-

Many owners of privately held businesses are planning to sell at least part of their interests in the firm in the next five to 10 years, a Raymond James study found.

January 20 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

The epic OBBBA tax law brings glad tidings to most families, but complacency can lead to costs for financial advisors and their clients.

December 23 American College of Financial Services

American College of Financial Services -

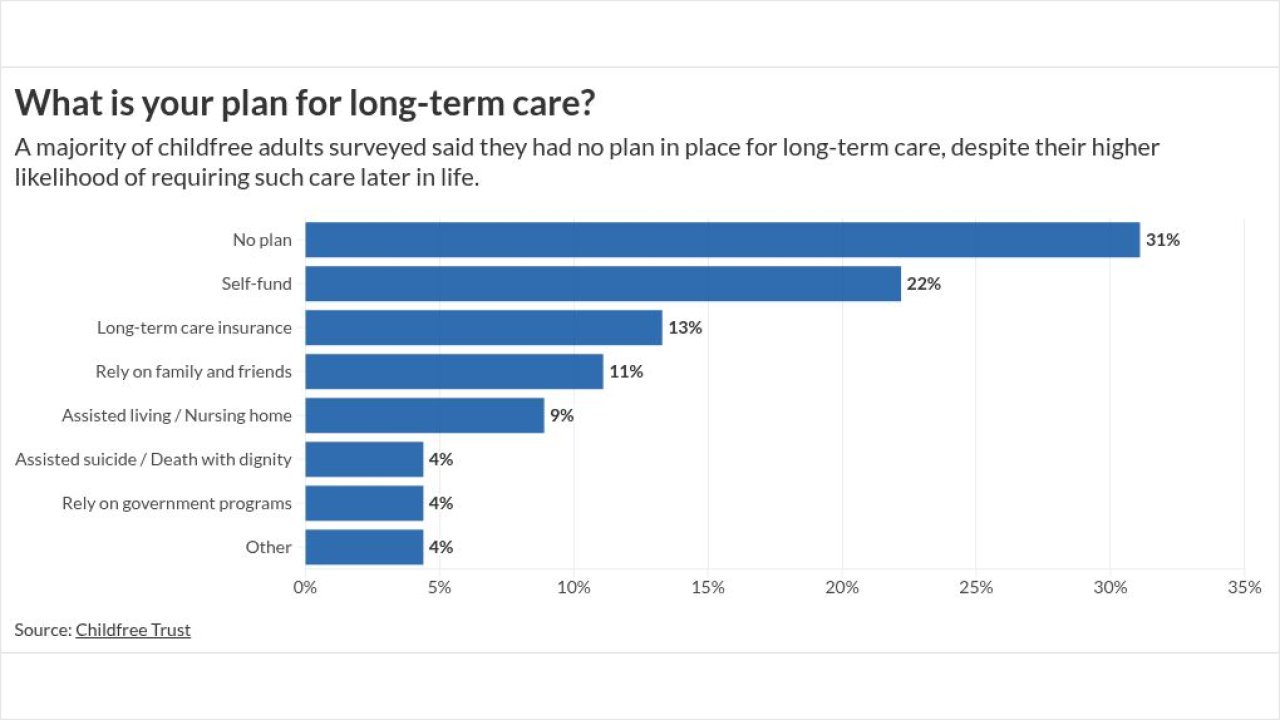

New research highlights a widening planning gap among childfree savers, with lagging estate and long-term care planning exposing unique risks — and opportunities for advisors.

December 19 -

Steve Lockshin and Michael Kitces tied what they view as some mistaken assumptions around fees to the competitive need for more estate planning services.

December 11 -

When clients die, their children are often left with the uncomfortable job of dealing with what they may see as just junk. That is, unless financial advisors make it a priority to address this topic sooner rather than later.

December 3 -

The integration eliminates the need for a third-party intermediary between the two platforms, allowing for a direct connection between financial planning and tax, estate and insurance data.

November 18 -

Panelists at the ADVISE AI conference said document processing has never been more efficient with the help of AI tools. But that doesn't mean there aren't challenges along the way.

November 3 -

The challenge bedevils many heirs' property owners. Here's why experts say it's such a threat and how financial professionals can help guide families through it.

October 23 -

Prepping clients for natural disasters and climate emergencies should start with coverage and end with estate planning.

October 15 Diana Cabrices Consulting

Diana Cabrices Consulting -

The many technical planning questions may be moot until spouses can find common ground on money and wealth in general, CFP Board conference panelists said.

October 8 -

Along with traditional financial planning, Tushar Kumar includes estate and tax planning services at his firm in order to give clients, especially high net worth ones, a complete picture.

October 3 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

While stock values get the most attention after the Fed cuts rates, they affect trusts, too. Some beneficiaries of entities without flexible distribution provisions could take a big hit.

September 29 -

The music superstar and Kansas City Chiefs football player together would have a vast fortune and are likely to need expert tax and financial planning advice.

September 17 -

Several panels and presentations last week at Future Proof focused on the idea of advisors growing their businesses through offering specialized, family office-style services.

September 15 -

The numbers look gaudy, but potential estate taxes and prohibitions on future strategies make the big retirement accounts much less appealing, two experts said.

September 15 -

A limited federal tax credit, an above-the-line deduction for non-itemizers and restrictions on those of itemizers represent three of the biggest shifts under the new law.

September 11 -

The use of multiple entities as a means of shifting a high net worth client's yearly income could help rack up bigger breaks, with some caveats.

August 25 -

Today's bereaved women clients expect respect, empathy and real connection from wealth managers as the great wealth transfer unfolds.

August 19 WidowRISE

WidowRISE