to comply with new regulations.

But don’t mistake these predictions as a death knell for the industry. For the survivors, Crowley sees near boundless opportunity over the next five to 10 years.

The estimated 10,000 baby boomers the Social Security Administration says retire every day will continue to need advice from a shrinking pool of advisers.

“It’s a bull market because there are fewer providers, the barriers to entry are much higher and the need for professional advice and planning has never been greater,” Crowley says. “I think it’s likely that revenues will go up and margins will improve as [IBDs] become more efficient and as they have more scale, and as they provide a more holistic experience for their clients. They are going to be very successful in continuing to take market share from the [wirehouses] because they are going to continue to be more nimble.”

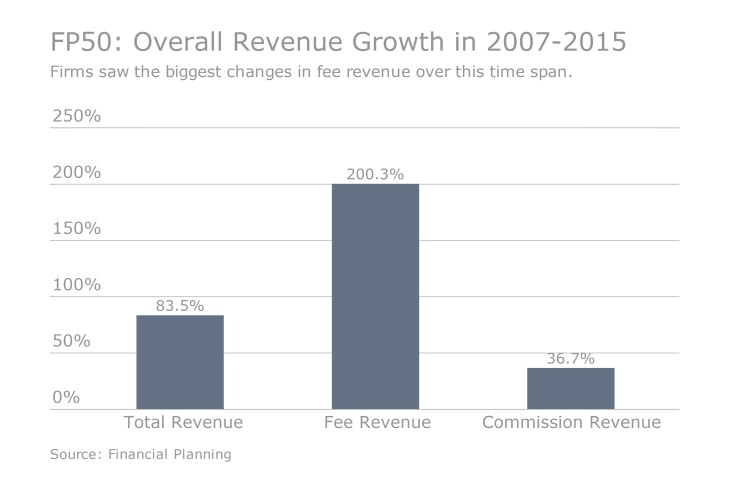

In what could be an early indicator of painful change to come, this year’s FP50 group recorded its first decline in revenues since the financial crisis. Overall revenues for the FP50 shrunk 0.12% from 2014 to 2015.

Previously, the last revenue dip for the FP50 was a 1.38% decline from 2008 to 2009.

The country’s largest IBD, LPL Financial, considered a bellwether, posted a 2.13% drop in revenues last year from 2014, allowing No. 2 Ameriprise to come within $284 million of taking the No. 1 spot. LPL’s commission revenues alone dropped by 7%.

LPL’s CEO, Mark Casady, says this decrease doesn’t take into account its expanding

custody business, which is reflected in its profitability.

“You do not see the impact of the growth of our hybrid RIA platform in our revenue numbers,” Casady says. “We had record gross profit in the first quarter of 2016 of $356 million.”

REVENUE DIP BELIES SUCCESS

Across the FP50, the general downward revenue trend masks some success stories.

No. 3 Raymond James Financial Services, No. 46 Securities Service Network and No. 50 United Planners Financial Services all recorded revenue increases of more than 10%.

“The firms that adapt to [regulatory] changes and provide tools to advisers, those are the firms that will succeed and thrive going into the future,” says Scott Curtis, Raymond James Financial Services’ president.

The new regulations offer “challenges and opportunities,” he says. Like many others on the FP50, Raymond James had one of its best recruiting years last year, which ultimately contributed to its higher returns, Curtis says.

For example, the St. Petersburg, Fla.-based firm added a $2.4 billion team from Morgan Stanley

Wealth Management. And six months into its current fiscal year, the IBD’s recruiting is “25% to 30% ahead of last year,” Curtis said in late April.

Firms that advisers tend to regard as safe havens, like Raymond James, should continue to see strong recruiting results, say father-and-daughter recruiters Larry Papike and Jodie Papike of Cross Search Broker & Executive Placement in Encinitas, Calif.

This is especially true in the wake of the profound troubles at Cetera Financial Group, the country’s second-largest IBD in terms of head count (Cetera’s 10 BDs report their financials separately).

After an acquisition spree that cobbled together the firms that formed Cetera Financial Group, the firm’s parent, RCS Capital, declared bankruptcy this spring. Cetera’s problems “put a black eye” on all IBDs, Jodie Papike says. “I think it’s changed the entire feeling of the industry.”

Going forward, many of the country’s IBDs are likely acquisition targets, the Papikes believe, adding that they peg the number of IBDs at about 1,900, the vast majority of which are quite small.

Regulation has only exacerbated the sense of unrest among brokers, many of whom once preferred an arms-length relationship with their IBDs, Jodie Papike says.

Now, faced with increased regulatory complexity and the specter of consolidation, brokers suddenly need and want support from a reliable IBD more than ever before, she says.

“There are plenty of firms out there who have taken a completely passive approach to this,” Jodie Papike says.

Not Cetera. It aims to boost its post-bankruptcy recovery with a new platform to help its advisers conform to the new rule and transition to a fee-based business, says its CEO, Larry Roth, who describes the efforts as a “more holistic approach.”

The past year and a half has been “a trying time“ for Cetera, Roth acknowledges, but adds, “My view is that now that we have put these parental challenges behind us, we are going to be better positioned than anybody because we will be more capitalized and have so much scale.”

Cultivating a niche can also provide a steady growth path. Take No. 17, H.D. Vest Financial Services, which specializes in helping accountants expand their businesses to holistic planning. The Irving, Texas-based firm posted nearly 5% revenue growth last year.

”Think about the market we are in,” the firm’s CEO, Roger Ochs, says. “There are 240,000 professionals who prepare taxes for a living.”

Whereas many IBDs rely on recruiting so-called breakaways from wirehouses, H.D. Vest has a quasi-private pool in which to fish to add to its ranks of 5,600 brokers. It plans to add another 580 brokers this year, Ochs says.

Like H.D. Vest, Cetera, Commonwealth and Raymond James, AIG Advisor Group (which was sold to Lightyear Capital in January) also had a banner recruiting year in 2015 and is on track to best its numbers again this year, says CEO Erica McGinnis.

“We have developed specific programs to help advisers transition to fee-based business,” McGinnis says. “We all know that moving a commission-based business to fee means that you are going to have a disruption in your own personal revenue.”

That is not the only reason the pressure to shift to this fee-based model rankles some in the industry.

LABELED PREDATORY

“I don’t like it at all,” says one veteran IBD broker and self-described “transactional guy” in Arizona, who requested anonymity. “Personally, I kind of resent being labeled predatory, which is essentially what they are saying.”

Now in his 70s, the broker says his practice has been almost purely commission-based for almost 30 years. As a result, many of his clients actually end up paying very little for his services, due to his buy-and-hold strategy — much less than if he were to charge them fees based on assets under management.

“All this fee-based stuff, and what have you, is going to be very harmful for a lot of people,” he says.

Although his IBD has offered numerous webinars and other tools to help acquaint him with the new regulation, he says he hasn’t begun the process of educating himself yet.

“I don’t really know enough about it,” he says.

Does that mean he could exit the business, just like some other brokers who choose retirement over going forward with the hassle of compliance?

“Nah,” he says, after taking a moment to reflect and conceding that he will probably migrate all of his accounts to fee-based after all.

“My wife would kill me if I were around the house,” he adds, “so I am going to die with my boots on, or at least my headset in my ear.”