-

Even though advisors doubt it will pass, California's proposed billionaire tax is already reigniting residency and wealth planning conversations.

February 6 -

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

Raymond James tapped industry veteran Mark Buchanan to lead a new ESOP advisory group focused on tax-advantaged succession strategies.

February 3 -

In a Q&A interview, Christine Brown explained her plans for the role leading a team of a half dozen specialists assisting Kestra financial advisors.

February 3 -

As more financial advisors near retirement without clear succession plans, some RIAs are turning to ESOPs and Section 1042 rollovers to exit on their own terms.

January 30 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

January 27 -

The ballot initiative was proposed by a California union as a way to fund health care.

January 20 -

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

Rhode Island Governor Dan McKee proposed a higher tax on millionaires to help fill a hole in the state's budget.

January 16 -

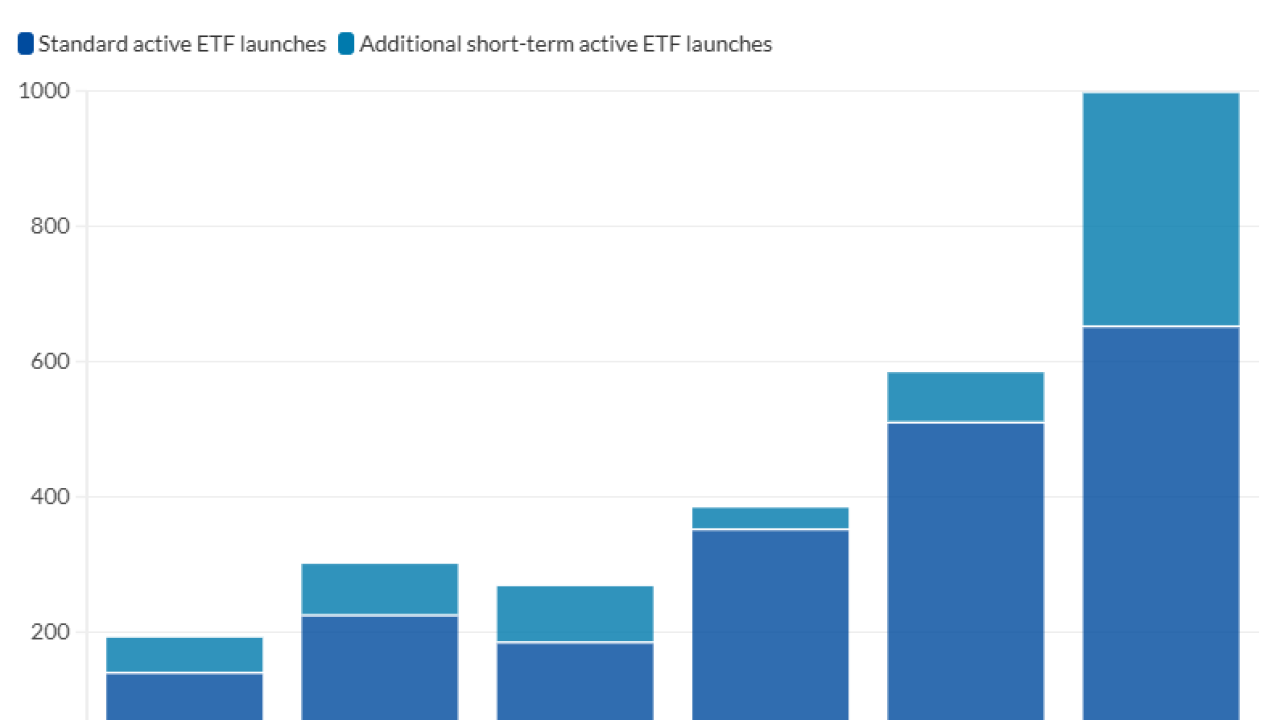

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Tax-loss harvesting's overlooked cousin can pay off for clients with low-earning years, concentrated positions or UTMA accounts.

January 14 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

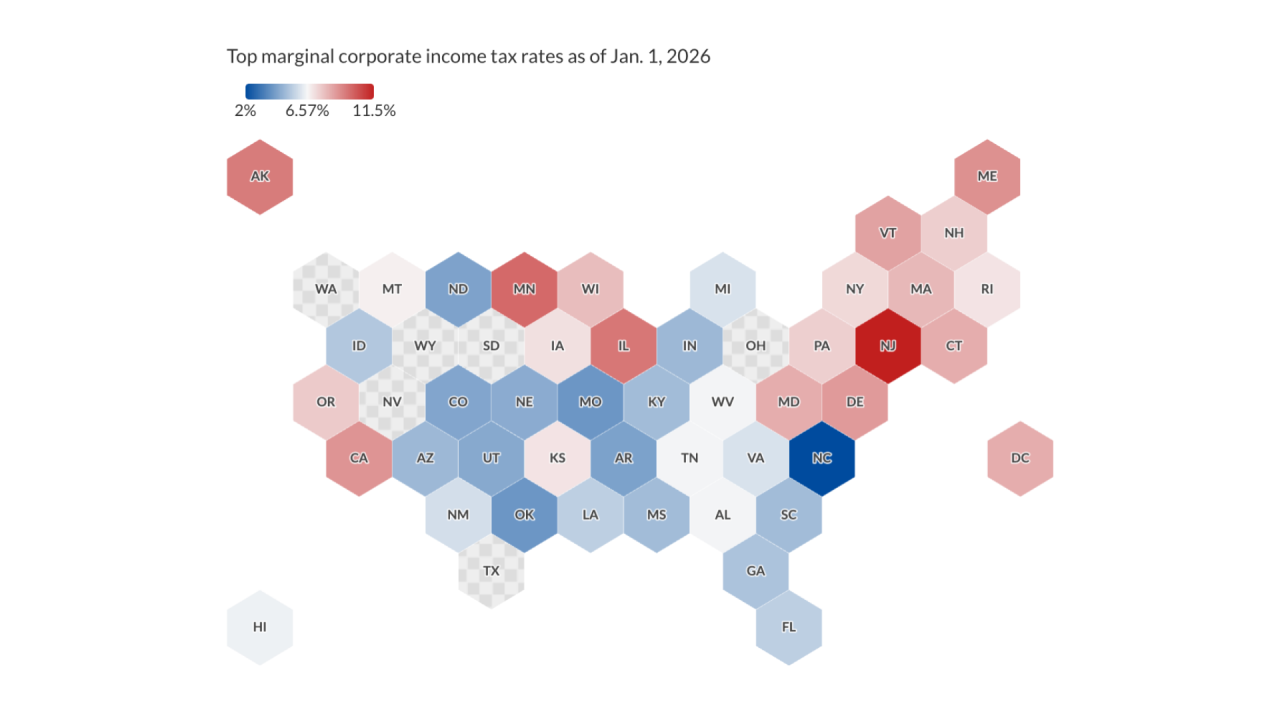

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

Spot bitcoin ETFs simplify custody, but they cost clients a major tax advantage. Here is why direct ownership still wins for HNW and UHNW clients.

January 7 -

The tax shield on student loan forgiveness has expired. Here is how advisors can help clients lower their burdens.

January 6 -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

The U.S. and more than 100 other countries finalized an agreement that would exempt American companies from some foreign taxes.

January 5 -

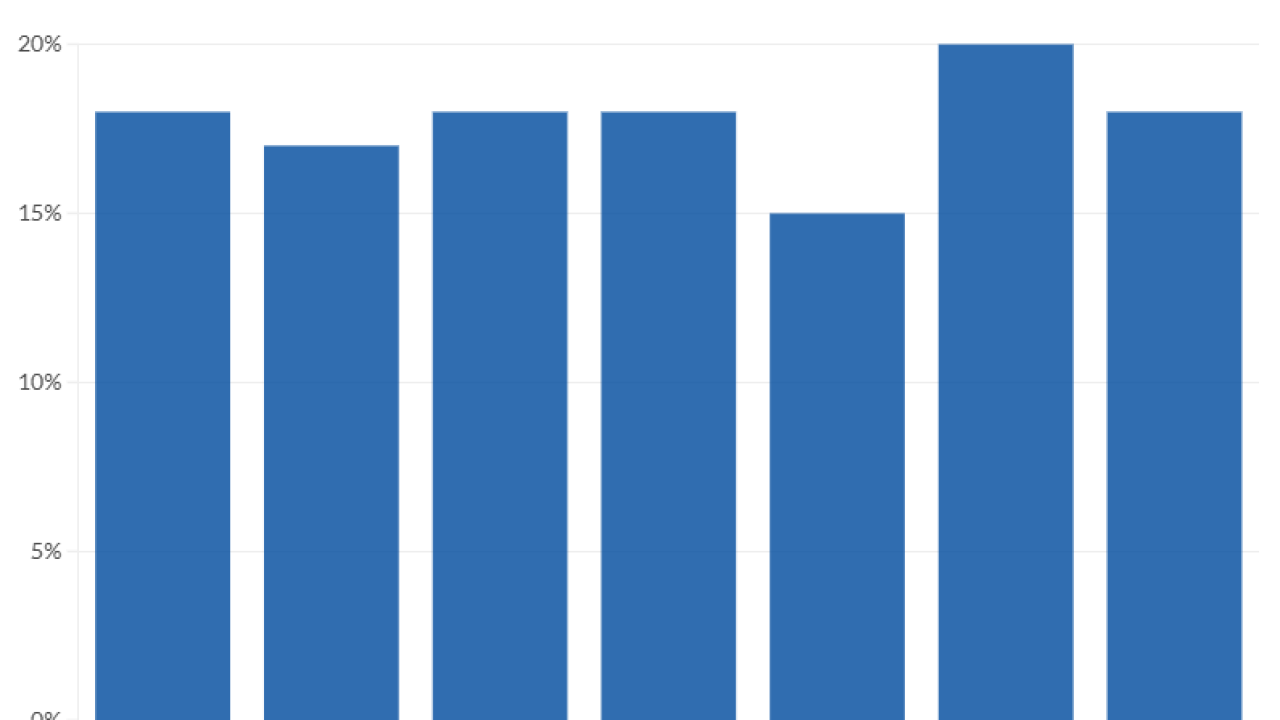

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

From AI advancements to greater access to private markets to the forces shaping retirement, six experts share their hot takes on what's just over the horizon in wealth management.

December 30 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29