Amid some improvement in market conditions, many advisors helped clients allocate more assets toward equities.

"Clients were more willing to purchase equities when the market started showing signs of recovery," one advisor reported. While many advisors don't think clients should feel acute volatility has been calmed, they encouraged them to take on more risk, according to the latest Global Asset Allocation Tracker.

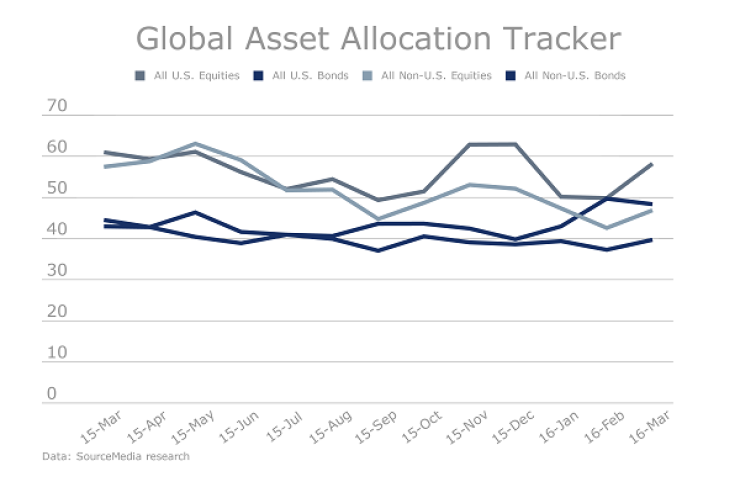

"Our clients are more confident in U.S. stocks, but see some opportunity in buying outside of the U.S.," one advisor wrote. Allocations to U.S. equities rose 8.4 points, and non-U.S. equities edged up 4.3 points, according to survey data. Advisors also reported an uptick in allocation toward non-U.S. bonds.

Worries about the stability of international markets — including China — burden clients. As a result, advisors reported a general preference of domestic over global assets.

"Our clients reduced their international equity and bond exposure, and increased U.S. exposure, as a hybrid flight-to-perceived-safety allocation," one advisor reported.

Despite increased optimism, many advisors opted to keep their clients flush with cash amid global uncertainty. "As storm clouds gather across the globe, it is clear a global recessionary scenario has developed. ... Go to cash, and be patient!" one concerned advisor wrote. Another said clients were still "holding more cash than normal."

Several advisors reported that clients with long-term views were more comfortable than others. "Those clients investing in longer-term investments have been more optimistic about increasing global allocations, even though the European and Asian markets are currently unstable," one planner said.