Roger Russell is a senior editor at Accounting Today. He focuses on tax developments and compliance, and professional liability issues affecting CPAs. He is a tax attorney and has been a researcher and analyst at several major tax publishing companies.

-

Both presidential candidates have floated it, and there are benefits for both workers and employers — though not always how you'd expect.

August 21 -

This year's Greenbook proposals contain some greatest hits, including a higher corporate minimum tax.

June 19 -

The timing of restructuring will be critical, though, thanks to its significant tax implications.

June 6 -

The freedom of working remotely while traveling the world doesn't include freedom from tax compliance issues.

June 6 -

A congressional hearing takes aim at an estate planning strategy that relies on the step-up in basis.

April 2 -

The Washington National Tax Office of Grant Thornton points out the most important state and local tax developments to keep an eye out for.

February 13 -

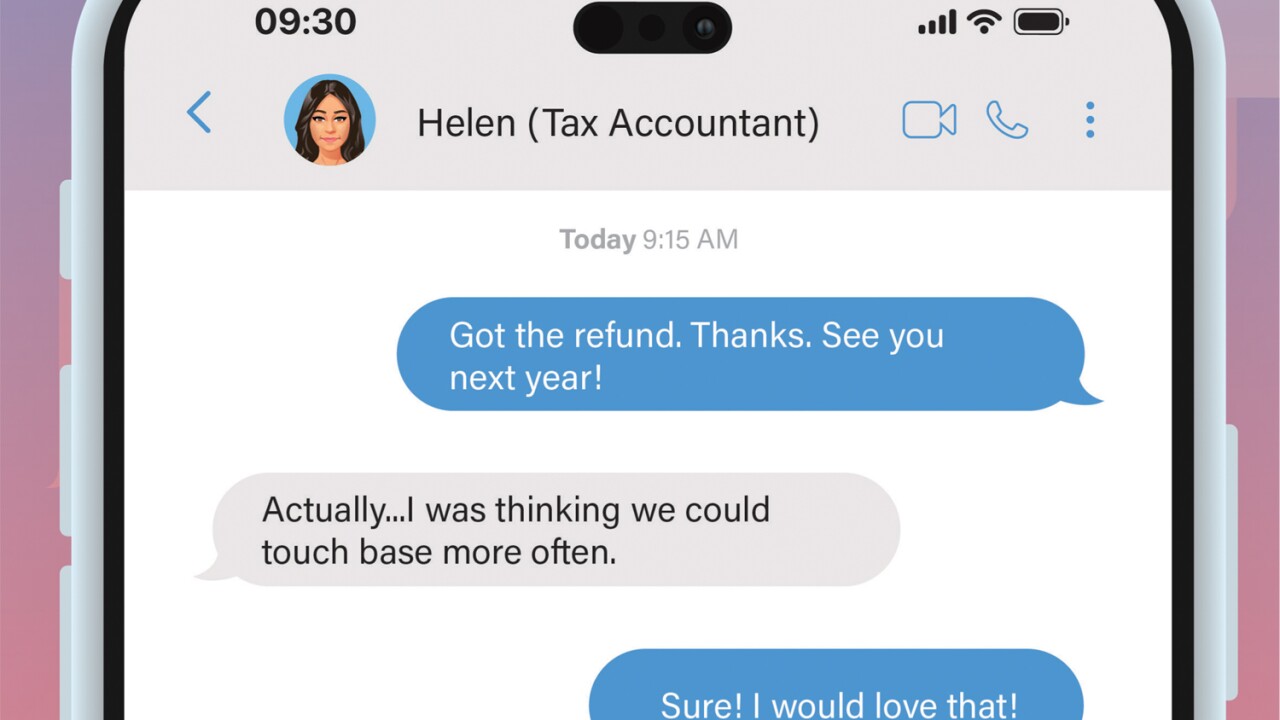

From estate, gift and trust work to Social Security maximization and charitable planning, there are a host of offerings firms can work on once the tax return is finished.

January 9 -

Practitioners have always shared advice as part of tax prep, but the future of the field is in proactive, intentional tax advisory services.

January 8 -

SMB organizations are calling for the Supreme Court to uphold the Tax Cuts and Jobs Act's Mandatory Repatriation Tax.

December 12 -

Among other things, they may unintentionally snare mutual funds, an expert testifies.

November 21