-

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

10h ago -

Prediction markets like Kalshi and Polymarket, growing in popularity, allow users to essentially bet on nearly everything. If your clients have questions, here's what experts say you should tell them.

December 5 -

Current market conditions and declining interest rates make small-cap ETFs an attractive option for diversification, but choosing the right one requires a hard look at the details.

December 4 -

When it comes to retirement planning, financial advisors are always looking for an edge. Could these strategies get them there?

December 3 -

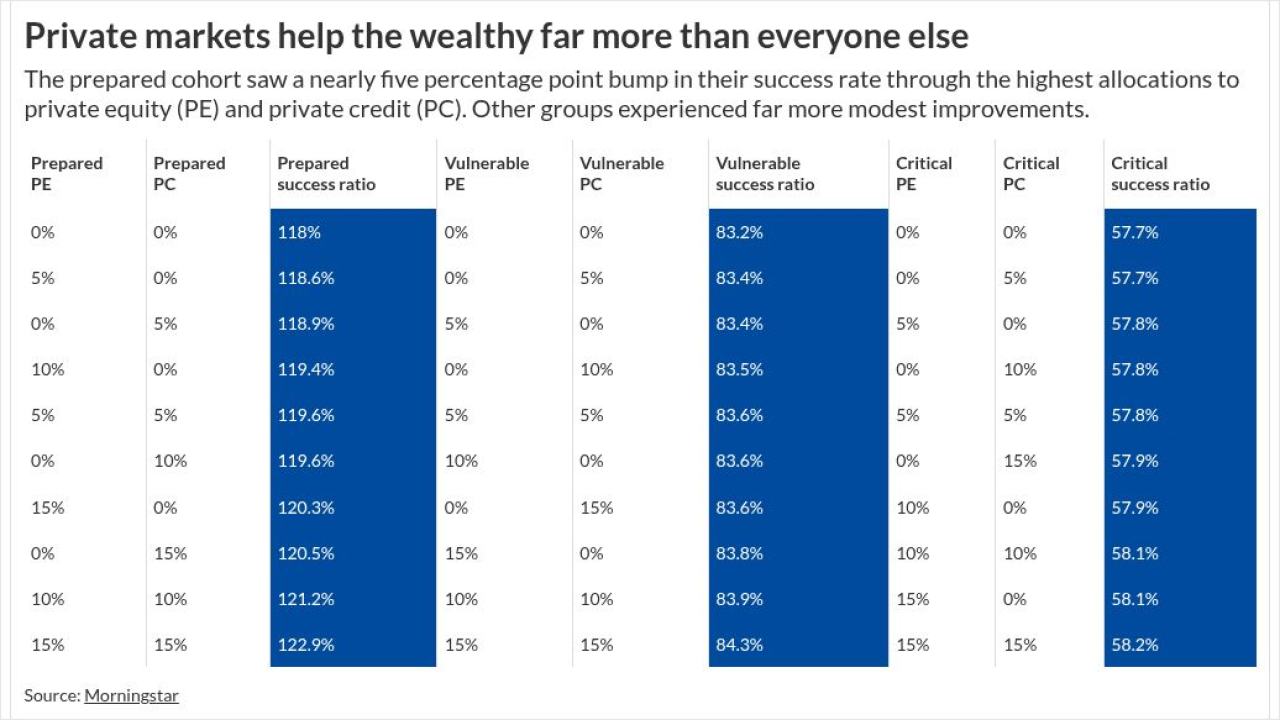

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

Funds that primarily hold select cryptocurrencies, including bitcoin, ether, XRP and solana will be allowed.

December 2 -

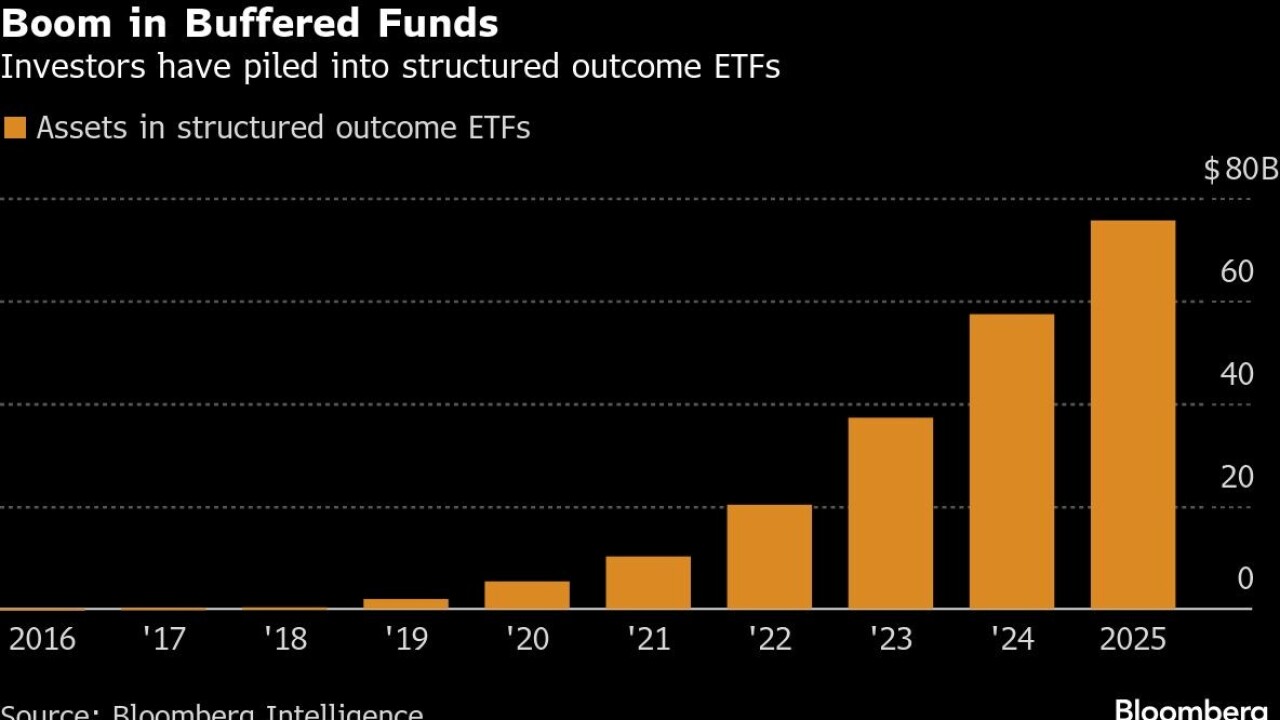

Innovator Capital Management, which Goldman will acquire next year, was a pioneer with ETFs that hedge risk by offsetting investors' exposure to equity losses by also capping their ability to realize gains.

December 1 -

After the newly crypto-friendly Donald Trump won reelection, bitcoin jumped over $100,000. Many advisors and even more clients remain skeptical, though.

December 1 -

A new Cerulli report finds that advisors who outsource investment management spend more time in direct dealings with clients.

November 24 -

Concerns grows that the the $1.7 trillion private credit industry could be adding hard-to-detect risks to the U.S. financial system.

November 21 -

Falling client risk tolerance and domestic turmoil may mean that these international equity funds could be more attractive to investors looking for diversification.

November 20 -

A hedging product tied to bitcoin offers investors enhanced gains and downside protection — as long as an underlying ETF doesn't lose more than 25% of its value.

November 19 -

After years of strong market returns, concern over stretched equity valuations is rising. Could a long-overlooked options strategy be the right tool for the moment?

November 18 -

Findings from iterations of Financial Planning's Financial Advisory Confidence Outlook show which assets have stood the test of time.

November 17 -

Advisors and experts say finding the right rare currency to invest in can add diversification to a portfolio. But scams are rampant, so buyers should beware.

November 17 -

The Wall Street mainstay joins JPMorgan and Citi in directing analysts to help give investors more insight into companies not traded on public markets.

November 11 -

Stocks have been on a historic bull run, but the good times can't last forever. Now's the time to diversify with private equity, credit and other alternatives, say wealth managers at Dynasty, Nuveen and WEG.

November 7 -

Sports are in for the ultrawealthy; paintings, out. Some 20% of 111 billionaire families served by the Wall Street giant now own controlling stakes in sports teams.

November 6 -

Schwab becomes the latest large wealth manager to cite the shrinking number of publc companies as a reason to help regular investors get into private markets.

November 6 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5