Over the last 12 months, we published dozens of stories with insight from both advisers and strategists that may act as useful tools in 2017. Some of these included guidelines for filing IRA beneficiary forms, converting IRAs with tax-deferred accounts and methods that may help reduce some of the tax burden that comes with divorce.

Click through the following slideshow for 15 tax tips from the last year to better navigate the landscape ahead.

Protect the panicked investor

Consider putting those who panicked and sold during the financial crisis of 2008 into a more conservative portfolio, or one that will get them to wait for the next bear market, before taking a more aggressive strategy, writes Allan S. Roth, founder of the planning firm Wealth Logic in Colorado Springs, Colorado.

"That past behavior is the best indicator of what they will do during the next plunge," Roth writes.

Read more:

Strategies for transferring a home

“It’s a great strategy for people who want to transfer ownership of their home in the future but at today’s value, reduced by the present value of his or her right to live in the house for the term of residency as set forth in the trust agreement,” Bertles says.

Read more:

Planning through the rearview mirror

Click below for a look at how the Protecting Americans from Tax Hikes Act of 2015, or PATH Act, provided new opportunities for clients in 2016 as an example.

Read more:

Protect your plane and avoid the IRS wealth squad

The elite team of regulators are always interested in aircraft and whether it is "being adjusted for correctly," noted Rosalind Sutch, a CPA at Philadelphia-based Drucker & Scaccetti. "There are ways of accounting for personal use whether you're an employee or not."

Read more:

Inform the accountant

McClanahan adds that her firm informs the accountants the number of 1099s they should expect from a client to ensure nothing accidentally goes unnoticed.

Read more:

'A trustee-to trustee transfer'

"By doing a trustee-to trustee transfer, the amounts awarded as a community property interest in a divorce can be moved from one spouse's IRA to the others without negative tax consequences," Slott adds.

Read more:

Minimizing the tax bite of a bypass trust

"Because the bypass trust is a separate, standalone entity from the surviving spouse and other beneficiaries for estate tax purposes, it gets treated as a separate income-tax–paying entity as well," he writes.

Read more:

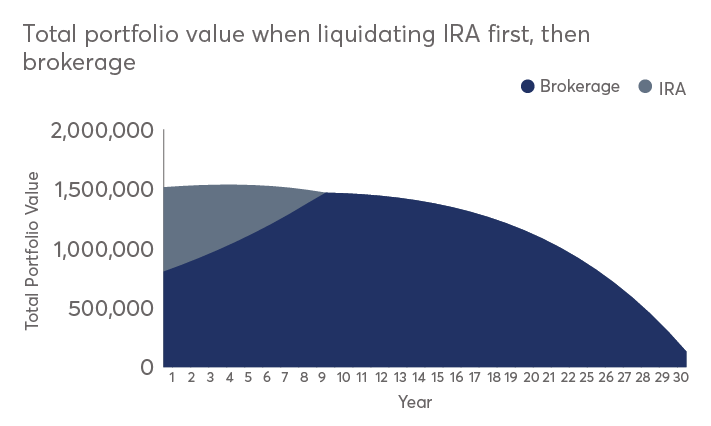

A tax-efficient retirement draw-down strategy

Advisers can achieve this goal by "funding retirement spending from taxable investment accounts — while also doing systematic partial Roth conversions of the pre-tax IRA to fill tax brackets in the early years," he adds.

Read more:

Donate to an IRS-approved public charity

"You'll only be able to deduct the basis — how much you spent in materials creating it — rather than the fair market value," Pagliarini notes.

Read more:

File IRA beneficiary forms with extra care

Slott reviews the consequences one adviser faced after erroneously changing a beneficiary from a look-through trust, which qualified as a designated beneficiary, to the estate, which does not. Although the adviser received a court order to approve a retroactive fix to the error, the IRS denied the requests and said that because there was no designated beneficiary, the inherited IRA must be paid over the client's remaining life expectancy.

Read more:

When tax-loss harvesting is best

“If you’re young and earning less than you will be in the future, you do get to take up to $1,500 per year [$3,000 per couple] in losses and deduct that from your income," Benke said.

Read more:

Converting IRAs with tax-deferred accounts

Reardon often converts chunks of his clients' regular IRAs into Roth IRAs at some point after they turn 59½, when the client can use tax-deferred accounts without penalty, but before 70½ when they are required to do so, he said. Advisers must also consider the chances of a higher tax bracket when starting to take distributions and other income streams begin to flow in.

Read more:

How to make divorce less taxing

"At $450,000 a year, you’re in the highest tax bracket for a single person but not if you’re married,” Miller said. “In this situation, being married is a tax benefit, so maybe we push the divorce into the following year.”

For individuals earning $250,000 or less a year, it is "probably better to get the divorce done this year," and file separately, unless one spouse has a lot of medical expenses, he said.

Read more:

Minimize the pain of a residency audit

“You have to pass the smell test,” said Sheryl Rowling, an adviser and CPA in San Diego. "What matters is how your family members and friends perceive your residency."

Shomari Hearn, an adviser and CFP with Palisades Hudson Financial Group in Fort Lauderdale, Florida, goes even farther, suggesting clients may even contemplate moving their valuable items — such as works of art — to their new state as soon as possible.

Read more:

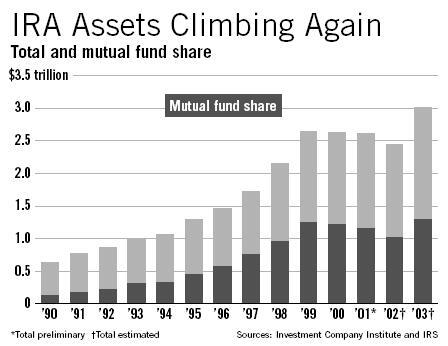

Create multiple tax pools for retirement savers

Keeping multiple pools of capital with varying tax characteristics provides the client flexibility to draw from each pool at different times and in different amounts, minimizing their adjusted gross income during retirement, notes.

Read more: