Which wins over 5 years: Active or passive?

Even in small-cap stocks, which are usually cited as an area where active managers will win out because the indexes cannot match their expertise, passive won the race. Indeed, in small-cap growth and small-cap value, over three and five years, average passive funds beat their actively managed counterparts.

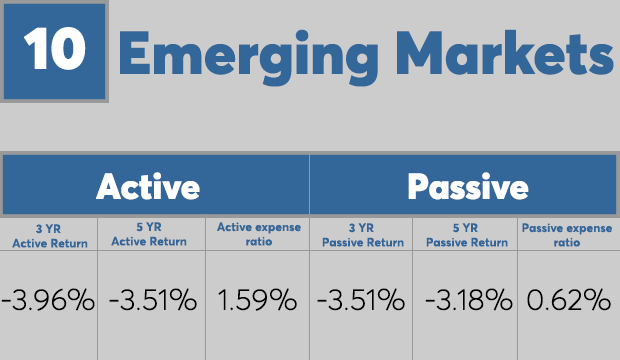

In emerging markets, another area where active managers are often thought to add alpha, passive funds actually rewarded investors more. Although that comes with the major caveat that even the best returns within our parameters were negative in those funds. The best emerging market category we analyzed -- five-year passive -- clocked in at -3.18%.

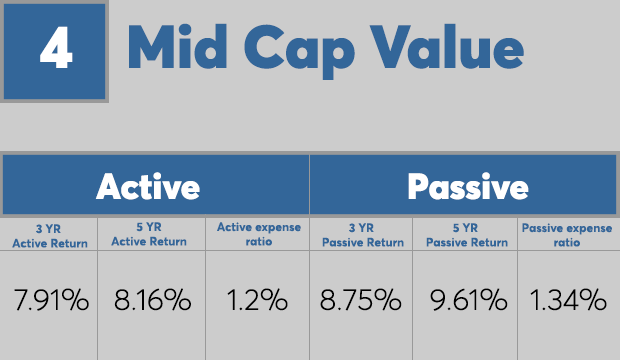

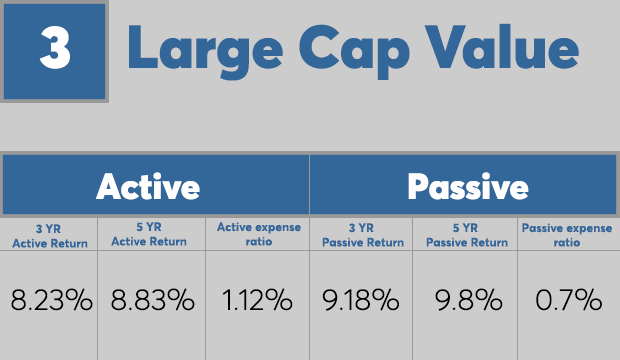

It wasn't an across-the-board victory for passive, however. Mid-cap growth for the past three years, and retirement income for both three and five years, are among the few areas where active won.

Click through to see all the return figures. All data is from Morningstar.

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?

Which wins over 5 years: Active or passive?