Key measures of clients' retirement confidence had another strong showing in June, but seem largely to have stabilized in recent months following the volatility of the pandemic, according to the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

While overall confidence remains solid, some advisors say they are looking to bank gains from a strong runup in market values and potentially shift to lower-risk positions.

"There have not been any significant changes other than clients' accounts have been growing, and we are trying to think about potentially shifting to assets deemed 'safe' in the current economic climate," one retirement advisor says.

In aggregate, advisors report strong confidence in equities as a component of clients' retirement plans, though June's RACI score in that category of 65.3 was off two points from May and four points from the all-time record of 69.3 posted in April.

RACI scores above 50 indicate an uptick in investor confidence, with scores below that mark signaling a decrease.

The RACI component that tracks equities has checked in above 60 for eight straight months, dating back to November 2020. This month's score was 3.8 points above the mark from June 2020.

Advisors describe a range of views among their clients on the direction the macro economy is heading. Many advisors describe a creeping anxiety that markets may be fully valued or overvalued, with some expressing concerns about a significant correction or the impact of Fed policy.

"My advice hasn't changed," one advisor says, "but I'm noticing clients getting 'twitchy' and asking about a potential crash."

Others say their clients are simply exuberant about the prospects of a post-COVID world.

"Clients anticipate an unleashed economy similar to the Roaring ‘20s," one advisor says.

RACI components across the board saw only minor movements from May to June, continuing a stabilizing trend that started when the COVID-19 vaccine rollout kicked into high gear and more businesses began reopening and hiring more workers.

In a key measure of confidence, it appears that worries among some clients about a market downturn, inflation or tax increases were offset by investors who remain bullish about markets and an overall economy that continues to rebound as the reopening continues.

The RACI component that measures retirement clients' risk tolerance ticked up a point to 57.8 in June, marking the second-highest score in that category in 2021, and up 5.8 points from last year.

The composite RACI score checked in at a healthy 54.4, off 0.6 points from May, but up 2.2 points from June 2020. The RACI composite hasn't dipped below 50 since October 2020.

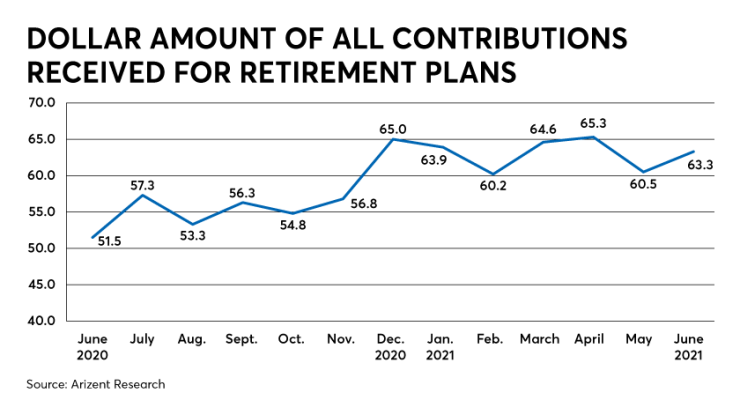

This month's RACI also reflected a truism about retirement planning: as more people have access to a plan through an employer, participation and contribution levels will rise. The RACI components that track total dollars contributed to plans and the number of retirement products sold both posted monthly and yearly increases. Overall contributions checked in at a solid 63.3, up 2.8 points from last month and 11.8 points from last year.

"There's been an increase in businesses hiring employees," one advisor says. "More people are going back to work."

One advisor reflected on the impact that the strong market performance has had on retirement savings and planning this year, one borne out by consistently above-water RACI scores. The challenge, the advisor says, is to convince clients that there's never a bad time to focus on retirement planning, regardless of where the markets are in a given moment.

"A good stock market always encourages people to invest in their retirement," the advisor says. "We just wish they would be as enthusiastic to invest when the stock market is down!"