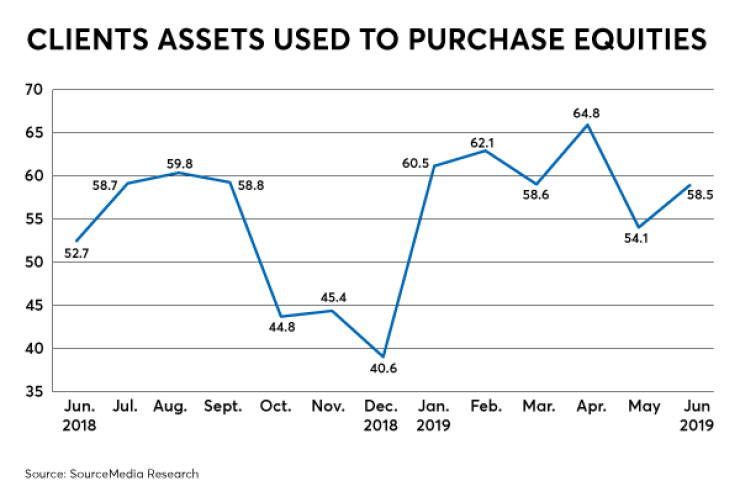

Despite concerns about a looming market downturn, clients have been buoyed by strong returns, shifting more money into equities and putting away more for retirement, according to the latest Retirement Advisor Confidence Index — Financial Planning's monthly barometer of business conditions for wealth managers.

"Clients are getting nervous about the economy but see stocks increasing," one advisor says, noting that they have been moving more assets to equities in response.

"Better market, more aggressive," says another advisor.

Thus, the RACI component tracking spending on equity-based securities increased 4.4 points in the most recent month, posting a mark of 58.5, up 5.8 points from the same month last year. RACI scores higher than 50 show an increase, while scores below that mark indicate a decline.

The equity score — while it bounced back from an earlier decline — still was the second-lowest mark in that category this year, suggesting some jitters about a potentially worsening global economy and ongoing trade tension.

Some advisors report their clients are beginning to feel the stock market is overpriced and are responding accordingly.

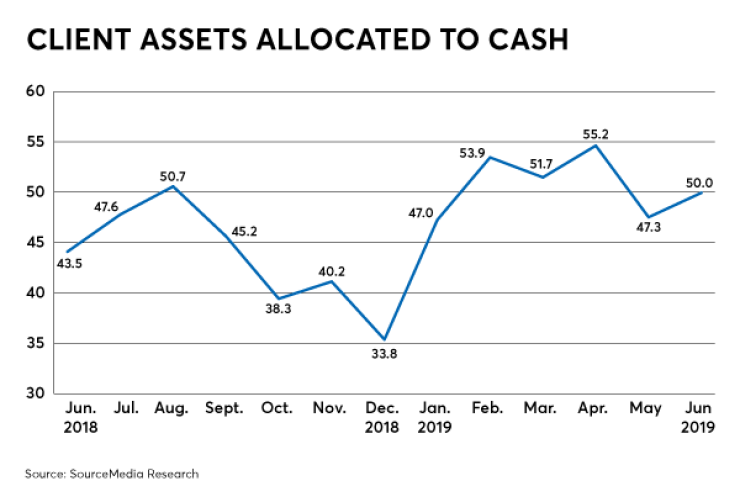

One advisor explains that clients are "feeling the market is expensive so [they] moved assets to cash."

"The market value of securities, in general, has many clients nervous enough to take a little money off the table," another advisor says.

Cash allocations jumped 2.7 points from the previous month, notching a score of 50, up 6.5 points from the year-ago period. In general, cash allocations were down from the earlier months of this year, but well ahead of where they stood in the second half of last year, when they hovered in the 40s and reached a nadir of 33.8 at the end of 2018.

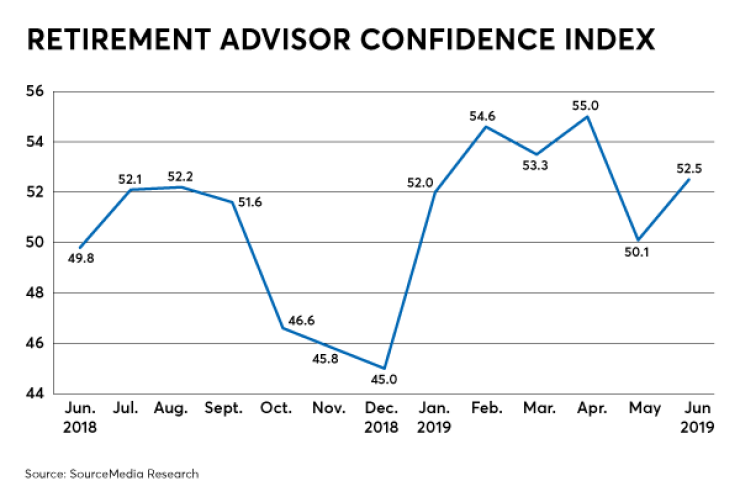

In total, the RACI composite index was 52.5, rebounding 2.4 points from the prior month but still down from its scores in the mid-50s from earlier this year.

Many clients seemed to regain their tolerance for risk in the retirement space despite worries about an overheating market and ongoing global uncertainty.

The component of the RACI index measuring risk tolerance checked in at 51 in the most recent month, up nine points from the prior month and 8.8 points from the year-ago period. Risk tolerance hit a high of 60.8 earlier this year, but the most recent score of 51 still ranks ahead of where the index was in the second half of 2018, just once rising above 50 and eventually plummeting to 25.8.

However, some clients see an opportunity in a prospective market dive.

"As the stock market hit record highs, clients are expecting a correction," one advisor says. "More than ever, if the market goes down 20%, they then want to increase their equity allocation."