M&A

M&A

-

Private equity-backed M&A activity has steadily risen. Owners may do great in a sale, but what about advisors lower in the organization?

February 5 -

With unfounded rumors spreading that Osaic was about to buy its rival Cetera, a Texas-based headhunting firm started calling advisors to see if they wanted to move. Other industry recruiters say that crossed an ethical line.

February 5 -

Ahead of the expected closing of Fifth Third Bank's deal to acquire Comerica Bank, Ameriprise CEO Jim Cracchiolo provided few new details.

January 29 -

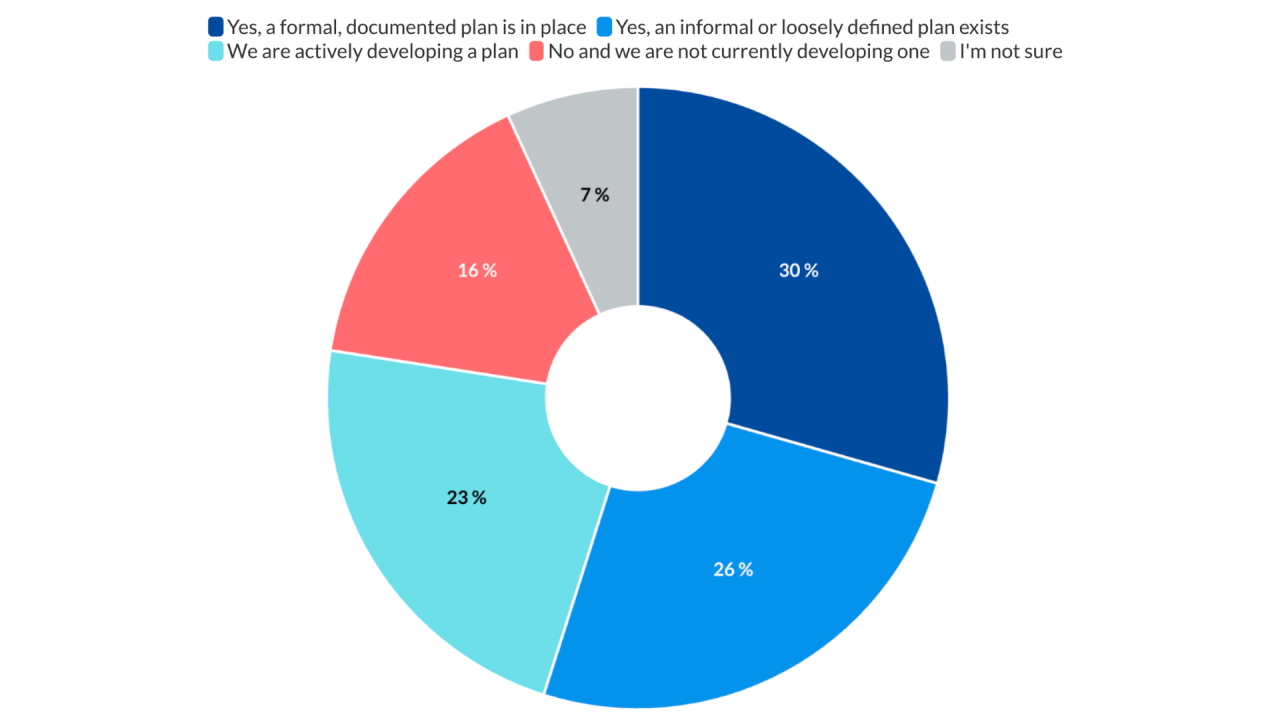

As valuations continue to rise across the industry, more firms are using compensation to invest in their top talent and future growth, Succession Resource Group says.

January 27 -

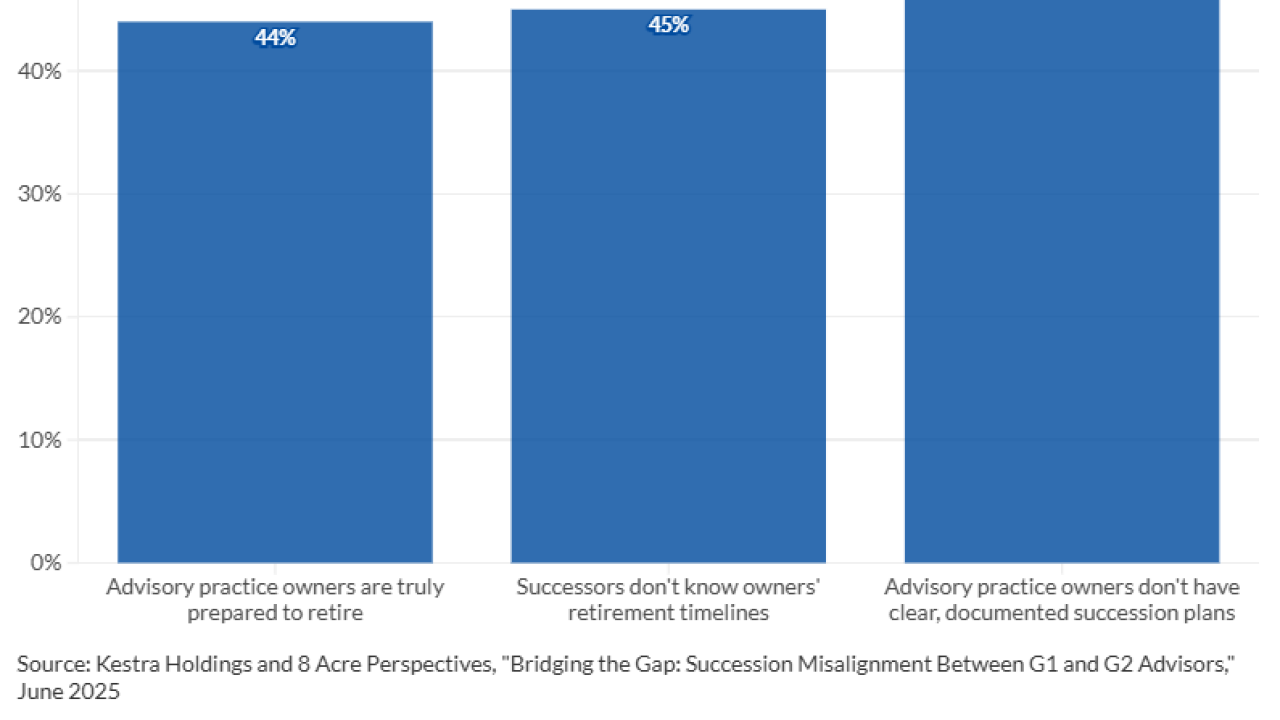

An internal successor, a seller and an acquirer dish out the most common mistakes they say advisory firms must avoid to address the challenge.

January 21 -

Many owners of privately held businesses are planning to sell at least part of their interests in the firm in the next five to 10 years, a Raymond James study found.

January 20 -

Philadelphia-based Clark Capital will be one of several "boutique" firms in Raymond James' global asset management division.

January 15 -

Wells Fargo lands big teams from Merrill and Citi, while Cerity Partners and Mercer Advisors continue their aggressive M&A streaks.

January 9 -

The loss of a $129 billion team for Merrill set the high-water mark in a year that also saw the departure of huge teams from UBS, JPMorgan, Wells Fargo and Oppenheimer.

December 29 -

Rockefeller becomes the latest firm to benefit from a steady stream of advisor defections from UBS this year.

December 26 -

A new survey from DeVoe & Co. suggests a big shift in what RIA firms need today in order to attract potential acquirers. (Hint: It's no longer just superstar advisors.)

December 23 -

While the term "financial supermarket" may have gone out of fashion, firms still see opportunity to boost profits and keep clients loyal by blurring the lines between banking and wealth management.

December 22 -

Also, DayMark Wealth Partners sells a minority stake to Constellation Wealth Capital.

December 18 -

Founders Elissa Buie and Dave Yeske are leaving a legacy in the profession and at the firm under three successors taking over in 2026.

December 16 -

Also, Independent Financial Partners secures a $700M team from Commonwealth/LPL, and NewEdge Capital names a new CEO.

December 11 -

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

December 10 -

Also, Cresset extends its reach in Texas, Janney recruits from Wells Fargo and Ameriprise, Merrill draws from Wells Fargo and Mercer acquires a $1B firm.

December 4 -

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

Also, Raymond James lands a $420M father-son team from Edward Jones, Cetera recruits a $350M LPL duo, and Cambridge acquires a $1B AUM dual registrant.

November 26