-

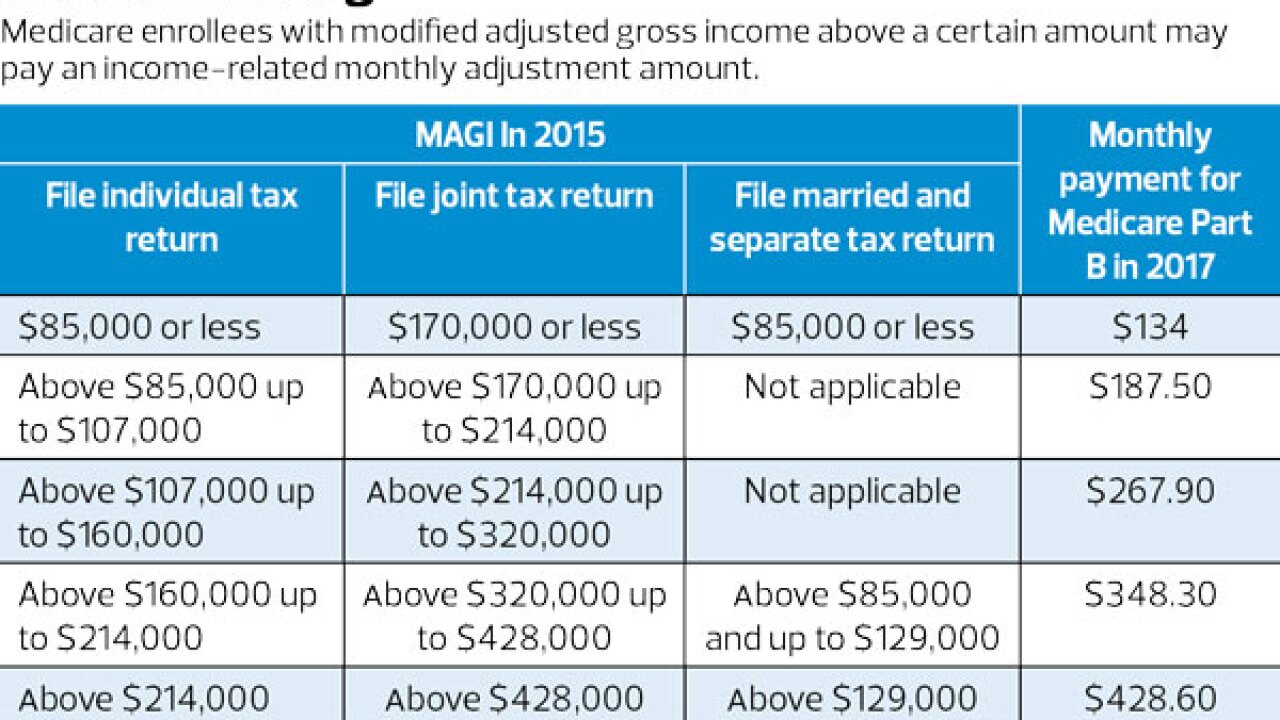

Planning may help high-income seniors avoid paying up to four times the going rate for Part B and Part D coverage.

August 8 -

If clients tap their Roth accounts at the wrong time, even after retirement, they could lose out on some potential tax benefits.

August 4 -

Naming a young grandchild as beneficiary of a traditional IRA could be a wrong move, as the distributions will be subject to the "kiddie tax."

August 2 -

Investors are about to enter the worst two-month period of the year for stocks, according to an expert with Bespoke Investment Group.

August 1 -

Yes, advisers can invest these funds in nontraditional assets, but you must understand the risks before giving clients the OK.

July 28 -

The agency says its adoption of WebEx will allow for improved outreach with clients in the more rural regions of the country.

July 28 -

Clients should plan to replace roughly 80% of their pre-retirement income after they leave the workforce for good.

July 26 -

Although the market continues to rally, a possible setback remains likely and retirement investors should be ready for this scenario.

July 14 -

With smaller paychecks and longer life expectancies than men, one strategy includes moving their IRA assets into a Roth to reap the tax advantages.

July 14 -

Here’s how receiving investments on a stepped-up cost basis can save a client’s inheritance.

July 10 -

Although traditional IRAs offer upfront tax deductions, clients will have to pay taxes later in life when they likely will be in a higher tax bracket.

July 7 -

High-earning seniors are advised to carefully plan when they file for Social Security benefits.

July 6 -

While retirees can start taking 401(k) withdrawals without penalties when they turn 59 1/2, they may want to consider drawing from their taxable accounts for their living expenses.

July 5 -

Gold tends to hold its value in the long-term, but it's volatile — almost as much as stocks — so clients may need decades to ride out its ups and downs,

June 26 -

Clients should not underestimate the impact of taxes on their income after they retire, as their tax liability could reduce substantially their net earnings.

June 21 -

Stocking away income in company-sponsored plans can provide corporate executive clients tax-free compounded growth on investments.

June 16 -

Health savings accounts are not only for funding immediate medical needs. They offer three distinct tax benefits that make them a powerful form of retirement savings.

June 16 -

Many carriers offering long-term care coverage are experiencing financial woes and may no longer guarantee payments when clients need them.

June 15 -

Retirees are automatically enrolled in Medicare by the time they reach 65 if they are already collecting their Social Security benefits.

June 5 -

Couples would be better off retiring at the same time, as they face major life changes together. And leaving a career-driven spouse at home in retirement can throw a marriage out of whack.

June 2