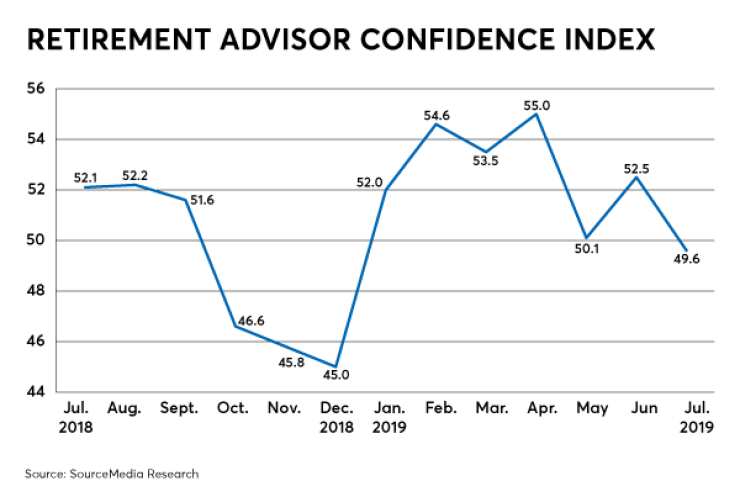

Nervous clients are feeling less confident about their retirement plans amid global unrest and market volatility, according to the latest Retirement Advisor Confidence Index – Financial Planning's monthly barometer of business conditions for wealth managers.

"Clients are very cautious, and I think with good reason," one retirement advisor says.

"I think a lot of people are starting to pull back from the more volatile investments as they believe that a recession is only a matter of time," says another advisor.

The composite RACI dropped 2.9 points to 49.6 from the month before. It’s the first time so far this year the index has dipped below 50. RACI scores under 50 indicate a decline in confidence, while scores above that level signify an increase.

Clients' views toward equity-based securities aptly illustrated their uncertainty. The level of assets allocated toward equities tumbled 8.5 points from the previous month to an even 50, and was off 8.7 points from the year before. This month's score was also the lowest measure of confidence in equities since December.

Advisors polled for this month's RACI survey expressed a common refrain: Clients were pulling away from equities in anticipation of a market correction and concerns that ongoing trade wars would fuel market jitters or even a recession.

"Geopolitical turmoil is making predicting the near future virtually impossible," one advisor says.

Another cites "more concern about slowing world economies, trade disputes and high valuations of U.S. equities."

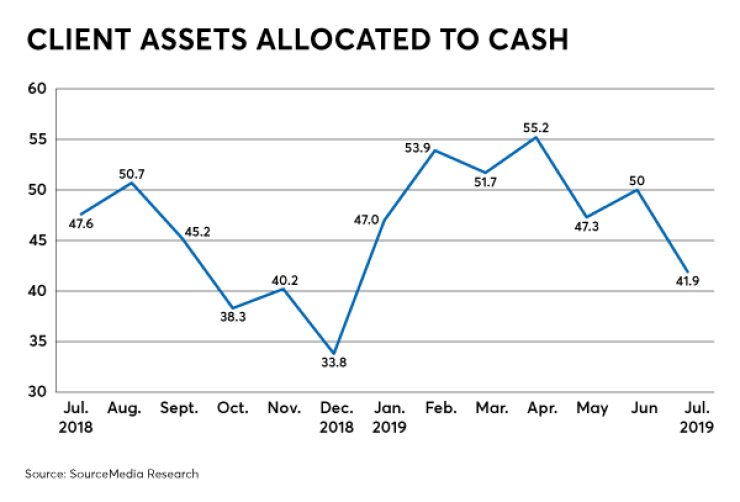

Clients weren’t just running from equities in their retirement planning.

The measure of assets used to purchase bonds or debt-based securities fell to 46.3, the lowest mark since June 2012. It’s the first time that category checked in below 50 since April.The most recent score for bonds and debt-based securities was down four points from the previous month and off 6.1 points from last year.

Cash allocations also took a substantial hit. Some advisors reported their clients were moving assets from equities and bonds toward cash, but in aggregate, the RACI component that measures cash allocations fell 8.1 points from the previous month to 41.9, the lowest mark of the year, and down 5.7 points from last year.

The drop in confidence in those individual categories was reflected in clients' diminished appetite for risk in retirement plans. Overall, clients' risk tolerance tallied a score of 46.3, down 4.7 points from the previous month and the third-lowest mark of the year.

Still, some advisors are counseling clients to stay the course and think of their retirement plans in the context of the long term rather than trying to time the markets.

"People are concerned with the current politics, but [it's] important to stay in [the] market," one advisor says. "Impossible to time a point to get out."